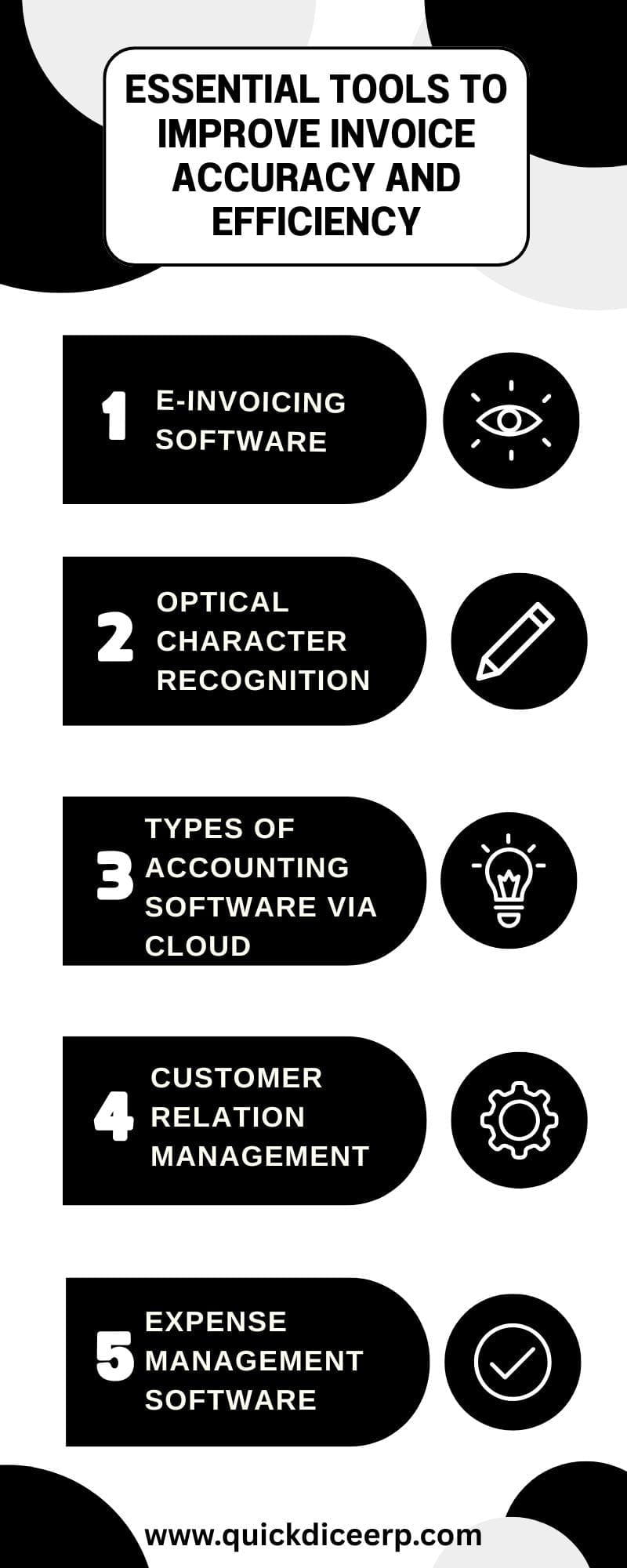

Explore essential tools that enhance invoice accuracy and boost efficiency, helping businesses streamline billing and reduce costly errors.

Today’s business scene is constantly changing; hence, well-executed invoicing is critical for any financial operation. As a result, any tiny inaccuracy in an invoice can quickly cause payment delays, client confusion, and even financial losses. Inaccuracy and inefficiency in invoice production are therefore sufficient reasons to demand adequately dependable billing software. Traditional invoicing methods, such as manual entry or spreadsheets, contain so many human errors—missing particulars, incorrect computations, and misplaced invoices—that any one of these might slow payment and potentially disrupt cash flow. Enterprises can use some systems to automate invoice generation, track payments, and maintain tax compliance, making financial management easier.

Modern billing software allows firms to easily generate and manage invoices. The program ensures that all necessary information, such as client information, taxes, and payment terms, is properly incorporated. Similarly, automation lowers human mistakes in data collection, accounting, and billing, while also boosting record-keeping through regular send-knock reminders. The material benefits of using effective invoicing technologies, like time savings and productivity increases, are growing and translating into increased consumer trust. Streamlined billing processes enable organizations to focus more on expansion rather than administrative difficulties.

This is an e-invoicing application program that automates the entire invoicing process, minimizing human errors and ensuring timely payments. QuickBooks, Xero, Zoho Invoice, and QuickDice ERP are examples of e-invoicing platforms that include invoice preparation and automatic payment tracking, as well as real-time changes. The e-invoicing program has a number of functionalities, including:

This is an e-invoicing application program that automates the entire invoicing process, minimizing human errors and ensuring timely payments. QuickBooks, Xero, Zoho Invoice, and QuickDice ERP are examples of e-invoicing platforms that include invoice preparation and automatic payment tracking, as well as real-time changes. The e-invoicing program has a number of functionalities, including:

OCR is used to digitize invoices and update them digitally. These significantly reduce the number of manual errors and accelerate the processing of paper invoices. An OCR pulls relevant data from receipts, including the invoice number, vendor name, and amount entered. ABBYY FineReader, DocuWare, and Kofax OCR are three prominent OCR software solutions. They offer:

All of the so-called benefits of a huge volume of invoices will be realized through the use of OCR tools, which will simplify and ease the overall invoicing system

Given the current state of accounting and finance management practice, it will be untenable to keep invoicing separate from all other integrated financial management tools. In that circumstance, the company will stay inaccessible to financial data from any location while maintaining flawless invoicing activities. The leading cloud-based accounting solutions include SAP Business One, FreshBooks, and Sage Intacct. These packages offer the following advantages of cloud accounting software:

Payment processing technologies enable automatic invoice payments, ensuring that payments are always precise and timely. When businesses integrate any of the following payment gateways: PayPal, Stripe, Square, or Razorpay, they enable bespoke transactions. The major benefits of automated payment processing include:

Automation lowers administrative effort and saves time, ensuring that payments are completed correctly for maximum business and client satisfaction.

CRM software improves invoice accuracy by preserving up-to-date client information such as payment history and signed contracts. Salesforce, HubSpot, and Zoho CRM are examples of prominent CRMs that include invoicing integration applications to assist billing activities to go smoothly. CRM software improves invoicing in the following ways.

Invoicing is an essential aspect of business, and ensuring accuracy is critical to sustaining financial stability. Relying solely on time-consuming manual processes would result in costly errors, payment delays, and customer frustration. Billing software would automate the invoicing process, thereby reducing human error and ensuring prompt payment. The best invoicing systems provide real-time tracking, secure payment processing, and seamless connection with an accounting system. As a result, this would reduce time and improve financial management capabilities, allowing for increased business cash flow.