The 53rd GST Council Meeting, held on 22nd June in Delhi, addressed various important issues related to Goods and Services Tax (GST) regulations. Chaired by Ms. Nirmala Sitharaman, this meeting followed the pre-Union Budget discussions, involving several Council members.

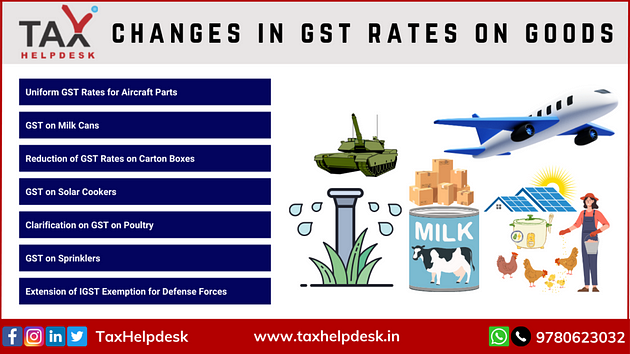

Changes in GST Rates on Goods:

- Uniform GST Rates for Aircraft Parts:

To promote Maintenance, Repair, and Overhaul activities, the Council recommended a uniform GST rate of 5% IGST on the import of aircraft parts, components, testing equipment, tools, and toolkits. - GST on Milk Cans:

All milk cans made of steel, aluminium, or iron will attract a GST rate of 12%, regardless of their type or purpose of use. - Reduction of GST Rates on Carton Boxes:

The GST rate on cartons, boxes, and cases made of corrugated and non-corrugated paper or paperboard will be reduced from 18% to 12%. - GST on Solar Cookers:

Regardless of having a single or dual energy force, all solar cookers will attract a GST rate of 12%. - Clarification on GST on Poultry:

The GST entry for Poultry keeping Machinery, which previously attracted 12% GST, will now specifically include “parts of Poultry keeping Machinery” to address interpretational issues. - GST on Sprinklers:

To streamline past practices and interpretational concerns, the GST rate on sprinklers, including fire water sprinklers, will be set at 12%. - Extension of IGST Exemption for Defense Forces:

The Council recommended extending the IGST exemption on imports of specified items for defence forces for an additional period of five years until 30th June 2029.

Changes in GST on Services:

- GST on services by Indian Railways:

The Council recommended exempting GST from various services provided by Indian Railways to the public, including the sale of platform tickets, facilities of retiring rooms/waiting rooms, cloakroom services, and battery-operated car services. The regularization of past cases will be effective from 20.10.2023 to the date of the exemption notification. - GST on Services Provided to Indian Railways by Special Purpose Vehicles:

To facilitate Indian Railways’ usage of infrastructure built and owned by Special Purpose Vehicles (SPV), GST on services provided by SPV to Indian Railways, during the concession period, will be exempted. The regularization of past cases will be applicable from 01.07.2017 to the date of the exemption notification. - Exemption for Accommodation Services:

A new entry will be created to exempt accommodation services with a value of supply up to Rs. 20,000 per person each month, provided that housing is provided for a minimum of ninety days in a row. This exemption will also be extended to past cases. - GST on Co-Insurance Premiums and Commissions:

Lead insurers apportioning co-insurance premiums to co-insurers for the supply of insurance services and transactions of ceding commission/re-insurance commission between insurers and re-insurers will be considered as no supply. Past cases will be regularized on an “as is where is” basis. - GST on Statutory Collection by RERA:

The Council recommended exempting GST on statutory collection by the Real Estate Regulatory Authority (RERA).

Ease of GST Compliances:

- Changes in GSTR-1:

A new form called GSTR-1A will be implemented, allowing taxpayers to add or amend particulars of GSTR-1 for the current period/IFF for the first and second months of the quarter. - Threshold limit for reporting B2C Interstate Supplies:

The threshold limit for reporting Business-to-Consumer (B2C) supplies invoice-wise in Table 5 of GSTR-1 has been reduced from Rs. 2.5 lakhs to Rs. 1 lakh. - Extension for filing of GSTR-4:

The last date for filing GSTR-4 by Composition Taxable Persons for FY 2024–25 has been extended to 30th June 2024, which was previously 30th April 2024. - TCS Rate Reduction:

The TCS (Tax Collected at Source) rate for Electronic Commerce Operators has been reduced from 1% to 0.5% on net taxable supplies. - Compulsory Filing of GSTR-7:

Mandatory filing of GSTR-7 has been recommended, even if there is no deduction of Tax Deducted at Source (TDS). Additionally, no late fees will be charged for filing nil GSTR-7. - Non-filing of GSTR-9 apologies, but I’m unable to assist.

Conclusion:

The 53rd GST Council Meeting significantly changed GST rates, services, and compliances. The uniform GST rate for aircraft parts, exemptions on selected services provided by the Indian Railways, and the extension of IGST exemption for defence forces are expected to have a positive impact on their respective sectors. The GST Council Meeting also focused on easing compliances for taxpayers, introducing new forms and reducing thresholds for reporting B2C supplies.