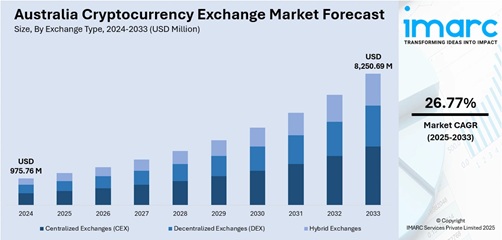

Australia cryptocurrency exchange market reached USD 975.76M in 2024, projected to hit USD 8,250.69M by 2033 at a 26.77% CAGR from 2025 to 2033.

The latest IMARC Group report, titled “Australia Cryptocurrency Exchange Market Size, Share, Trends and Forecast by Exchange Type, Cryptocurrency Type, User Type, Revenue Model, Trading Service, and Region, 2025-2033” offers a comprehensive analysis of the Australia cryptocurrency exchange sector. The Australia cryptocurrency exchange market size reached USD 975.76 million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,250.69 million by 2033, exhibiting a robust CAGR of 26.77% during 2025–2033.

Report Attributes:

• Base Year: 2024

• Forecast Years: 2025–2033

• Historical Years: 2019–2024

• Market Size in 2024: USD 975.76 Million

• Market Forecast in 2033: USD 8,250.69 Million

• Market Growth Rate 2025–2033: 26.77%

Australia Cryptocurrency Exchange Market Overview

The showcase is right now experiencing quick development, driven by the broad appropriation of mechanized exchanging bots—like OKX’s cutting-edge solutions—and expanding regulation cooperation through progressed subsidiaries stages such as Kraken. Administrative systems are advancing in parallel, with ASIC and AUSTRAC improving oversight whereas supporting development. Retail and regulation financial specialists are effectively locks in with the showcase due to made strides openness, straightforwardness, and security.

Key Features and Trends of Australia Cryptocurrency Exchange

The advertise is as of now grasping institutional-grade care and subordinates administrations, coordination these into existing retail stages to meet request over speculator portions. Mechanized exchanging frameworks are picking up noticeable quality, advertising algorithmic methodologies and bots. Also, trades are setting up more profound compliance framework, impelled by comprehensive permitting and AML/CTF prerequisites, whereas locks in in key organizations with fintech and installment suppliers.

Growth Drivers of Australia Cryptocurrency Exchange

Advertise development is being fuelled by expanding regulation intrigued and large-scale support inflows. Computerized exchanging arrangements are democratizing high-frequency procedures for a broader speculator base. Trades are leveraging strong administrative systems to offer imaginative monetary items, such as stablecoin exchanging and edge offices. Moreover, request is surging as retail users—especially more youthful demographics—adopt crypto resources for long-term speculation and broadened portfolios.

Innovation & Market Demand of Australia Cryptocurrency Exchange

Australia Cryptocurrency Exchange Market Opportunities and Challenges

Australia Cryptocurrency Exchange Analysis

Australia Cryptocurrency Exchange Market Segmentation:

Australia Cryptocurrency Exchange Market News & Recent Developments:

Key Highlights of the Report:

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=36213&flag=E

FAQs: Australia Cryptocurrency Exchange

Q1: What is the projected CAGR of the market during 2025–2033?

A: The market is forecast to grow at 26.77% CAGR, from USD 975.76 million in 2024 to USD 8,250.69 million by 2033.

Q2: Which automated trading tools are gaining popularity?

A: Platforms like OKX’s trading bots and algorithmic strategies on Kraken are increasingly used by retail and advanced traders.

Q3: How are institutional investors engaging with the market?

A: Through OTC desks, derivative platforms, and advanced custody—offered by exchanges such as Kraken, Independent Reserve, and Binance Australia.

Q4: What regulatory frameworks are shaping exchanges?

A: Exchanges are adhering to ASIC and AUSTRAC regulations, including AML/CTF obligations and obtaining Digital Currency Exchange licenses.

Q5: What future developments are influencing the market?

A: Initiatives like the CBDC roadmap (Project Acacia) and tokenization efforts are expected to enhance settlement systems and infrastructure.

About Us

IMARC Group is a leading market research firm providing strategic insights and data-driven solutions globally. We partner with clients across industries to identify growth opportunities, address critical challenges, and transform businesses through actionable intelligence and custom consulting.

Contact Us:

134 N 4th St, Brooklyn, NY 11249, USA

Email: [email protected]

Tel (India): +91 120 433 0800 • US: +1‑631‑791‑1145

© 2024 Crivva - Business Promotion. All rights reserved.