Discover how ERP software enhances Saudi Arabia’s e-invoicing system, ensuring compliance, efficiency, and seamless financial operations.

E-invoicing becomes the ground for mandatory requirements from the professional organizations of Saudi Arabia as per Zakat, Tax and Customs Authority (ZATCA). The companies are to pair ZATCA’s e-invoicing system with their Enterprise Resource Planning (ERP) software to fall under compliance obligations. Such systems enable automating all functionalities associated with the generation, submission, validation, and processing of invoices while significantly reducing errors and enhancing operational efficiency for peacetime operations. A good selection of ERP software in Saudi Arabia is critical for a smooth and compliant e-invoicing process.

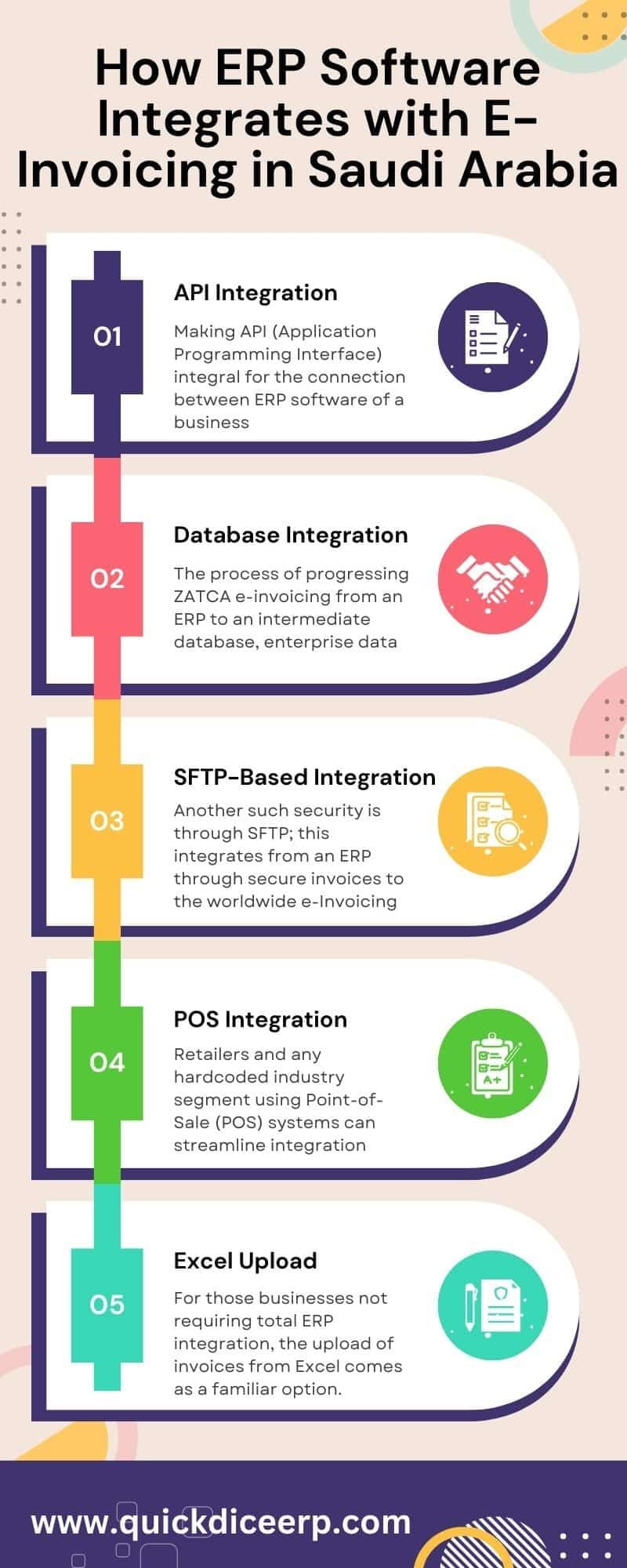

The best ERP software in Saudi Arabia must also have included e-invoicing capabilities, thus rendering a company completely adherent to the rules of operation over at ZATCA. Cross-platform ERP solutions will ensure that you are definitely not finding your business looking toward amazing routes to integration, including but not limited to API, database, SFTP, POS, Excel, UI, and e-invoicing.

Making API (Application Programming Interface) integral for the connection between ERP software of a business and the ZATCA E-invoicing system is the best possible means of enabling the ERP business to link the invoices in real time into the ZATCA e-invoicing system and validate them right there.

The process of progressing ZATCA e-invoicing from an ERP to an intermediate database, enterprise data then, is very effective for the following reasons: –

It enhances the ability to process invoices in bulk.

Ensures complete transaction data security.

Monitor compliance issues through audit trails of invoice records.

Another such security is through SFTP; this integrates from an ERP through secure invoices to the worldwide e-Invoicing solution. SFTP has the following benefits:

Data is more secure through encrypted file transfers.

Batch processing of invoices is possible.

Maintenance through downloads and uploads can be automated.

1. Compliance with ZATCA Regulations

ERP Integration with ZATCA allows for compliance with such regulations. Thus, organizations will avoid penalties and operate smoothly.

2. Minimized Manual Errors

The error rate in tax tally and bottlenecks are the most common automation-erasable mistakes. The system of this automation enjoys higher accuracy in general.

3. Greater Efficiency and Productivity

Through the integration of the integrated invoice processing system into the ERPs, a company can create, validate, and transmit invoices within the desired time bracket, lowering the processing time and increasing operational efficiency.

4. Enhanced Data Security

API and SFTP are two secure approaches to integration that businesses may leverage to secure sensitive financial information from both hacking and unauthorized access.

An integrated ERP software with e-invoicing will revolutionize business compliance, efficiency, and the accuracy of financial records for companies in Saudi Arabia. Under Phase 1 and Phase 2 mandates of Zakat, Tax and Customs Authority, businesses need digital invoicing for compliance purposes; they should use automated solutions to avert penalties and optimize the work processes. The best ERP software in the Saudi Arabia field towards seamless compliance automates invoices generated, validates, and submits them to the Fatoora platform.

Automating the processes involved in e-invoicing leads to and ensures the elimination of most errors that manually occur. In other words, rather than processed manually, automated invoicing, completes structures with the defining elements of accuracy and tax compliance that would limit the variance and, as a result, reduce the risk for audits. Real-time invoice tracking closely combined with reporting would enhance financial transparency as well as allow better monitoring of cash flow.