Explore the challenges businesses face when implementing e-invoicing tools, including compliance, integration, cost, and security concerns.

This digital transformation of financial transactions is becoming increasingly vital for organizations as e-invoicing standards become more widely adopted around the world. ZATCA e invoicing software is one of the most important tools for businesses to comply with the Zakat, Tax, and Customs Authority (ZATCA). However, while e-invoicing is useful in terms of enhanced efficiency and accuracy, as well as improved tax compliance, it has suffered acceptance hurdles. Small and medium-sized businesses have the problem of transitioning from traditional invoicing to a fully digital format.

The majority of firms face an issue due to a lack of technical skills to combine their e-invoicing systems with existing financial software. Most businesses use outdated accounting systems that are unable to interact with ZATCA e-invoicing software, necessitating further investment for upgrades. Aside from that, many staff lack training on these new invoicing systems, which can cause to errors, delays, and difficulty in assuring compliance with e-invoicing standards. There are additional technical challenges, as well as concerns about data security, system downtime, and other implementation-related costs. These concerns must be resolved in order for the transition to digital invoicing to proceed smoothly.

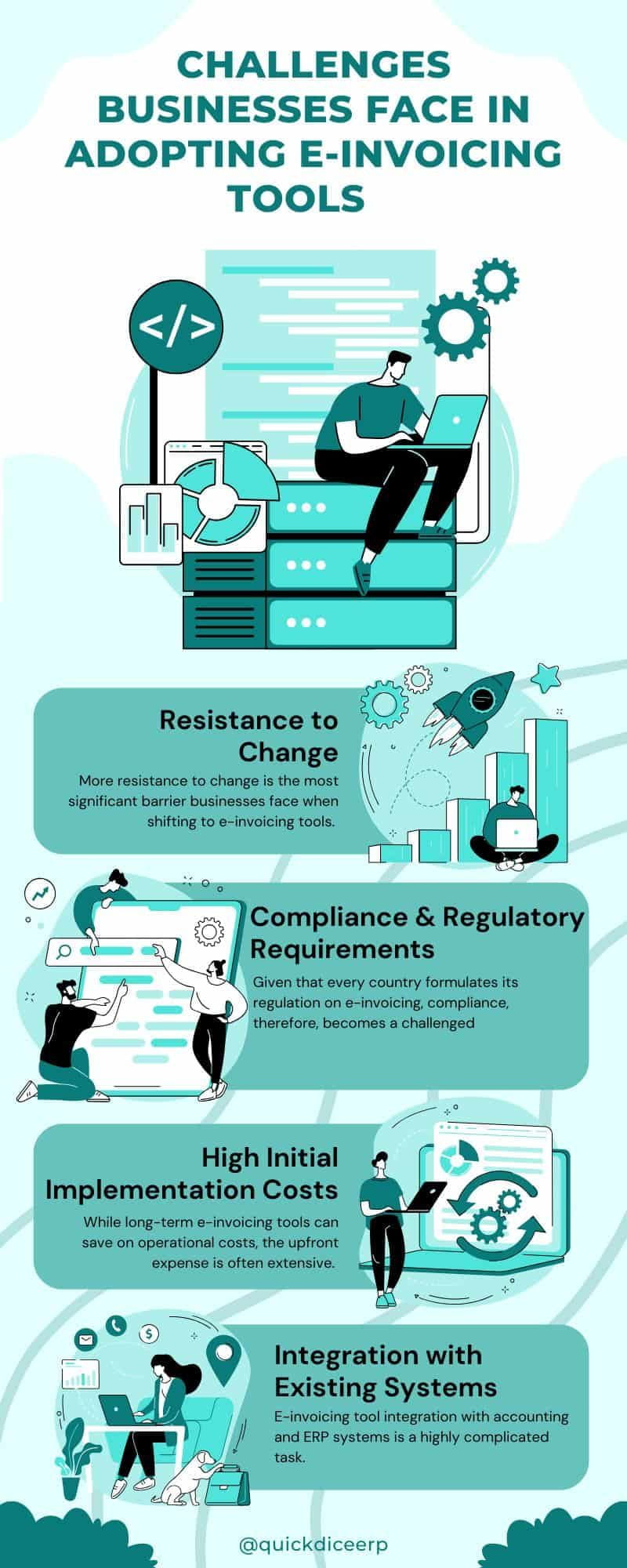

1. Resistance to change.

The most important hurdle to firms adopting e-invoicing solutions is increased resistance to change. Employees and external stakeholders may be hesitant to adopt these new technologies because they are accustomed to traditional methods of invoicing. Resistance may originate from a lack of understanding about the benefits of e-invoicing or a concern of greater complexity. Proper training and instruction will help staff adapt to the new system

Given that each country has its own e-invoicing regulations, compliance has become a concern for many organizations operating in many locations. These organizations must guarantee that the e-invoicing software follows the government’s guidelines for tax filing, digital signature authentication, and so on. A corporation that fails to comply faces penalties and legal liability.

While long-term e-invoicing systems can save operational costs, the initial investment is often significant. Software must be purchased, the infrastructure upgraded, and workers trained. All of these variables together might make it prohibitively expensive for small and medium-sized businesses (SMEs). This makes it easier for SMEs to begin making these expenditures if they select cloud-based solutions with reasonably priced subscriptions.

Integrating an e-invoicing solution with accounting and ERP systems is a complex process. Businesses sometimes rely on antiquated software and do not have contemporary e-invoicing solutions. The smooth integration necessitates technical skill, time, and investment. Businesses should explore e-invoicing products that support existing systems before investing in integration support.

With the world’s rapid digitization, more transactions are taking place digitally, raising the risk of cyber-attacks. There is always a risk of data breach, hacking, and fraud linked with new e-invoicing innovations. Data security solutions worth investing in, such as encryption, multi-factor authentication, and adherence to data protection legislation, provide the most secure protection of sensitive financial information from harmful internal sources. Companies can invest in safe e-invoicing solutions to mitigate these dangers.

The transition to ZATCA e-invoicing software is fundamentally modernizing Saudi corporate transactions; yet, it has presented several obstacles thus far. From the technical integration type to the knowledge barrier, security level hazards, and compliance limits, such a corporation may need to overcome each one of them in order to fully profit from the efficiency and accuracy of electronic invoicing. Employee training, software selection, and cybersecurity spending can all help firms move in this direction.