Discover what expense tracking is and why it matters. Learn how tracking your expenses helps you save money, reduce stress, and reach your financial goals.

In a world where every dollar counts, understanding how and where you spend your money is more important than ever. Whether you’re an individual trying to save for the future, a freelancer managing variable income, or a business owner controlling company costs, expense tracking is one of the most powerful financial habits you can develop.

In this article, we’ll explore what expense tracking is, why it’s crucial for everyone, and how you can use modern tools to make the process effortless and insightful.

Expense tracking is the process of recording, categorizing, and analyzing all your financial transactions — from everyday purchases like groceries and gas to business-related costs like software subscriptions and travel expenses.

The goal is simple: to understand your spending behavior and use that information to make better financial decisions.

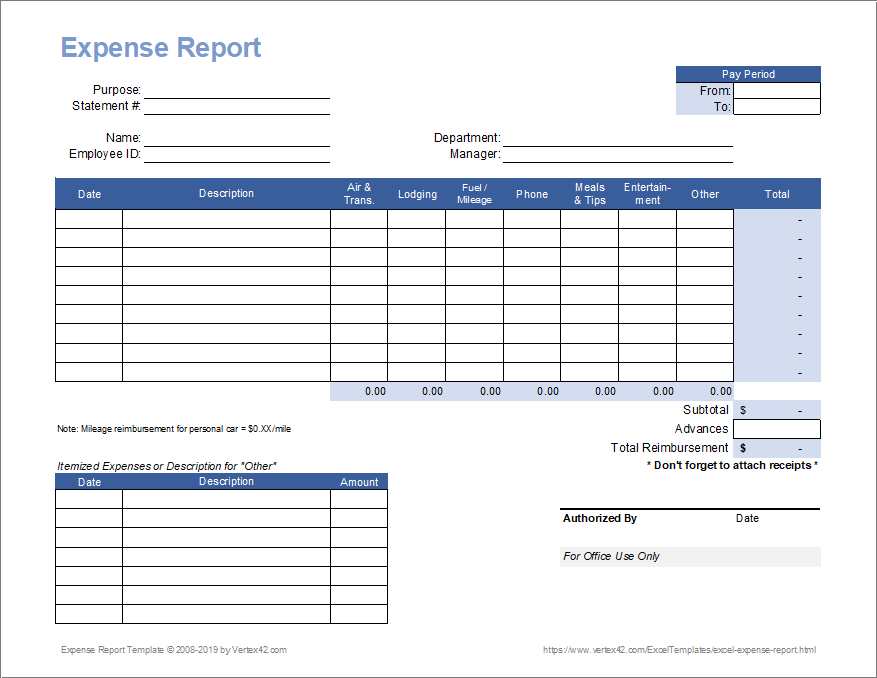

In the past, people tracked expenses manually using notebooks, envelopes, or spreadsheets. But today, digital expense trackers and automated finance apps have revolutionized the process. These tools connect directly to your bank accounts, credit cards, and digital wallets to log every transaction automatically, categorize them intelligently, and provide real-time financial insights.

In short, expense tracking transforms raw spending data into meaningful information — empowering you to take control of your finances with confidence.

Tracking expenses isn’t just about keeping records; it’s about gaining financial awareness and control. Here’s why expense tracking is essential for everyone — regardless of income level or lifestyle.

You can’t manage what you don’t measure. Expense tracking helps you see exactly where your money goes each month. Maybe you’re spending more on dining out than you realize or subscribing to unused services. By identifying these patterns, you can make informed adjustments to align spending with your financial goals.

A budget only works when it’s based on accurate data. Expense tracking provides that foundation. Once you know your average monthly spending, you can create a budget that reflects your actual habits, not just what you think you spend. This makes it easier to plan ahead and stick to financial goals.

Without tracking, it’s easy to lose sight of small daily expenses that add up quickly. Expense tracking tools can send alerts when you approach your spending limits, helping you stay disciplined and avoid debt.

For freelancers, entrepreneurs, and small business owners, tracking expenses is critical for tax compliance. Keeping digital records of every transaction ensures you can claim legitimate deductions and avoid last-minute stress during tax season.

