Learn how to choose the best online invoicing software to streamline billing, improve accuracy, and boost financial management for your business.

Choosing the best e-invoicing software is a vital chore these days, especially for businesses looking to simplify their financial administration. Invoicing is essential to all financial operations since it is utilized for cash flow management, documenting, and regulating the financial temperature to tax. With everything going digital, the best e-invoicing software is a game changer rather than just a bill, and it includes automation, integration, and security. When it comes to producing digital invoices, the types of software available are virtually limitless. There are methods for determining what software is most appropriate for a firm in terms of economy, functionality and long-term results.

The best e-invoicing software must have a user-friendly interface, several payment channels, and complete integration with accounting and ERP systems. Security should be adequately maintained to ensure the safety of private financial records. Practitioners should consider their other problems, such as cost and affordability, scalability, and customer service availability. The utilization of user input, demonstration software programs, and evaluating the usability of several business applications reduces the likelihood of selecting the incorrect application.

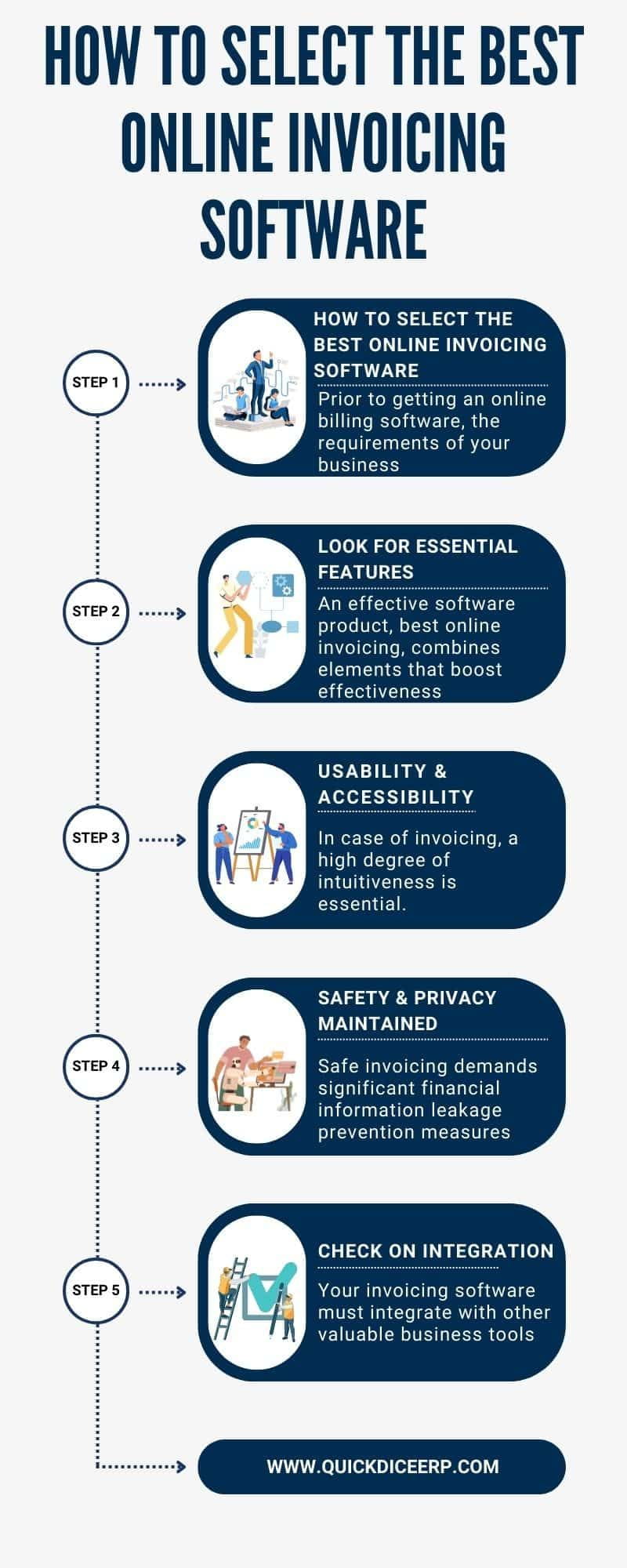

Here’s how You Choose the Best Online Invoicing Software:

1. Determine Your Business Needs

Before purchasing online billing software, you need first understand your company’s requirements. For example, the entrepreneur may wish to consider the company’s size, the amount of bills created, and other associated factors. The following questions should be asked repeatedly:

Will you utilize a program that supports multiple worldwide currencies, or will a single one suffice?

Do you serve customers from other countries?

Are there any other features to this type of payment?

Is auto payment necessary, and will it be used more than once?

Completing a needs assessment will be very helpful in guiding you.

2. Look for essential features.

An efficient software solution, the best online invoicing, contains components that improve effectiveness and accuracy. The most significant characteristics to look for are:

Automation: With automatic invoicing, you may schedule and send invoices during reviews.

Customized models allow you to have your own logos, colors, and personalized fields.

Identification of numerous payment options, such as credit cards, bank transfers, and online wallets.

Tax deduction and compliance: It is automatic, and you are knowledgeable about taxes and the region.

Support for Multiple Currencies and Languages: This is critical in a corporation that interacts with worldwide consumers.

Invoicing using Alert Systems and Tracking: Looks for reminders for due and late payments.

Integration with Business Software: It will coordinate properly.

3. Evaluate usability and accessibility.

Invoicing requires a high level of intuition. Software that a user enjoys should be simple to grasp, even for those who know very little about accounting. It must be cloud-based so that you can complete all of your invoicing tasks without difficulty. More importantly, if you are a business owner who is constantly on the go, you must guarantee that you have mobile access.

4. Identify the level of safety and privacy maintained.

Safe invoicing necessitates extensive financial information leakage prevention methods. When selecting an invoice online, ensure that the following items are present:

Data encryption ensures that no one else can see the report.

Proper user identity protection, such as two-step verification while accessing software.

Copyright updates assist in keeping track of any changes; otherwise, if the system dies, all installed plugins will be lost permanently. In corporate operations, customer data is highly sensitive information, and providing excellent customer service is critical.

Finally, safety requires a secure way for making and distributing invoices.

5. Comparison of Prices and Subscription Options

Various invoicing software packages have varying pricing schemes. Some have free plans, which means they offer their consumers free services but demand them to pay monthly or annually via subscriptions. Choose this plan while considering the following categories:

What is available for free under the freemium model?

Extra fees for additional staff per transaction.

Does the price meet your budget?

Any additional fees for payment processing or integration.

Get software that provides the best value while retaining important functionality.

Conclusion

Businesses must have e-invoicing solutions since they increase billing efficiency, ensure accuracy, and so improve financial management. The ideal e-invoicing software should have capabilities such as time savings or automation of procedures, internal tax control when applicable, support for multiple payment methods, and ease of transaction management. In addition, difficulties with integrations and application security should be addressed when using e-invoicing software. A correctly established e-invoicing system ensures that transactions require little manual involvement, as well as that errors are reduced.