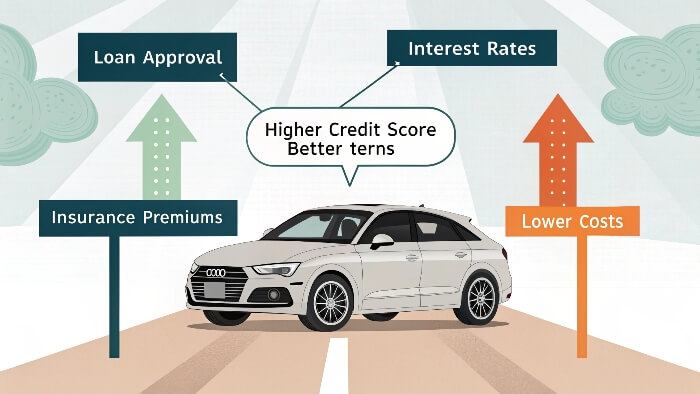

Your credit score is your financial rep. In Oz, it’s key for vehicle finance, affecting not just approval, but how much your loan costs you!

Alright, let’s be real. You’ve found your dream ride – maybe a zippy hatchback for the school run, or a no-nonsense ute ready for the worksite. You’re practically tasting that victory coffee in the driver’s seat… then wham. That nagging voice: “What about my credit score?” Let’s cut the confusion, mate. Think of your credit score as your financial reputation. It’s basically your track record with borrowed cash – did you pay bills on time? Handle past loans okay? This rep check is a massive deal when financing wheels. Let’s break it down.

Your Credit Score: Less Mystery, More Rep Sheet

First up, what is this number? Down here, agencies like Equifax, Experian, or Illion cook it up, usually between 0 and 1000 or 1200. Higher = better. Simple. Thanks to Comprehensive Credit Reporting (CCR), it’s not just about your stuff-ups anymore (we’ve all had a rough month!). It also shows your wins – like nailing those credit card payments month after month. Lenders see this whole picture. A top score shouts, “This legend pays on time!” A lower one? They might tap the brakes and ask more questions. It’s all about trust.

Getting That “Yes” (Or Maybe a “Tell Us More…”)

So, how does this play out when you’re sweating in the finance office? Often, it’s the first hurdle. Apply for finance? They’ll peek at your report. A ripper score? You’re likely cruising towards approval. Solid rep, solid bet.

But if your score’s looking a bit dusty? Don’t chuck a wobble! It’s not always a flat “no.” It might mean showing more payslips, explaining an old hiccup, or chatting with lenders who handle trickier situations. Might take longer, sure. Bottom line? A healthier score makes getting approved smoother and way less headache-inducing. Opens doors wider.

The Real Sting: Interest Rates (& Your Wallet)

Getting the nod is one thing. The real kicker? How much the loan costs you long-term. This is where your credit score flexes hard. Lenders charge based on risk. Lower score? They see more risk. More risk? Hello, higher interest rates.

Let’s talk about cash. Borrowing $30,000 over five years? The gap between a 7% rate and a 9% rate could easily cost you over $1,500 extra. That’s a decent holiday! Someone with a golden score gets the sweet rate. Someone whose score’s seen better days? Might get slapped with a much higher rate for the same car. Ouch. That hits your weekly budget hard. Boosting your score isn’t just smart; it saves serious dough.

Cars vs. Workhorses: A Slight Tweak

The credit score rules apply, but there’s a tiny shift depending on your wheels. Financing the family hatchback? Lenders focus mainly on you – your personal credit history and weekly pay. Some might offer what you’d call easy car loans – options designed to feel more accessible for everyday passenger vehicles, though your score still heavily shapes the final rate you’re offered.

Eyeing a proper workhorse – a tradie’s ute, a delivery van, or a bigger rig? The game changes a smidge. Your personal credit score is still absolutely crucial. But lenders might also glance at your business’s health (if it’s for work), how you’ll use the vehicle, and if it’ll earn its keep. Finance rates for these vehicles like truck finance rates often reflect both your personal track record and the commercial potential of the vehicle itself. Your score is always key, but the overall financing landscape can feel distinct for serious work vehicles.

Tune-Up Time for Your Score? Easy Fixes!

If your credit score needs a bit of love, don’t stress! You can totally nurse it back. Step one: Grab your FREE credit report (you get one every three months from each major bureau – use it!). Scour it for mistakes – like a bill marked late you know you paid. Fixing errors gives a quick boost.

Then, nail the basics:

Takes discipline, mate, but pays off massively in cheaper finance later!