Samarium prices are largely driven by demand from advanced technology sectors, especially for samarium-cobalt magnets used in electronics.

APAC Samarium Price Analysis – Last Quarter

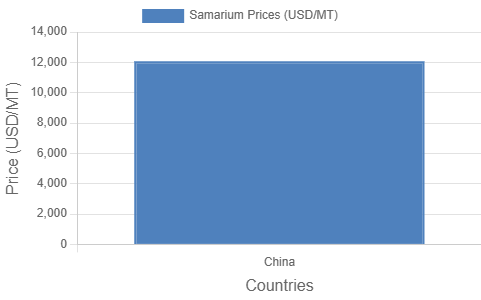

Samarium Prices in China:

In China, Samarium Price reached 12,070 USD/MT, reflecting notable fluctuations driven by a combination of supply constraints, regulatory policies, and shifting market conditions. Stricter regulations on rare earth mining and export controls have significantly impacted availability, limiting the overall supply of samarium.

Additionally, Samarium Price Index has been shaped by strong demand from key industries such as electronics, magnet production, and nuclear applications, which rely on this rare earth element for advanced manufacturing. Global economic uncertainties and trade restrictions have further contributed to market volatility, while steady consumption in high-tech sectors has helped stabilize prices to some extent. As supply chain disruptions and geopolitical factors continue to influence the rare earth market, samarium prices are expected to remain dynamic in the coming months.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/samarium-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer’s specific needs.

Regional Analysis: The price analysis can be extended to provide detailed Samarium price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hong Kong, Singapore, Australia, and New Zealand, among other Asian countries.

Key Factors Influencing Samarium Price Trend, Index, and Forecast (2025)

High-Tech and Industrial Demand

Samarium prices are largely driven by demand from advanced technology sectors, especially for samarium-cobalt magnets used in electronics, renewable energy, aerospace, and automotive industries. As these industries expand, particularly in Asia Pacific and North America, demand for high-performance magnets and materials grows, supporting price increases.

Supply Chain Concentration and Geopolitical Risks

Global samarium supply is highly concentrated, with a few countries (notably China) dominating mining and production. This creates vulnerability to supply disruptions, export restrictions, or geopolitical tensions, all of which can trigger price volatility or sudden spikes.

Production Costs and Raw Material Availability

The cost of producing samarium, including extraction and metallothermic reduction of its oxide, is influenced by raw material prices, energy costs, and technological efficiency. Any rise in production expenses or challenges in sourcing rare earth feedstocks can push prices higher.

Economic and Currency Factors

Macroeconomic conditions such as inflation, exchange rates, and interest rates directly affect samarium pricing. Economic growth in key regions boosts demand, while currency fluctuations can impact international trade and price competitiveness.

Environmental Regulations and Sustainability

Stricter environmental policies in major producing countries can increase compliance costs and limit output, tightening supply. Growing emphasis on sustainable mining and recycling may also reshape the market and influence long-term price trends.

Market Structure and Inventory Levels

The limited number of suppliers and buyers, combined with low market liquidity, means that inventory changes or strategic stockpiling can have an outsized impact on prices. Any imbalance between supply and demand is quickly reflected in the price index.

Samarium Price Outlook for 2025

Summary:

Samarium price trends in 2025 are shaped by high-tech demand, concentrated supply chains, production costs, economic factors, environmental regulations, and market structure. The outlook is for continued growth and potential volatility, with prices supported by expanding use in advanced technologies and ongoing supply chain risks.

Samarium Market: Prices, Outlook & Strategic Importance

What’s the Current Global Samarium Price Trend?

Samarium prices have been notably stable around 74-75 CNY/kg in early 2025, showing limited impact on overall magnet prices despite cobalt fluctuations.

How Does the Samarium Price Index Reflect Market Conditions?

Samarium’s price index is tracked through specific price data from rare earth metal platforms, reflecting feedstock costs, supply/demand, and market trends, primarily from China.

What’s the Samarium Price Forecast for 2025 and beyond?

Short Answer: Samarium prices are forecast to increase, with the market growing at a 14% CAGR from 2025-2030, driven by rising demand in high-performance magnets for EVs and renewable energy.

Which Key Industries Are Primarily Driving Global Samarium Demand?

Samarium demand is primarily driven by its use in high-performance Samarium-Cobalt magnets for aerospace, EVs, renewable energy, and electronics, plus applications in nuclear and medical sectors.

Contact us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145