Integrate equipment rental software with accounting systems to enhance invoicing, track assets, and streamline financial operations efficiently.

What is more important than integrating equipment rental software with accounting software is the significant improvement in equipment rental business operations and administration on a variety of fronts, including finance. Their magic spell focuses on resource management, which rental companies must address with software that interfaces seamlessly with their accounting systems.

This interface will ensure that all financial activities, whether invoicing or expense tracking, are recorded precisely, in real time, and with significantly fewer manual errors, saving time in the process. While equipment software rental provides valuable benefits such as asset management, contract tracking, and billing, having an accounting system in place allows the organization to have a unified view of physical inventory and finance when managing day-to-day resources. Businesses will be better able to track cash flow, revenue, and operating expenses in order to comply with financial requirements as a result of this integration.

In a word, the need of seamless integration has increased significantly in modern business environments. In the absence of an adequate system, rental organizations would be forced to deal with anomalies that would develop as a result of comparing and discrepancies between their rental records and financial statements. Manual entries, miscommunications, and delayed updates are the most prevalent issues that firms experience while creating records in both equipment management and accounting systems (those that still split their activities.

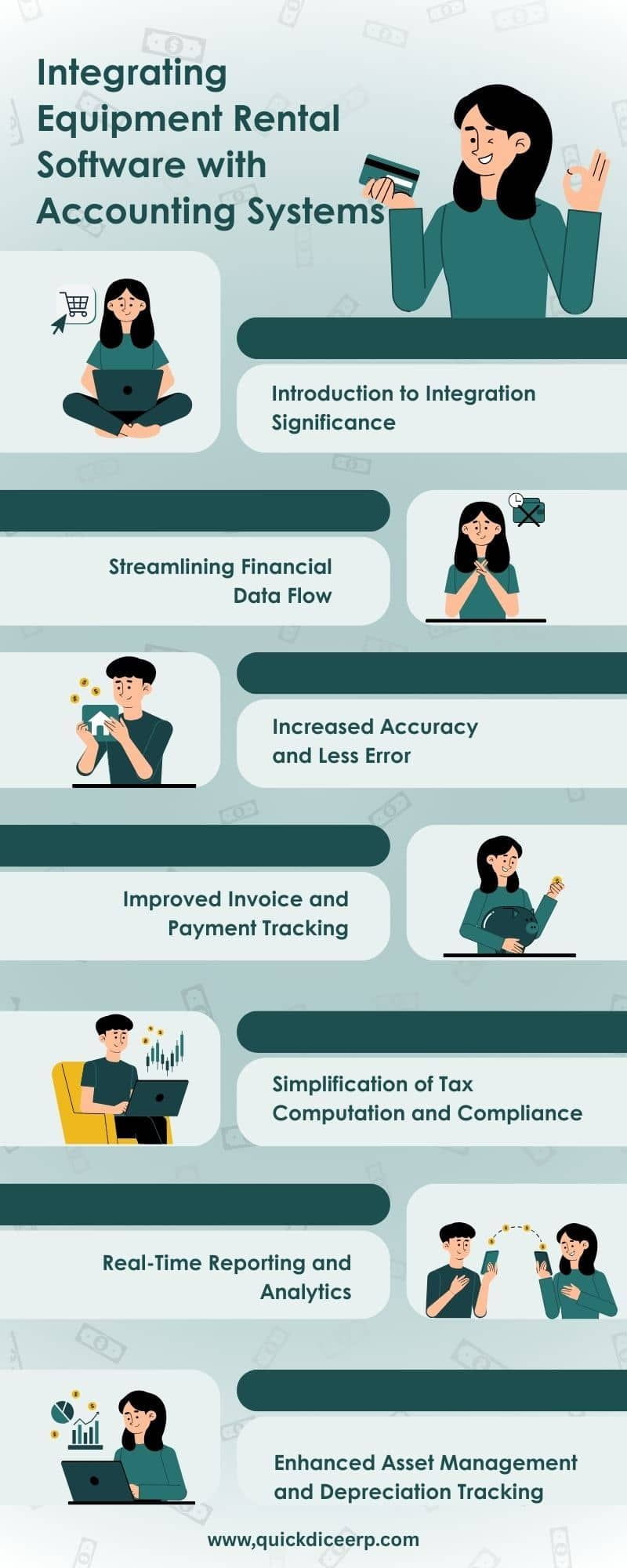

1. Introduction to Integration Significance.

Modern rental organizations must integrate equipment rental software with accounting systems. This connection reduces human data entry, improves accuracy, and ensures that financial records are always up to date. Equipment rental companies execute a variety of financial duties on a daily basis, including invoicing, payment monitoring, and asset depreciation, which would become time-consuming and error-prone if these large tasks were not adequately integrated into the company. Integration ensures that operational duties and finance management flow seamlessly together.

The most significant advantage of integration is the real-time flow of financial data. When a rental order is created or a payment is received by the rental software, the information is immediately updated in the accounting system. This alleviates the stress of duplicating labor while reducing the very real possibility of missing or incorrect information. This allows accountants and business owners to examine current cash flow, outstanding payments, and expenses without having to switch between platforms.

Manually entering rental transactions into accounting software increases the potential of errors such as incorrect amounts, missed decimal points, and unknown entries. Integration automates this procedure, ensuring that accurate data is transferred with each transaction. This means reduced likelihood of costly billing, taxing, and financial-reporting problems. Equalized records between systems make account reconciliations easier to automate.

Rental software typically includes billing features depending on rental term, equipment usage, and additional charges for delivery or maintenance. When these invoices are incorporated into the accounting system, they are automatically entered and tracked. Thus, the company can see which invoices/clients have been paid and which are past due, all from a single dashboard view. As a result, speedier payment, improved cash flow, and following up with clients on delinquent payments become much easier.

Tax reporting is a significant difficulty for rental equipment companies, particularly those operating in multiple regions with differing tax rules. Integration allows for the precise computation and tracking of taxes such as VAT or sales tax based on rental transactions. These statistics are appropriately entered into the accounting software, allowing for easier reporting and timely filing of returns. It assures conformity with local legislation, lowering the likelihood of incurring penalties for improper submissions.

The integration of equipment rental software and accounting systems will surely change the game for organizations in the equipment rental industry. Automating their financial procedures with improved data accuracy would highlight areas where they need to focus more on customer service and business growth. The suggested continuous communication between the two systems enhances revenue, expense, and inventory tracking, guaranteeing that financial records are accurate and reliable. In addition, organizations will gain insight into their profitability and operational efficiency, which will direct their efforts to make data-driven decisions that lead to success.