Discover how outsourcing accounts payable and receivable can transform financial operations for US real estate businesses.

In the high-stakes, fast-paced world of US real estate, where deal flow is the lifeblood and cash flow is the ultimate metric of success, managing the intricate back-office financial engine can feel like a monumental, never-ending task. For property managers, ambitious developers, and savvy investment firms, the daily deluge of operational minutiae—processing a constant stream of invoices from a multitude of vendors, from general contractors to utility providers; meticulously managing tenant rent collections across diverse portfolios; and tirelessly reconciling complex accounts—creates a significant administrative burden on in-house teams. This relentless cycle often leads to a critical bottleneck: crucial financial data becomes siloed in spreadsheets and disparate systems, core processes slow to a crawl, and strategic decision-making is hampered by a lack of real-time, accurate information. In an industry where timing and precision are everything, being bogged down by manual accounting is a luxury no competitive firm can afford.

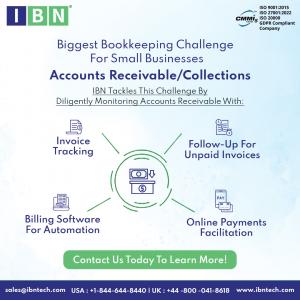

This operational challenge is precisely why a strategic shift towards outsourcing accounts payable (AP) and receivable (AR) functions is emerging as a powerful game-changer. It is a move that transcends simple cost-cutting; it is about proactively injecting superior efficiency, specialized expertise, and seamless scalability directly into the financial core of a real estate business. By partnering with a specialized service provider, forward-thinking real estate enterprises can fundamentally transform their accounting function from a reactive, overhead-heavy cost center into a proactive, data-driven strategic asset that actively supports sustainable growth and market stability.

The Critical Role of AP/AR in Real Estate Profitability

To understand the value of outsourcing, one must first appreciate that in real estate, AP and AR are not mere generic accounting tasks. They are intrinsically tied to core business functions and directly impact profitability and reputation. Accounts Payable (AP) involves managing a complex web of outgoing payments to a vast ecosystem of vendors—including contractors, maintenance crews, utility companies, and local authorities. Delays or errors here do more than just incur late fees; they can lead to severely strained contractor relationships, costly work stoppages that derail project timelines, and in worst-case scenarios, mechanics’ liens being placed on properties, clouding titles and jeopardizing future transactions.

Conversely, Accounts Receivable (AR) is the undeniable lifeblood of the business, primarily consisting of tenant rent collections. Efficient, systematic AR management is what ensures a consistent and predictable cash flow necessary to cover mortgages, property taxes, insurance, and other critical operational expenses. In a sector where margins are meticulously calculated, even a marginal improvement in collection times and a reduction in delinquencies can have a substantial, direct impact on the bottom line. Relying on manual, paper-based processes is inherently prone to human error, leading to a cascade of issues including late payments, missed early-payment discounts from vendors, and frustrated tenants or partners.

Why US Real Estate Firms are Making the Strategic Shift to Outsourcing

The unique complexities of the US real estate market—characterized by intense regulation, seasonal transaction volumes, and a vast network of stakeholders including tenants, owners, vendors, and investors—make it exceptionally well-suited for the outsourcing of these financial processes. Outsourcing provides a solution that is both agile and robust, allowing firms to leverage a dedicated team of accounting professionals who are not only experts in general ledger principles but are also well-versed in the specific nuances of real estate finance, from CAM (Common Area Maintenance) reconciliation to managing security deposits in compliance with state laws.

This partnership offers several transformative advantages:

About IBN Technologies: Your Strategic Financial Partner

IBN Technologies stands as a global leader in providing tailored business process outsourcing solutions, with a deep and nuanced understanding of the technology and operational imperatives of the modern real estate industry. We recognize that effectively managing finances is the non-negotiable cornerstone of any successful real estate operation. Our dedicated team offers comprehensive, white-glove accounts payable and receivable services meticulously designed for the unique demands of US-based real estate firms, REITs, and investment funds. By strategically leveraging our “Global Talent Cloud,” we deliver accurate, timely, and infinitely scalable financial processing, empowering our clients to enhance operational efficiency, improve cash flow visibility, and drive sustainable, long-term growth. We do not just perform tasks; we partner with you to create a seamless, integrated, and intelligent back-office function that directly and proactively supports your most ambitious strategic objectives.

Conclusion: From Administrative Burden to Strategic Advantage

For forward-thinking real estate businesses across the United States, the decision to outsource accounts payable and receivable is no longer viewed as a mere administrative convenience—it has firmly become a strategic imperative. It represents a decisive opportunity to streamline complex, time-consuming processes, reduce debilitating operational burdens, and gain valuable, actionable financial insights that were previously obscured by daily chaos. By delegating these critical functions to a trusted, expert partner like IBN Technologies, firms can unlock new levels of operational excellence, ensure unwavering financial accuracy and compliance, and most importantly, reallocate their precious internal resources and executive focus towards high-value, revenue-generating activities and strategic growth initiatives. In an intensely competitive sector where every advantage counts, optimizing your financial operations through a strategic outsourcing partnership is not just an option; it is the key to building a more resilient, profitable, and dominant portfolio for the future.