The financial markets have always been a dynamic arena, offering opportunities for wealth creation to those who can navigate their complexities. With the advent of artificial intelligence (AI), trading has evolved significantly, empowering investors with tools to make informed decisions faster and more effectively. One such innovation is the AI trading platform, which combines cutting-edge […]

The financial markets have always been a dynamic arena, offering opportunities for wealth creation to those who can navigate their complexities. With the advent of artificial intelligence (AI), trading has evolved significantly, empowering investors with tools to make informed decisions faster and more effectively. One such innovation is the AI trading platform, which combines cutting-edge technology with real-time market insights to simplify and enhance trading strategies. This article explores how AI trading platforms are revolutionizing investment opportunities, particularly for trading Tesla stocks, and provides a comprehensive guide to leveraging these tools for success.

Artificial intelligence has transformed industries worldwide, and financial trading is no exception. AI-powered platforms analyze vast amounts of data at unprecedented speeds, enabling traders to identify trends, predict market movements, and execute trades with precision. Unlike traditional trading methods that rely heavily on human intuition and manual analysis, AI trading platforms use machine learning algorithms to process real-time data, historical trends, and market sentiment, offering a competitive edge to both novice and experienced investors.

AI trading platforms are designed to simplify the complexities of the financial markets. By automating data analysis and decision-making processes, these platforms allow traders to focus on strategy rather than getting bogged down by numbers. Key benefits include:

For those looking to invest in innovative companies like Tesla, platforms like the one offered at Tesla Investing provide a seamless way to monitor and trade stocks with confidence.

Tesla, under the visionary leadership of Elon Musk, has redefined the automotive and energy industries. Its stock performance since its 2010 IPO reflects its relentless pursuit of innovation, making it a prime target for investors. An AI trading platform enhances the ability to capitalize on Tesla’s dynamic market performance by offering tools to track real-time stock movements and predict future trends.

Tesla’s journey from a niche electric vehicle manufacturer to a global leader in sustainable technology is a testament to its innovative spirit. Key milestones that have boosted its stock value include:

The launch of the Tesla Model S in 2012 marked a turning point for the company. With its long range and high performance, the Model S set a new standard for electric vehicles, leading to a significant surge in Tesla’s stock price.

Introduced in 2014, Tesla’s Autopilot system brought autonomous driving into the mainstream. This innovation not only captured public imagination but also drove investor confidence, resulting in a notable increase in stock value.

Tesla’s foray into energy storage with the Powerwall and Powerpack systems offered solutions for energy independence. These products underscored Tesla’s commitment to sustainability, further boosting its market capitalization.

The acquisition of SolarCity and the launch of the Solar Roof in 2016 expanded Tesla’s footprint in renewable energy. By turning rooftops into power generators, Tesla reinforced its position as a leader in sustainable technology.

The unveiling of the Cybertruck in 2019 showcased Tesla’s ability to innovate in design and performance. Its unique aesthetic and robust capabilities led to another spike in stock value, reflecting market enthusiasm.

These milestones highlight why Tesla remains a compelling investment opportunity. An AI trading platform allows investors to track these developments and make data-driven decisions to maximize returns.

Trading Tesla stocks requires agility and insight, given the company’s volatile market performance. AI trading platforms streamline this process by offering tools tailored to dynamic market conditions. Here’s how they make a difference:

AI platforms provide live data feeds, enabling traders to monitor Tesla’s stock movements as they happen. Interactive charts and analytics tools offer insights into price trends, trading volumes, and market sentiment, helping investors seize opportunities in both bullish and bearish markets.

Using machine learning, AI platforms analyze historical data and current market conditions to forecast Tesla’s stock performance. This predictive capability helps traders anticipate price movements and adjust their strategies accordingly.

For those who prefer a hands-off approach, AI platforms offer automated trading features. By setting predefined parameters, investors can let the platform execute trades based on market signals, ensuring timely responses to price fluctuations.

