Natural Rubber price trends are driven by production levels in Asia, demand from the automotive industry, and oil price movements.

Natural Rubber Price Trends in North America: Q1 2025 Overview

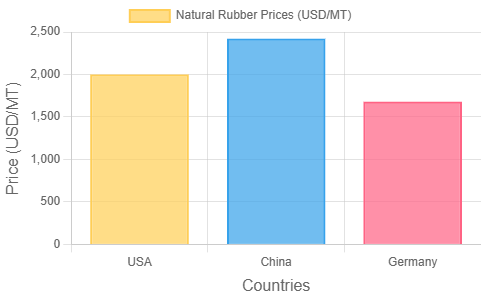

Natural Rubber Prices in the United States:

| Product | Category | Price |

| Natural Rubber | Agricultural Feedstock | 2000 USD/MT |

During Q1 2025, natural rubber prices in the USA surged to around 2000 USD/MT due to adverse weather conditions like floods and heatwaves that severely impacted latex harvesting. Additionally, supply chain disruptions such as port congestion and shipping delays worsened shortages. These combined challenges significantly influenced the natural rubber price index, causing higher prices and increased market volatility throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/natural-rubber-pricing-report/requestsample

Note: This report can be modified to align with the client’s specific requirements.

Natural Rubber Price Trends in APAC: Q1 2025 Overview

Natural Rubber Prices in China:

| Product | Category | Price |

| Natural Rubber | Agricultural Feedstock | 2420 USD/MT |

According to the Natural Rubber Historical Price Chart, Prices in China rose to 2,420 USD/MT due to seasonal production pauses during the Spring Festival, which temporarily disrupted supply. Following the holiday, increased demand from tire manufacturing and related industries further pushed prices higher. These combined factors significantly influenced the Price Trend of Natural Rubber, leading to a clear upward movement in China’s market throughout the first quarter of 2025.

Regional Analysis: The price analysis can be extended to provide detailed Natural Rubber price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hong Kong, Singapore, Australia, and New Zealand, among other Asian countries.

Natural Rubber Price Trends in Europe: Q1 2025 Overview

Natural Rubber Prices in Germany:

| Product | Category | Price |

| Natural Rubber | Agricultural Feedstock | 1680 USD/MT |

During Q1 2025, natural rubber prices in Germany experienced significant fluctuations, reaching around 1,680 USD/MT in March. Supply chain disruptions, shifting industrial demand, and currency volatility, particularly fluctuations in the Euro exchange rate, were key factors driving this instability. These combined influences were clearly reflected in the Natural Rubber Price Index, highlighting the challenges faced by Germany’s rubber market during this period.

Regional Analysis: The price analysis can be expanded to include detailed Natural Rubber price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Factors Affecting Natural Rubber Price Trend, Index, and Forecast

Supply Constraints: Production is limited by adverse weather (such as El Niño, floods, and heatwaves), aging plantations, and a shortage of skilled tappers. Seasonal pauses, like the cutting suspension in Asia, further tighten supply and support higher prices.

Rising Production Costs: Higher labor, fertilizer, energy, and transportation costs in major producing countries directly increase the cost of natural rubber, pushing prices upward.

Global Demand Growth: Strong demand from tire, automotive, and manufacturing sectors—especially in China, India, and Thailand—continues to outpace modest supply growth, keeping the market tight and prices elevated.

Inventory and Stock Levels: Low inventories can drive prices up as buyers compete for limited supply, while high stocks may temporarily ease upward pressure.

Supply Chain and Logistics Disruptions: Port congestion, shipping delays, and global logistics issues can restrict the flow of natural rubber, causing price volatility and regional differences.

Currency Fluctuations and Trade Policies: Changes in exchange rates, tariffs, and trade agreements impact import/export costs and regional price trends, adding to market uncertainty.

Competition from Synthetic Rubber and Oil Prices: Lower crude oil prices make synthetic rubber cheaper, which can reduce demand for natural rubber and put downward pressure on prices.

Geopolitical and Regulatory Factors: Delays in regulations (such as the EUDR in Europe) and trade tensions (e.g., US-China tariffs) can either support or suppress prices depending on market sentiment and policy direction.