Introduction

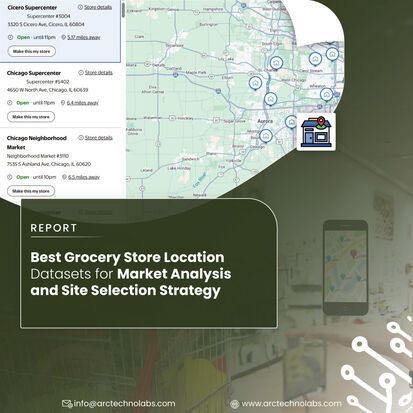

In the era of data-driven decision-making, the importance of accurate and comprehensive Grocery Store Location Datasets cannot be overstated. Businesses seeking optimal site selection, market penetration, or competitive pricing analysis rely heavily on high-quality, geo-tagged data.

With the rise of omnichannel retail, hyperlocal marketing, and Q-commerce models, the demand for Grocery and Supermarket Datasets has increased dramatically. These datasets offer actionable insights that support critical business operations such as new store planning, logistics optimization, pricing strategy, and customer targeting.

This report by ArcTechnolabs explores the Best Grocery Store Location Datasets available and how they contribute to successful market analysis and site selection strategies.

Growth of Grocery Location Data Usage in Business Intelligence (2020–2025)

| Year | % of Grocery Retailers Using Location Intelligence | Annual Spend on Grocery Location Datasets (Global, in $M) | % Retailers Reporting Improved Site Selection Accuracy |

|---|---|---|---|

| 2020 | 41% | $980M | 39% |

| 2021 | 52% | $1.32B | 47% |

| 2022 | 63% | $1.76B | 55% |

| 2023 | 71% | $2.24B | 62% |

| 2024 | 78% | $2.82B | 68% |

| 2025* | 85% (est.) | $3.44B (est.) | 75% (est.) |

Importance of Grocery Store Location Datasets

The strategic placement of a grocery store significantly impacts customer footfall, revenue generation, and overall business success. Grocery and Supermarket Datasets offer crucial insights into:

The strategic placement of a grocery store significantly impacts customer footfall, revenue generation, and overall business success. Grocery and Supermarket Datasets offer crucial insights into:

1. Demographics & Regional Demand

| Region | Average Household Income (USD) | Population Growth Rate (2020–2025) | Key Consumer Segments |

|---|---|---|---|

| North America | $68,000 | 2.1% | Urban families, Millennials |

| Europe | $62,000 | 1.8% | Seniors, Health-conscious |

| Asia-Pacific | $30,000 | 3.5% | Young professionals, Low-income |

| Latin America | $15,000 | 2.9% | Working-class, Bargain shoppers |

Insight: Understanding demographics and regional demand is crucial for determining the optimal location for grocery stores, ensuring they cater to the right audience. Best Grocery Store Location Datasets provide this information for precise targeting.

2. Competitor Proximity

| Competitor Distance (miles) | Number of Competing Stores | Market Saturation (%) | Retailer Share (%) |

|---|---|---|---|

| 0-1 | 3-5 | 15% | 20% |

| 1-3 | 6-8 | 30% | 25% |

| 3-5 | 9-12 | 40% | 30% |

| 5+ | 12+ | 50% | 25% |

Insight: Competitor proximity is essential for defining a store’s competitive advantage. A high concentration of competitors may indicate oversaturation, while a lack of competition could signal an underserved market. Grocery Store Location Datasets help identify these opportunities.

3. Consumer Traffic Flow

| Region | Peak Shopping Hours (Avg. Visits per Hour) | Foot Traffic (%) Growth (2020–2025) | Most Visited Store Type |

|---|---|---|---|

| North America | 250 | 15% | Supermarkets |

| Europe | 200 | 12% | Discount stores |

| Asia-Pacific | 180 | 18% | Hypermarkets |

| Latin America | 150 | 20% | Local grocery chains |

Insight: Consumer traffic flow data provides key insights into the best times for grocery store operations and locations with the highest foot traffic. Using a Grocery store location details scraper, businesses can extract this valuable data.

4. Pricing Strategy

| Year | Average Grocery Price Change (%) | Top Price Competitive Regions | Price Sensitivity |

|---|---|---|---|

| 2020 | +2.4% | U.S., Western Europe | Medium |

| 2021 | +3.1% | Canada, Eastern Europe | High |

| 2022 | +2.9% | Southeast Asia, Latin America | Medium |

| 2023 | +3.3% | U.S., Australia | High |

| 2024 | +4.0% | Western Europe, South Africa | High |

| 2025* | +4.5% (est.) | Global | High (est.) |

Insight:Pricing strategy heavily influences consumer choices and can be optimized by analyzing Web Scraping Grocery Prices. These insights can be obtained from Grocery & Supermarket Datasets.

5. Store Clustering and Saturation

| Region | Number of Grocery Stores per 1000 People | Market Saturation (%) | Potential for New Stores |

|---|---|---|---|

| North America | 2.5 | 65% | Low |

| Europe | 3.2 | 70% | Medium |

| Asia-Pacific | 1.2 | 50% | High |

| Latin America | 0.8 | 40% | High |

Insight:Store clustering and saturation analysis help identify regions with excessive competition or potential growth areas for new grocery stores. By using a Grocery store location details scraper, businesses can find underserved areas ripe for expansion.

By leveraging Grocery Store Location Datasets and Web Scraping Services, businesses can gain a competitive edge in the site selection strategy and market analysis process, optimizing their approach to store placement and pricing.

Types of Grocery Store Location Datasets

Grocery store location datasets are essential tools for businesses aiming to optimize their site selection and market analysis strategies. These datasets provide valuable insights into various factors such as demographics, foot traffic, competitor proximity, and consumer preferences. By leveraging location data, businesses can identify high-potential areas, assess market saturation, and tailor their pricing strategies effectively. In addition, Web Scraping Services allow real-time data extraction, enabling businesses to stay competitive in dynamic markets. With comprehensive Grocery & Supermarket Datasets, businesses can enhance decision-making, streamline operations, and ultimately boost customer engagement and sales.

Grocery store location datasets are essential tools for businesses aiming to optimize their site selection and market analysis strategies. These datasets provide valuable insights into various factors such as demographics, foot traffic, competitor proximity, and consumer preferences. By leveraging location data, businesses can identify high-potential areas, assess market saturation, and tailor their pricing strategies effectively. In addition, Web Scraping Services allow real-time data extraction, enabling businesses to stay competitive in dynamic markets. With comprehensive Grocery & Supermarket Datasets, businesses can enhance decision-making, streamline operations, and ultimately boost customer engagement and sales.