Integrating trading software with financial tools enhances efficiency, improves decision-making, and ensures better risk management and financial planning.

The current, rapidly increasing economic world relies significantly on traders and investors, who are surrounded by technology, to handle their activities efficiently. Integrating trading software with various financial instruments is a highly valued innovation in this industry. This creates a powerful ecosystem that allows users to improve decision-making capabilities, analyse real-time data, and manage operations efficiently. Thus, this connection benefits both individual traders and institutional investors by decreasing manual work, minimizing errors and providing better insight into market movements. The trend toward trading on digital platforms validates this integrated strategy as a theory rather than an optional way to proper competitiveness and accuracy.

Trading software allows users to buy and sell financial products such as stocks, currencies, and commodities. It already gives a solid foundation for trading and market analysis. When trading software is combined with accounting software, portfolio trackers, and risk management tools, its value increases significantly. Traders can automate reporting processes, synchronize data across many platforms, and obtain a consolidated view of their financial performance. This not only saves time, but it also requires strategic planning, which promotes efficiency and makes trading easier for all users, regardless of experience level.

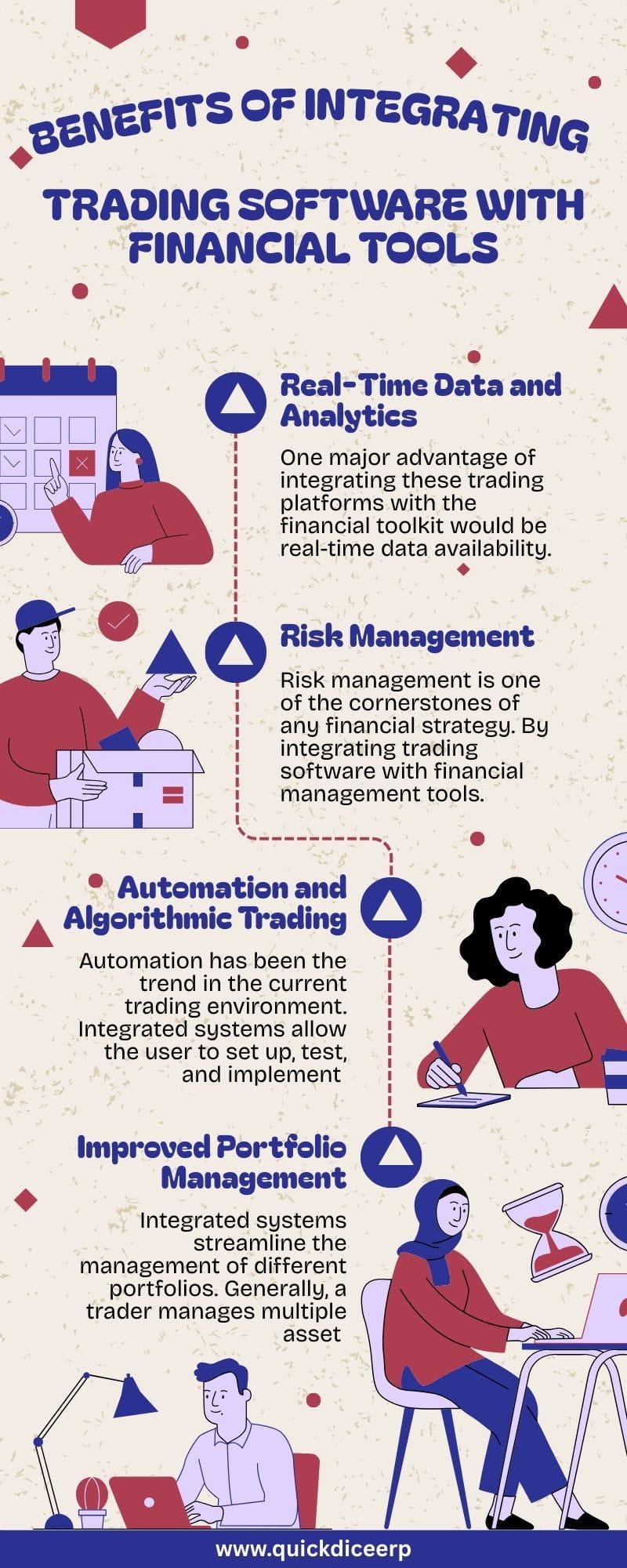

One significant benefit of integrating these trading platforms into the financial toolset is real-time data availability. trade software can be integrated to analytic tools such as Bloomberg, Terminal, Meta Trader, and other financial APIs to offer hourly updates on market prices, trade volumes, news, and economic indicators.

Real-time analytics enable traders to make the best decisions quickly. They can respond to market developments as they happen rather than relying on late-breaking news. Users that have access to sophisticated charting, algorithmic modeling, and AI-based forecasting tools can better analyze trends and pinpoint entry and exit points.

Risk management is a key component of any financial strategy. Traders can now spot and manage risks like never before thanks to the integration of trading software and financial management solutions. Portfolio trackers, volatility calculators, and margin surveillance tools all help to assess exposure and manage leverage more effectively.

For example, integrating traders’ platforms with a risk management dashboard may result in automated notifications when trades exceed a predetermined risk threshold. As a result, simulation testing or “what-if” scenarios can be performed prior to live trades. Such gadgets capitalize on preventing potentially costly errors while going the extra mile to preserve cash.

Automation has become the norm in the present trading climate. Integrated systems enable users to set up, test, and execute trading algorithms that run without additional human interaction. These include algorithmic tactics based on technical indications or delivered through news on sentiment, as well as highly advanced quantitative models.

Trading software, when combined with financial instruments that feed live market data and statistical models, enables traders to automate the entire process, from market scanning to trade placement and portfolio management. This would save a significant amount of time while also eliminating the emotions associated with trading for consistent results.

Integrated systems make it easier to manage many portfolios. A trader typically oversees various asset classes, including equities, currency, commodities, exchange-traded funds, and cryptocurrencies. Financial tools connected with trading software offer a consolidated picture of holdings, performance indicators, and asset allocations.

Investors can set goals, track progress, and rebalance their portfolios in real time based on market data. Integrated systems also aid in the correct documenting of trades and performance, all of which are necessary for tax and performance evaluation purposes.

Today, much modern trading is subject to a variety of regulatory restrictions and reporting criteria. Integrated trading systems make this easier by automating the creation of financial reports and compliance documents.

The benefits of integrating trading software and financial tools extend far beyond mere convenience. It offers a smarter, faster, and more exact method of managing trades and tracking financial performance. The advantage of having real-time data, automating processes, and reducing human error results into a better trading experience. Traders are now equipped with information and agility to stay ahead in volatile markets. This combination means that traders are not only reacting to market situations, but also able to plan with complete confidence about their financial health.

© 2024 Crivva - Business Promotion. All rights reserved.