The butadiene price trend has always been a subject of interest for industries that use rubber, plastics, and synthetic materials.

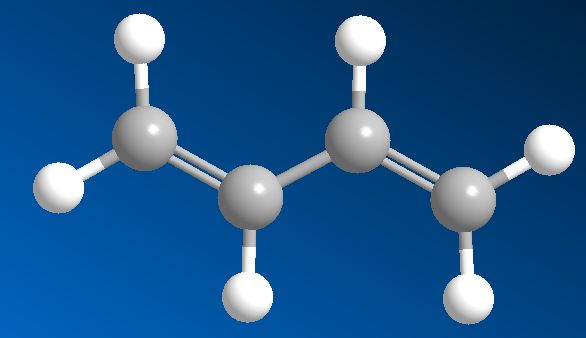

The butadiene price trend has always been a subject of interest for industries that use rubber, plastics, and synthetic materials. Butadiene, a colorless gas with a mild gasoline odor, plays a critical role in manufacturing everything from car tires to plastic hoses. Like many other raw materials, its price trend shifts over time due to a mix of supply, demand, costs, and broader market forces.

What Affects Price Fluctuations?

👉 👉 👉 Please Submit Your Query for Butadiene Price Trend, demand-supply, suppliers, forecast and market analysis: https://www.price-watch.ai/contact/

Recent Patterns and Insights

Lately, the butadiene price trend has seen some interesting movement. Earlier in the year, healthier crude oil prices fed through to feedstock costs, nudging butadiene higher. But as summer arrived, maintenance-driven outages in certain regions created supply tightness, briefly pushing prices up further. Once those crackers resumed operation, a slight correction followed.

Adding to this, demand from the automotive sector came into focus. Tire manufacturers have been busy restocking inventories, adding gentle upward momentum to butadiene pricing. Meanwhile, other sectors—like adhesives or latex production—have been more cautious, balancing the overall outlook.

One subtle but important development is the link between butadiene and the merchant bar price trend in related materials like metals or industrial rubber. Changes in one market often ripple into another. When metal bars or industrial rubber bar prices creep up, producers may anticipate higher costs across the board, impacting both strategy and pricing expectations for butadiene and similar feedstocks.

How Businesses React to Price Shifts

When prices climb steadily, manufacturers may seek alternative materials or renegotiate long-term contracts. Buyers and sellers both aim to protect margins. Some buyers stock up in anticipation of further increases; others prefer flexible contracts tied to market indices. Sellers may throttle volumes or delay shipments to support price levels. These tactics influence the rhythm of price movements.

Volatility can encourage innovation. Some users explore new formulations that require less butadiene or shift to completely different feedstocks. Such adjustments don’t happen overnight, but sustained high prices can prompt research and investment in alternatives. That’s part of how the butadiene price trend gradually evolves over the long term.

What Lies Ahead

Looking forward, several key factors will shape where prices go next: