Discover how ERP software in Saudi Arabia ensures ZATCA compliance by automating e-invoicing, tax reporting, and reducing manual errors.

Over the past few years, Saudi Arabia has also experienced remarkable progress in the sector of tax administration mainly by the ZATCA. Another of the significant areas of change that companies have to track is the implementation of e-invoicing that has recently become obligatory for all the companies in the Kingdom. ZATCA Compliance and especially the e-invoicing has the potential of increasing the transparency in the taxes and also the procedures of the tax collection and remittance between the business and the government. Therefore, organisations require to ensure that they implement the correct solutions that will enable them to address these new regulations effectively.

That is where ERP software in Saudi Arabia becomes very useful. An ERP system is meant to support business processes, and given the increasing focus on ZATCA approved E-invoicing in Saudi Arabia Compliance, ERP systems can support e-invoicing while keeping tax compliance accurate. From automating invoices, to guaranteeing secure and timely submission to ZATCA, ERP software offers businesses the necessary tools to manage change and avoid penalties.

The compliance is named ZATCA, standing for Zakat, Tax and Customs Authority in the Kingdom of Saudi Arabia. This addresses issues to do with VAT and tax records and returns, as well as accuracy, accountability and compliance to local tax laws.

Recent years, ZATCA has tightened its regulations, and companies that do not meet the requirements are subject to penalties or fines. The compulsory implementation of e-invoicing in Saudi Arabia is part of this process, and record keeping has never been more crucial.

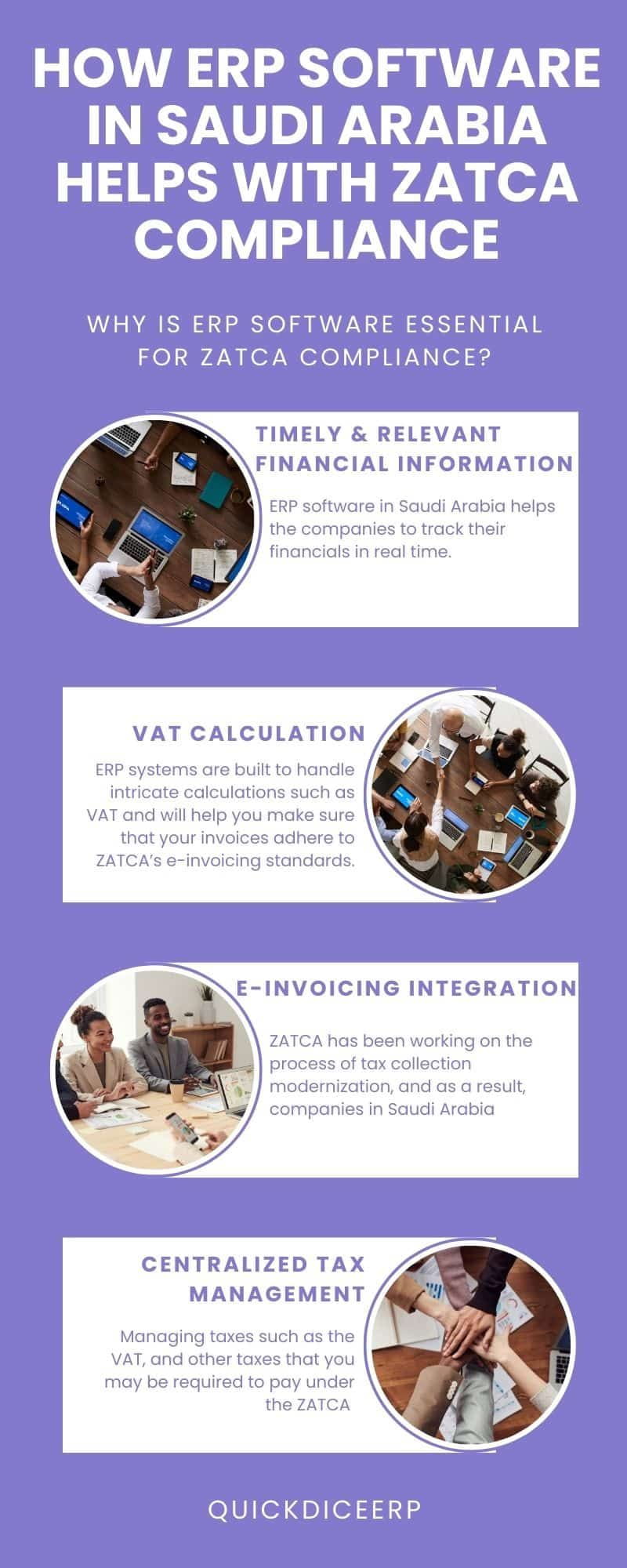

ERP software in Saudi Arabia helps the companies to track their financials in real time. It records transactions, prepares the organisation’s financial statements and checks that all the information recorded is correctly computed for tax purposes. Another approach of ZATCA compliance is accurate reporting since businesses are obliged to file tax returns with the ZATCA at least once per month, including sales and VAT payments.

ERP systems are built to handle intricate calculations such as VAT and will help you make sure that your invoices adhere to ZATCA’s e-invoicing standards. The software is also able to calculate the vat for each transaction depending on the standard input VAT set by ZATCA. It helps keep your business within the laws of correct VAT rates, thus minimizing the likelihood of mistakes.

ZATCA has been working on the process of tax collection modernization, and as a result, companies in Saudi Arabia need to provide e-invoices for each sale. ERP systems used in KSA are compatible with the ZATCA certified e-invoicing solution to ensure that your invoices are automatically formatted, stored and sent to ZATCA.

Managing taxes such as the VAT, and other taxes that you may be required to pay under the ZATCA guidelines becomes easier when all the processes are embodied in the ERP software. All the processes are in one place and not across different spreadsheets and systems making your taxation processes less complicated.

ZATCA’s regulations are strict and pay much attention to the quality and security of the financial information. This is especially important for businesses in Saudi Arabia because ERP software offers strong protection of the business data. This helps in keeping your financial data intact and also free from any vandals or acts of interferes with by unauthorized persons.

By adopting ERP software tailored for ZATCA compliance, your business can:

In conclusion, ZATCA Compliance is one of the essential factors of Saudi Arabia’s business environment, and ERP software in Saudi Arabia can be considered the optimal answer to emerging tax requirements. As companies were forced to adopt e-invoice and as the need for real time financial data increases – the implementation of an ERP system can greatly reduce the amount of manual work and errors. The features of the ERP software are automated to keep businesses compliant with ZATCA and improve tax filings, transparency, and compliance to reduce penalties.