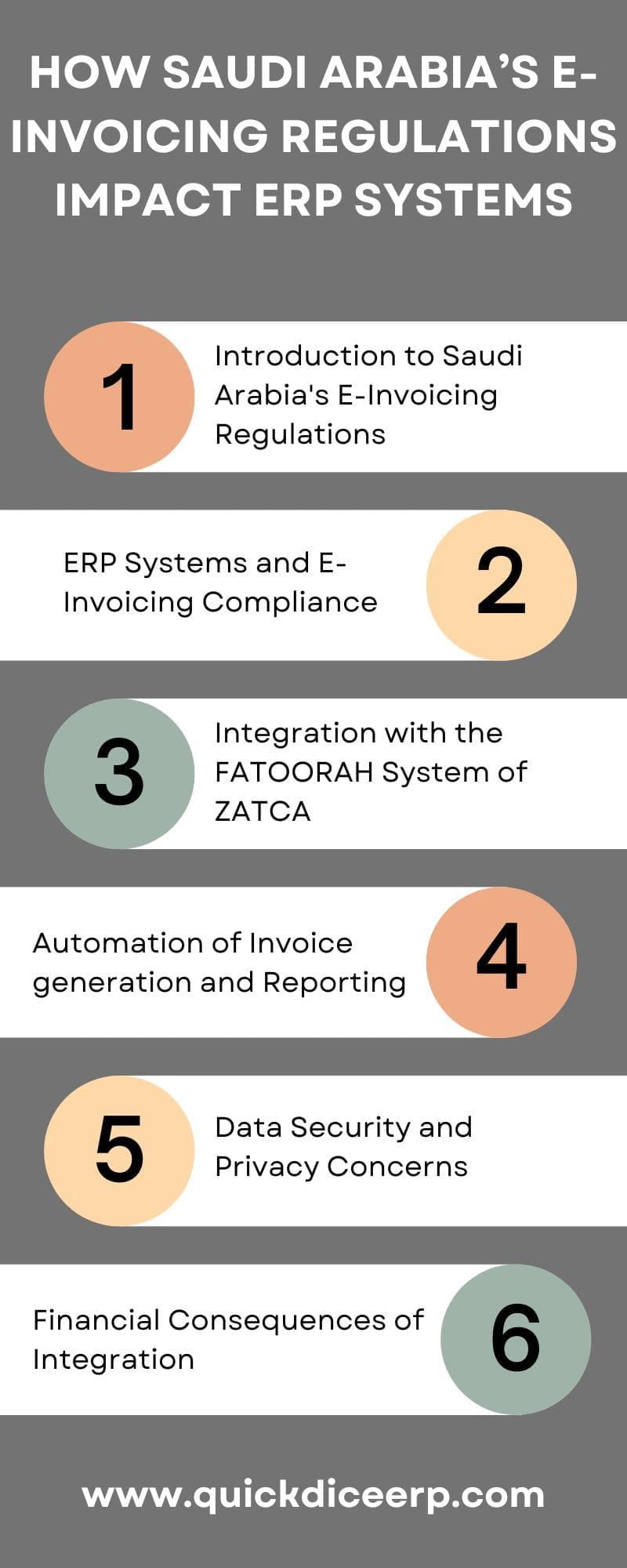

Saudi Arabia’s e-invoicing regulations Impact ERP Systems, ensuring compliance, enhancing efficiency & streamlining tax reporting processes

The e-invoicing system has been introduced as an obligatory system and is now one of the main steps in digitizing the tax system in Saudi Arabia over the years, and this has happened through sophisticated advances. Starting from 2021, it shall become mandatory for any Saudi business to issue an invoice electronically according to the rules of the Saudi Tax and Customs Authority (ZATCA) regarding issuing invoices. The move targets tax compliance that has reduced fraud and increased transparency within the impact ERP systems.

Integrating e-invoicing within the Impact ERP Systems will lead to, in essence, the change in how business is conducted in Saudi Arabia. As ERP systems are often the foundation upon which business processes are built and around which they are streamlined, organizations now have to reconfigure their ERP solutions in line with the adoption of e-invoicing. That is, invoices should be generated, stored, and moved electronically in the appropriate format; thus, ERP software in Saudi Arabia needs to be upgraded to interface directly with ZATCA’s System FATOORAH; so that there is, in turn, real-time reporting and data exchange between the businesses and tax authority.

In 2021, Saudi Arabia made it compulsory for businesses to provide e-invoices, with the intention of improving compliance to tax obligations, reducing tax evasion, and making the process of invoicing. E-invoice stipulations came down to issuing, storing, and exchanging electronic invoices through the FATOORAH system established by the Saudi Tax and Customs Authority (ZATCA). In effect, businesses that operate within Saudi Arabia must incorporate the electronic invoicing capabilities of the falling systems into their legacy ERP systems. Here, long-awaited regulatory action shifts how the controls of invoices affect every aspect of business.

ERP comprises almost all business operations as well as finances and accounts. Hence, businesses must amend their ERP systems to enable them produce electronic invoices in the format required by the e-invoicing regulations in Saudi Arabia. Integrating the ERP systems with ZATCA’s platform will allow real-time reporting and verification of invoices with the appropriate tax authorities. For businesses, this would mean an end to manual processes and the era of automated ones wherein compliance with the new tax regulations has been assured against the possibility of errors or fraud.

ERP has a very significant implication for e-invoicing regulations introduced in Saudi Arabia since they now require integration with the FATOORAH platform. Such an ERP must be able to generate invoices in a structured format, either in UBL or XML, to assign it through an API to the FATOORAH system. Such an integrated solution lets businesses comply with ZATCA guidelines and avoid penalties while keeping invoicing, reporting, and tax compliant smooth processes.

The biggest benefit in terms of e-invoicing integrated within the Impact ERP Systems is the automating invoice generation along with report writing. Prior to the mandates, businesses could usually resort to manual processes or a mixed bag of systems for invoice creation. In the case of e-invoicing, an ERP system generates invoices automatically in real-time doing away with human errors and in turn, speeding up the process.

It is essential to link the ERP system with the ZATCA to ensure that sensitive data will exchange with ZATCA; hence why enterprises need to comply with data protection rules and regulations to move towards real e-invoicing where transactions will need to link with ZATCA through invoices. This means that invoice data transmission will have to accompany encryption and authentication protocols implemented by such Impact ERP Systems securing against the access of entities.

The advent of E-invoicing as regulations for businesses in Saudi Arabia has unequivocally altered the context of doing business in the Kingdom. These rules require companies to change their invoicing processes to comply with the FATOORAH system by ZATCA, which, in essence, translates to a change in the management of financial data in businesses. Impact ERP Systems plays a key role in this because it is the connector for different sides of the business, including invoicing, regulatory tax reporting, and inventory management.