Money-related anxiety often stems from uncertainty. When you have a clear picture of your financial situation, you replace stress with confidence. Expense tracking gives you that clarity — showing you exactly what’s happening with your money.

Expense tracking isn’t just for short-term savings. It’s a long-term habit that leads to smarter financial decisions, higher savings rates, and improved overall financial health. It’s one of the most effective ways to build wealth gradually and sustainably.

At its core, expense tracking follows three simple steps: recording, categorizing, and reviewing.

Here’s a closer look at how modern expense tracking tools handle these steps efficiently:

Modern expense tracking apps automatically record your transactions by syncing with your bank accounts, credit cards, and e-wallets. Each purchase is imported instantly — no manual entry required.

Once transactions are imported, AI-powered systems automatically classify them into categories like housing, groceries, utilities, entertainment, travel, or business expenses. You can customize or create new categories for greater accuracy.

The app then visualizes your spending habits through charts, graphs, and reports, helping you spot trends, compare months, and identify opportunities to save.

Some trackers even include budgeting features that allow you to set limits per category — sending alerts when you approach or exceed your target.

Technology has taken the hassle out of manual record-keeping. Here’s how automated expense tracking makes financial management easier and more efficient:

Time-Saving Automation – No need to enter data manually; the system handles it all.

Real-Time Updates – Transactions appear instantly, giving you up-to-date insights.

Improved Accuracy – Automation reduces the risk of human error in data entry.

Cloud Access – View your finances from any device, anytime.

Seamless Integration – Connects easily with accounting or budgeting software like QuickBooks, Xero, or Mint.

By using automation, you free up time to focus on making decisions rather than crunching numbers.

Here are some of the best expense tracking solutions that make managing money simple, smart, and stress-free:

Mint is one of the most popular free expense tracking apps. It connects to all your financial accounts, categorizes transactions, and helps you build customized budgets.

Perfect for freelancers and business professionals, Expensify automates receipt scanning, reimbursement tracking, and tax reporting.

Ideal for personal finance management, PocketGuard helps users see how much they can safely spend after bills and savings.

A leading tool for businesses, QuickBooks offers built-in expense tracking, invoicing, and reporting capabilities — all in one platform.

YNAB is a proactive budgeting app that helps users give every dollar a purpose. It’s ideal for individuals aiming to take full control of their finances.

To make expense tracking truly work for you, consistency is key. Here are some tips to maximize results:

Track Every Expense – Even small purchases count; they add up over time.

Review Weekly or Monthly – Regular check-ins help catch issues early.

Separate Personal and Business Finances – Use different accounts for clarity and compliance.

Use Categories Wisely – Organize expenses logically for better analysis.

Set Goals and Budgets – Link your tracking habits to financial targets for motivation.

Automate Whenever Possible – Let technology handle repetitive work so you can focus on decision-making.

Expense tracking isn’t just for accountants or business owners — it’s a universal tool.

Individuals can identify wasteful spending and start saving effectively.

Freelancers can manage irregular income and prepare accurate tax reports.

Businesses can improve cash flow management, enhance transparency, and streamline reporting.

No matter who you are, expense tracking helps you gain control over your financial future.

The next generation of expense tracking is smarter and more intuitive than ever. With the help of artificial intelligence (AI) and machine learning, expense tracking tools will soon predict spending trends, detect anomalies, and offer personalized financial advice.

Imagine a system that not only tracks your expenses but also recommends how to cut costs, save more, and invest wisely — all automatically. That’s the direction we’re heading.

So, what is expense tracking and why does it matter? It’s the cornerstone of financial health — the habit that bridges the gap between earning and saving.

By tracking your expenses, you gain visibility, control, and confidence over your finances. You’ll spot wasteful spending, set smarter budgets, and work steadily toward your financial goals.

Whether you’re managing personal expenses or running a business, now is the perfect time to start. Use modern tools, embrace automation, and make expense tracking a daily habit.

Because when you control your expenses, you control your future.