When purchasing a residential property through a home loan, individuals can avail of tax benefits under various sections of the Income Tax Act.

When purchasing a residential property through a home loan, individuals can avail of tax benefits under various sections of the Income Tax Act. Understanding these tax-saving schemes is essential for maximizing savings and making informed financial decisions. In this blog, we will delve into the details of tax benefits associated with home loans and the specific sections of the Income Tax Act that provide these benefits for the Assessment Year 2024–25.

According to the provisions of the Income Tax Act, only individuals who have ownership of the property and have taken the loan in their name can claim deductions on a home loan. This benefit is available to individuals or members of Hindu Undivided Families (HUFs), and it does not extend to companies, partnership firms, body corporates, or trusts.

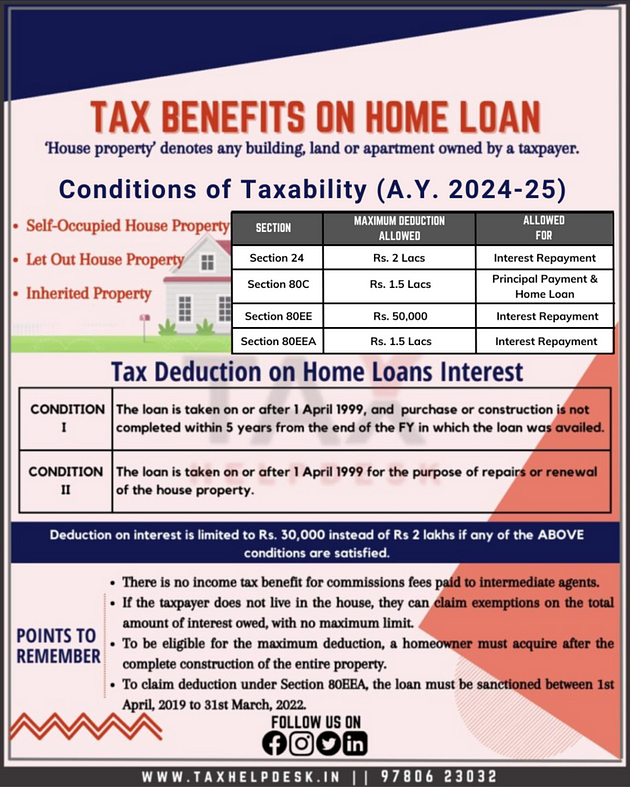

Under Section 24, individuals can claim deductions on the interest paid on the principal amount of the home loan. The sub-clauses in this category include:

To claim the maximum deduction on the loan interest amount, individuals must fulfil the following conditions:

There are a few exceptions to Section 24 deductions:

The only condition for claiming deductions under Section 80C is that the house should not be sold within five years of possession. If the property is sold within this period, the previously claimed deduction will be added back to the individual’s income in the year of sale.

Section 80EE provides deductions in respect of interest on loans for residential house property. The maximum allowable deduction under this section is Rs. 50,000.

Conditions for Section 80EE

To avail of deductions under Section 80EE, individuals must fulfil the following conditions:

Section 80EEA, introduced by the Union Budget 2019, allows deductions in respect of interest on loans for certain house property. The maximum deduction available is up to Rs. 1,50,000.

Conditions for Section 80EEA

To claim deductions under Section 80EEA, individuals must meet the following conditions:

Tax benefits on home loans can significantly reduce the financial burden of borrowers while also encouraging homeownership. Individuals must carefully understand the provisions of the Income Tax Act and the specific sections mentioned above to make the most of the available deductions. It is advisable to consult with a tax professional or financial advisor to ensure compliance with tax laws and optimize tax savings.