Prepare for ZATCA Phase 2 compliance in Saudi Arabia with the right e-invoicing software, ERP integration, and regulatory best practices.

In this era of digital revolution, taxation systems have joined the party; Saudi Arabia is one such country. The Zakat, Tax, and Customs Authority, or ZATCA, is the principal institution driving this program in the Kingdom. ZATCA has launched out Phase 2 of e-invoicing, also known as the Integration Phase, following the successful implementation of Phase 1 (the Generation Phase) in December 2021. Phase 2 is intended to connect taxpayers’ e-invoicing systems to ZATCA Phase 2 in order to validate invoices in real time and transparently.

ZATCA Phase 2 is being implemented in stages, each targeting a certain class of taxpayers based on yearly turnover thresholds. As a result, firms must change their internal processes, train employees, and choose compliant e-invoicing software in addition to addressing the technological integration requirements. Failure to do so leads to penalties and disruptions in business operations. For this reason, businesses in Saudi Arabia must prepare thoroughly to adapt to this digital revolution, as well as comply with the most recent ZATCA rules and regulations.

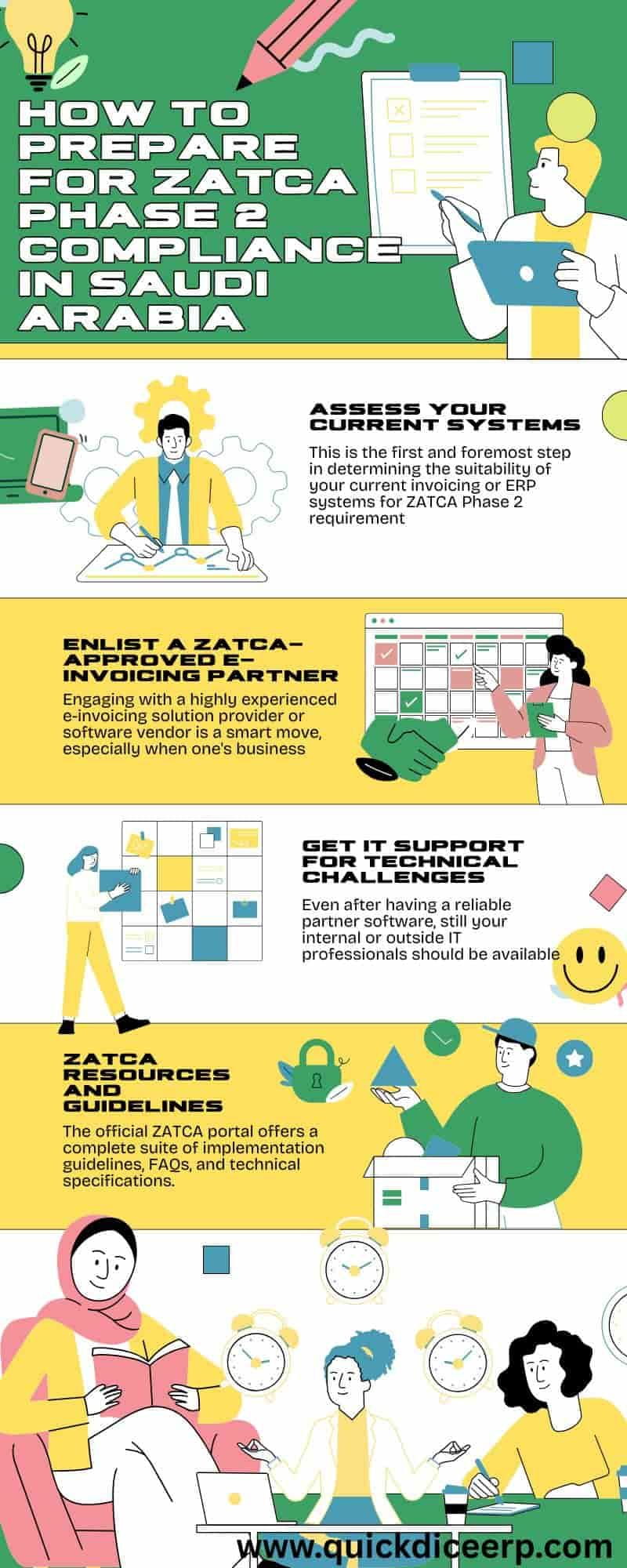

Here are various approaches to preparing for ZATCA Phase 2 compliance in Saudi Arabia

1. Evaluate your current systems

This is the first step in establishing whether your current invoicing or ERP systems meet ZATCA Phase 2 criteria. This encompasses:

Will conducting a thorough gap analysis help identify the essential improvements or changes that must be implemented?

Engaging with a highly skilled e-invoicing solution provider or software vendor is a wise decision, especially if your company decides to take the next big step in the second phase of ZATCA. Select a seller who is ZATCA-approved or certified. Connected with integration possibilities, allowing for direct access to Fatoora from your systems. We can provide you with ongoing support and updates as regulations change. A good partner, to say the least, will help develop that technological basis while also assisting with worker training and post-deployment assistance.

Even if you have a dependable partner software, your internal or external IT personnel should be ready to manage the integration and testing stages. Here are some things that he will do: Upgrading systems to meet XML standards. Installation of digital signatures and cryptographic security. In real or near real time, invoices are transmitted to ZATCA’s system process. Error when generating and submitting an e-invoice. Internal and external IT support, as well as legal expertise, are critical to assuring the system’s durability, scalability, and data security.

The official ZATCA portal provides a comprehensive set of implementation guides, FAQs, and technical specifications. These include data sections for XML schema definitions and integration documentation.

– Compliance criteria

– Security and control requirements.

Consult these materials on a frequent basis, as ZATCA will issue new versions or explanations. Their official Fatoora portal is the go-to resource for documentation and compliance resources.

Phase 2 requires thorough and standardized invoicing data. Inspect your system’s data collecting method for the following:

Details of the seller and buyer, including VAT registration numbers. Date and time of invoice issuance.

Unique invoice identifiers (UUIDs). Line item details with the appropriate product/service codes.

VAT amounts are totaled for each line item and the invoice as a whole. Cryptographic stamp, prior invoice hash, and QR code (simplified invoices). Missing, incorrect, or incomplete data may result in invoice rejection or noncompliance penalties.

Preparing for ZATCA Phase 2 is more than just a technical improvement; it ushers in the key phase of comprehensive digital tax compliance. Companies would not only meet legal standards, but also simplify operations and improve financial accuracy by investing in necessary infrastructure, selecting ZATCA-approved solutions, and providing proper staff training. This compliance journey may even deliver long-term benefits like as improved data visibility, faster reporting, and more informed decision-making through digitized operations.

© 2024 Crivva - Business Promotion. All rights reserved.