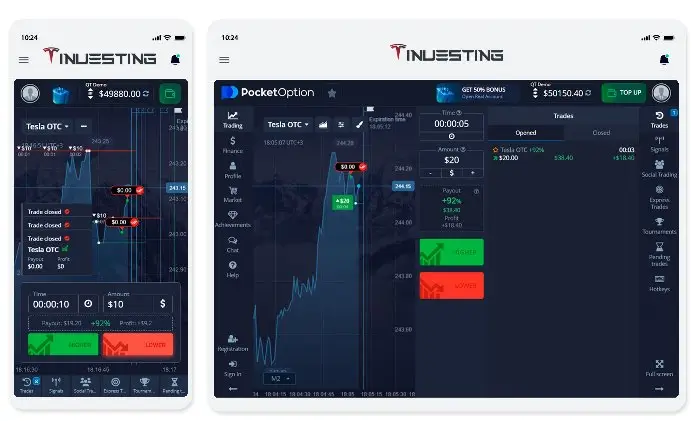

AI trading platforms are designed with accessibility in mind. Whether you’re trading from a desktop or a mobile app, the intuitive design ensures that even beginners can navigate the platform with ease. For example, the platform at Tesla Investing offers dedicated apps for iOS and Android, allowing traders to manage investments on the go.

Investing in Tesla stocks through an AI trading platform is straightforward. Here’s a step-by-step guide to begin your trading journey:

Sign up on a secure AI trading platform by providing basic information. The registration process is quick, and platforms like Tesla Investing ensure data security through encrypted systems.

Deposit funds using a variety of payment methods, such as credit/debit cards, bank transfers, or e-wallets like PayPal. A minimum deposit, often as low as $250, is required to start trading.

Use the platform’s real-time tools to analyze Tesla’s stock performance. Select Tesla OTC from the asset menu and leverage analytics to identify trading opportunities.

Track your portfolio and make informed decisions using the platform’s insights and reports. Adjust your strategy as needed to optimize returns.

While Tesla offers significant growth potential, trading its stocks comes with risks. Market volatility, economic conditions, and company performance can impact stock prices. An AI trading platform mitigates some of these risks by providing data-driven insights, but investors should still conduct thorough research and understand their risk tolerance.

AI platforms help investors manage risks by offering tools like stop-loss orders, real-time alerts, and portfolio diversification suggestions. These features enable traders to protect their investments while capitalizing on Tesla’s growth potential.

The combination of Tesla’s innovative trajectory and the power of AI trading platforms creates a compelling opportunity for investors. Here are some reasons to consider this approach:

Whether you’re a beginner or a seasoned trader, AI platforms simplify the trading process with user-friendly interfaces and robust tools. This democratization of trading ensures that anyone can participate in Tesla’s growth story.

AI trading platforms are accessible worldwide, allowing investors from North America, Europe, Asia, and beyond to trade Tesla stocks. This global scope ensures that market opportunities are within reach, regardless of location.

Many platforms, including Tesla Investing, offer transparent pricing with no hidden fees. Free registration and low minimum deposits make it easy to get started without significant upfront costs.

Tesla’s success is driven by its commitment to pushing boundaries, and AI trading platforms mirror this ethos by leveraging cutting-edge technology to enhance trading outcomes. By aligning with a platform that shares Tesla’s innovative spirit, investors can trade with confidence.

How Can I Start Investing in Tesla Stocks?

Sign up on an AI trading platform, verify your account, and make an initial deposit. You’ll gain access to tools and resources to begin trading Tesla stocks.

What Are the Risks of Investing in Tesla?

Investing in Tesla involves risks such as market volatility, company performance, and economic factors. Research thoroughly before investing.

How Do Tesla Stocks Compare to Other Automakers?

Tesla’s focus on electric vehicles and renewable energy sets it apart from traditional automakers. Comparing financial metrics can provide deeper insights.

What Factors Influence Tesla’s Stock Price?

Quarterly earnings, product launches, market demand for electric vehicles, and economic conditions all impact Tesla’s stock price.

Is Tesla a Good Long-Term Investment?

Tesla’s leadership in electric vehicles and renewable energy suggests strong long-term potential, but investors should align their strategies with personal goals.

The AI trading platform represents a game-changer for investors looking to capitalize on Tesla’s innovative journey. By combining real-time insights, predictive analytics, and user-friendly tools, these platforms empower traders to navigate the complexities of the financial markets with confidence. Whether you’re drawn to Tesla’s groundbreaking technology or its visionary leadership, an AI trading platform offers the tools to turn opportunities into wealth. Start your investment journey today and be part of the future of trading.

Disclaimer: Trading involves risks, and past performance is not indicative of future results. Always conduct thorough research and consult financial advisors before investing. The platform mentioned is not affiliated with Tesla or Elon Musk and is used for illustrative purposes.