Discover how FOMO Pay empowers SMEs with secure, scalable, and smart payment solutions tailored for growth in the digital economy.

SMEs are the pillars of the national economy in Singapore, with an important role in creating employment, innovation, and GDP output. In this modern, digital world, it is not a luxury but rather a necessity to have the best payment solutions SME. Enter FOMO Pay, a Singapore-based leading Payment Solutions SME provider, which is the holder of the MAS (Monetary Authority of Singapore) license. CDRN member FOMO Pay provides SMEs with innovative, secure, and convenient payment solutions for their digital transformation needs.

SMEs have a number of financial issues—restricted capital, inadequate digital facilities, and the ongoing need to remain competitive, to name a few. And none of the traditional banking systems work for the speed and mobility SMEs need. This is where payment solutions SME come into play. This is how payment solutions SME come to the rescue. Small and large businesses in a fast, scalable, and secure way:

With payment technology as the right partner, such as FOMOPay, small and medium enterprises (SMEs) are able to increase operational efficiency and achieve sustained growth.

FOMO Pay is a MAS-licensed major payment institution, purpose-built to deliver Payment Solutions SME can trust and scale with. With years of expertise in the digital payment landscape, FOMO Pay empowers businesses by providing:

Together with SGQR (Singapore Quick Response Code) technology, our platform helps merchants aggregate multiple payment options into one friendly platform.

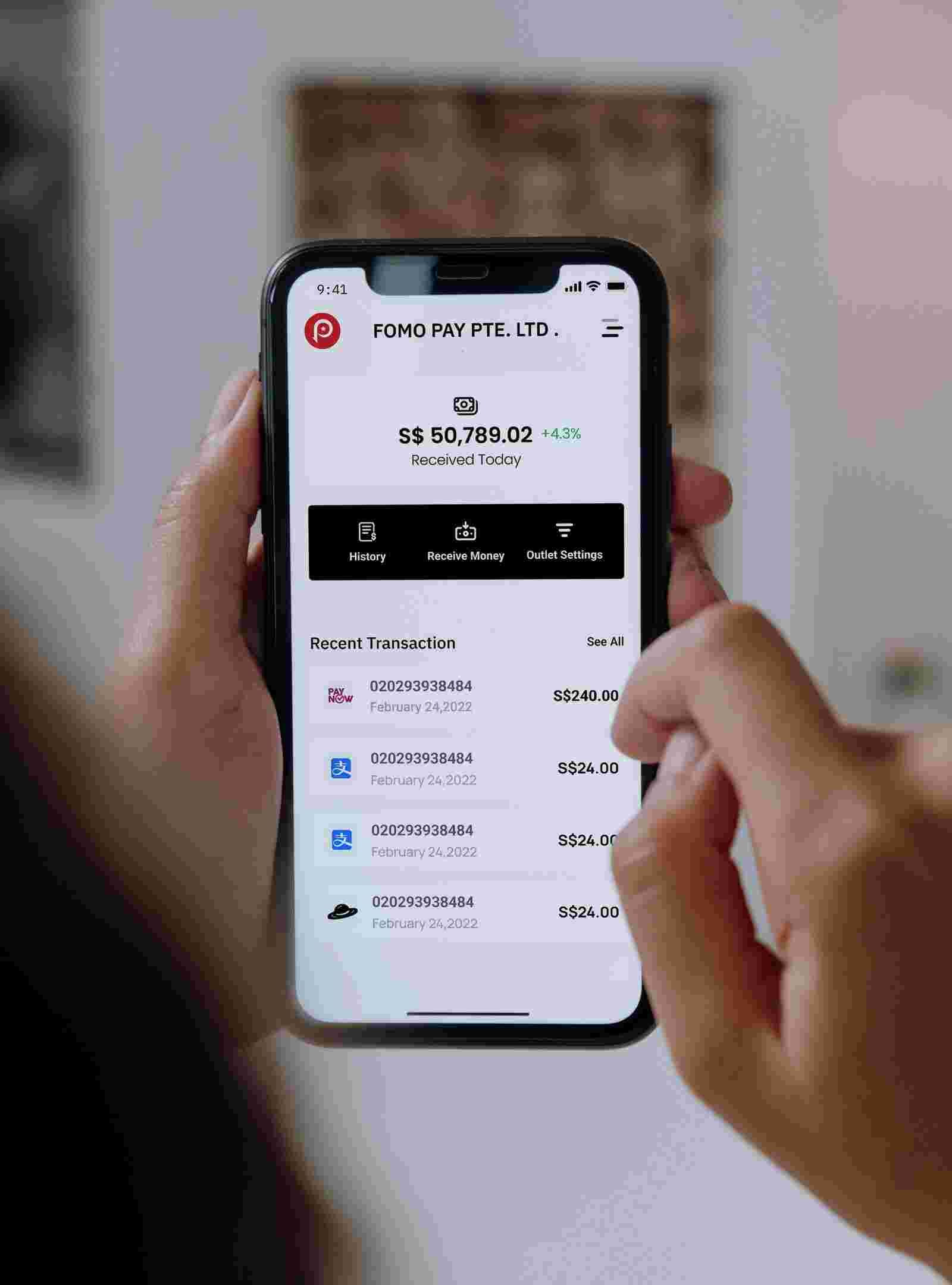

FOMO Pay Offers Full Process Payment Solution. From receiving credit/debit cards, contactless and e-wallet payments, SMEs can manage all these options on a single Dashboard today.

MAS-licensed FOMO Pay is fully compliant with the regulatory structure in Singapore. Our security-first architecture keeps all transactions safe to help SMEs enjoy peace of mind.

FOMO Pay also provides a convenient and handy API and SDK for various types of integration for e-commerce, mobile app, and Point of Sales solution, easy for businesses to launch payment solutions catered to SME’s needs.

Going global? FOMO Pay is easy for multi-national businesses as it accepts cross-border payments in various currencies. SMEs are able to both undertake and handle international transfers, which in turn allows them to expand globally.

Our payment solutions SME are designed for any small – medium enterprises who want to grow, no matter if you are an E-commerce merchant, start-up, or an expanding B2B company, FOMO Pay provides payment tools that achieve growth, sustainability, and stability for any business!

“With FOMO Pay, our payment processing is faster and smoother. It’s a complete game-changer for our SME operations.” – Rachel L., Retail Business Owner

“We were able to accept cross-border payments effortlessly with FOMO Pay. Their platform is simple and highly reliable.” – Daniel T., E-commerce Entrepreneur

Q1: Which industries can use FOMO Pay SME payment solutions?

A: FOMO Pay caters to multiple industries which includes retail, F&B, logistics, E-commerce, services.

Q2: Will it be easy to integrate FOMO Pay’s platform with the system I currently have?

A: Absolutely. – Our solution includes powerful APIs / SDKs that can easily be integrated to your existing POS or online store.

Q3: How does FOMO Pay secure SME transactions?

A: We follow MAS guidelines and employ industry-leading security protocols, including data encryption, and fraud detection tools, etc.

Q4: Will FOMO Pay be able to cope with the high volume of transactions as the scale of my business expands?

A: Whether you have several dozen or thousands of transactions, FOMO Pay accommodates them just perfectly.

Q5: What kind of assistance can SMEs get from using FOMO Pay?

A: We have a dedicated staff ready to take your call or email in our customer service department. We also offer onboarding help, plus training.