Discover how top accounting software streamlines ZATCA e-invoicing with automated compliance, simplified billing, and accurate VAT reporting.

The implementation of ZATCA (Zakat, Tax, and Customs Authority) e-invoicing regulations in Saudi Arabia has reshaped how businesses handle invoicing and tax compliance. With the transition to a fully digital invoicing system, companies are required to submit their invoices electronically, ensuring they meet the standards set by ZATCA. The best accounting software in Saudi Arabia plays a crucial role in simplifying ZATCA e-invoicing, offering automated solutions that ensure businesses adhere to these regulations seamlessly. These software tools are designed to reduce manual efforts, enhance accuracy, and streamline the process of generating and submitting e-invoices.

Simplifying ZATCA e-invoicing with advanced accounting software is essential for businesses looking to avoid errors and penalties associated with non-compliance. The best accounting software in Saudi Arabia simplifies ZATCA e-invoicing by automatically incorporating necessary information such as VAT details, invoice numbers, and buyer and seller information, directly into the e-invoice templates. This automation eliminates the possibility of manual data entry errors, saving valuable time and resources. By integrating with other business systems, such as ERP and CRM, top accounting software ensures that data is updated in real time, further simplifying ZATCA e-invoicing and maintaining compliance. This seamless integration between systems ensures the accuracy and timeliness of invoice submissions, while reducing the administrative burden on businesses.

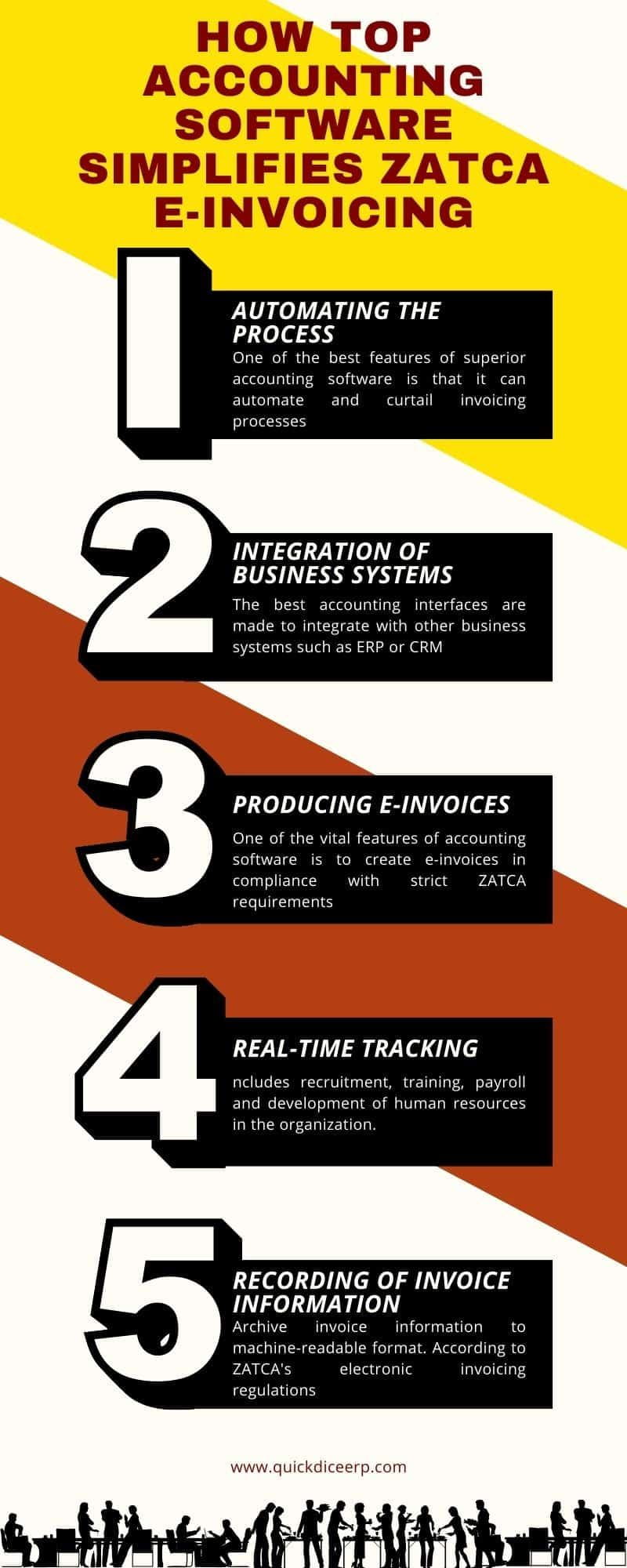

One of the best features of superior accounting software is that it can automate and curtail invoicing processes, which greatly reduces the instances of manual data entry. Previously, businesses had to enter every transaction detail manually, and the whole exercise proved time-consuming and bore the high risk of human error. This could have resulted in the issuance of an incorrect invoice, delay in payment, and the risk of tax non-compliance.

The best accounting interfaces are made to integrate with other business systems such as ERP or CRM or incoming stock management systems. This integration causes the total transaction information passing between departments to form accurate, timely invoicing.

One of the vital features of accounting software is to create e-invoices in compliance with strict ZATCA requirements. According to ZATCA, all invoices must include certain data elements, such as buyer and seller information, invoice number as well as the invoice date and VAT details and lastly a unique QR code. The top accounting software automatically includes each of these elements when generating invoices so that businesses do not incur penalty mistakes.

Here is another major benefit that comes with advanced accounting software, especially as simplifies ZATCA E-Invoicing: Status updates on e-invoices can be tracked in real time. ZATCA’s e-invoicing system requires businesses to submit invoices electronically and receive a report on their acceptance status. The major advantage of this is making possible real-time tracking by which businesses can always know whether submitting their invoices has resulted in approval or rejection. This in turn makes it quite easy to take appropriate action when this happens.

Archive invoice information to machine-readable format. According to ZATCA’s electronic invoicing regulations, companies will store invoice data in a secure file, one readable by machine, during the prescribed time. This ensures quick access for audits and easy retrieval when authorities request it. Most of the best accounting software solutions offer built-in features that automatically archive e-invoice data in a secured and compliant manner.

To finalize, the best accounting software in Saudi Arabia would break ZATCA e-invoicing into easy pieces. Top-class accounting software would obviously feature a variety of automated tools that will ease the processes, reduce errors, and ensure compliance as everyone strives to adhere to the rigorous norms laid down by ZATCA in terms of invoice handling. This kind of software allows businesses to generate e-invoices that are compliant automatically, archive details of the invoice automatically, and check the status of each invoice in real-time by integrating with existing business systems. These automated tools help businesses avoid costly penalties and errors often caused by manual invoice workflows.