For expert assistance, Elite Mortgage Consultants will help you navigate the mortgage process with ease.

Buying a home is a significant milestone, and securing the right mortgage is a crucial part of the process. Whether you’re a first-time homebuyer or an experienced investor, working with professional mortgage advisors Dubai can make all the difference. These experts help you navigate the complex world of home loans, ensuring you get the best possible financing options based on your financial situation.

The mortgage industry in Dubai is highly competitive, with various banks and financial institutions offering different loan products. Choosing the right mortgage can be overwhelming, especially if you’re unfamiliar with the terms, interest rates, and loan structures. Mortgage advisors Dubai simplify the process by providing personalized guidance, helping you compare different lenders, and ensuring that you meet all eligibility requirements.

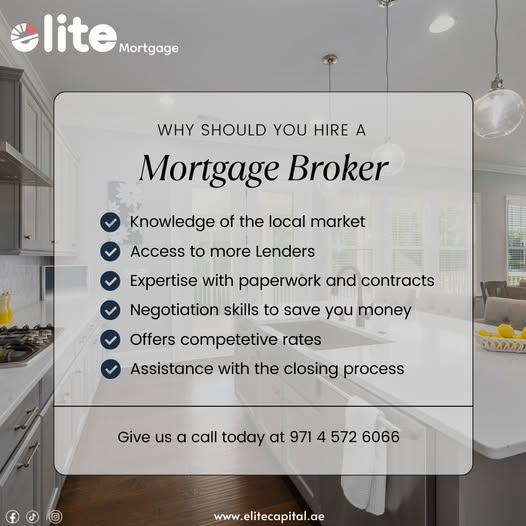

A mortgage advisor acts as a bridge between you and financial institutions. They assess your financial profile, understand your needs, and suggest the best mortgage plan tailored to your situation. Instead of approaching multiple banks, a mortgage advisor can present you with multiple options, saving you time and effort.

Mortgage advisors have extensive knowledge of the market and strong relationships with banks and lenders. This allows them to negotiate better interest rates and loan terms on your behalf. You may even get exclusive deals unavailable to the general public.

Understanding mortgage terms, repayment plans, and interest rates can be confusing. A professional advisor breaks down these aspects in simple terms, ensuring you fully comprehend your financial commitment before signing any agreement.

Applying for a mortgage involves extensive paperwork and multiple bank visits. Mortgage advisors handle the application process, from documentation to lender negotiations, making it hassle-free for you.

Each homebuyer has unique financial circumstances, and mortgage advisors help find the right loan based on income, expenses, and long-term financial goals. Whether you need a fixed-rate mortgage, variable-rate mortgage, or Islamic home finance, they guide you toward the most suitable option.

With numerous mortgage advisory firms in Dubai, selecting the right one is essential. Look for advisors with a proven track record, positive customer reviews, and a transparent fee structure. A reliable mortgage advisor should be licensed and have access to a wide range of lenders.

Additionally, it’s crucial to choose an advisor who listens to your needs and provides unbiased advice rather than pushing specific loan products for their benefit. The right advisor will prioritize your financial well-being and work towards securing the best mortgage for you.

Securing a mortgage can be a daunting process, but with the help of professional mortgage advisors Dubai, you can make informed decisions and find the best financing solutions for your property purchase. These experts offer valuable insights, negotiate better deals, and ensure a smooth application process, making homeownership in Dubai more accessible and stress-free.

For expert assistance, Elite Mortgage Consultants will help you navigate the mortgage process with ease. Their experienced team provides tailored solutions, ensuring you secure the best loan terms that align with your financial goals. Whether you’re buying your dream home or investing in real estate, Elite Mortgage Consultants are your trusted partners in achieving your property goals.