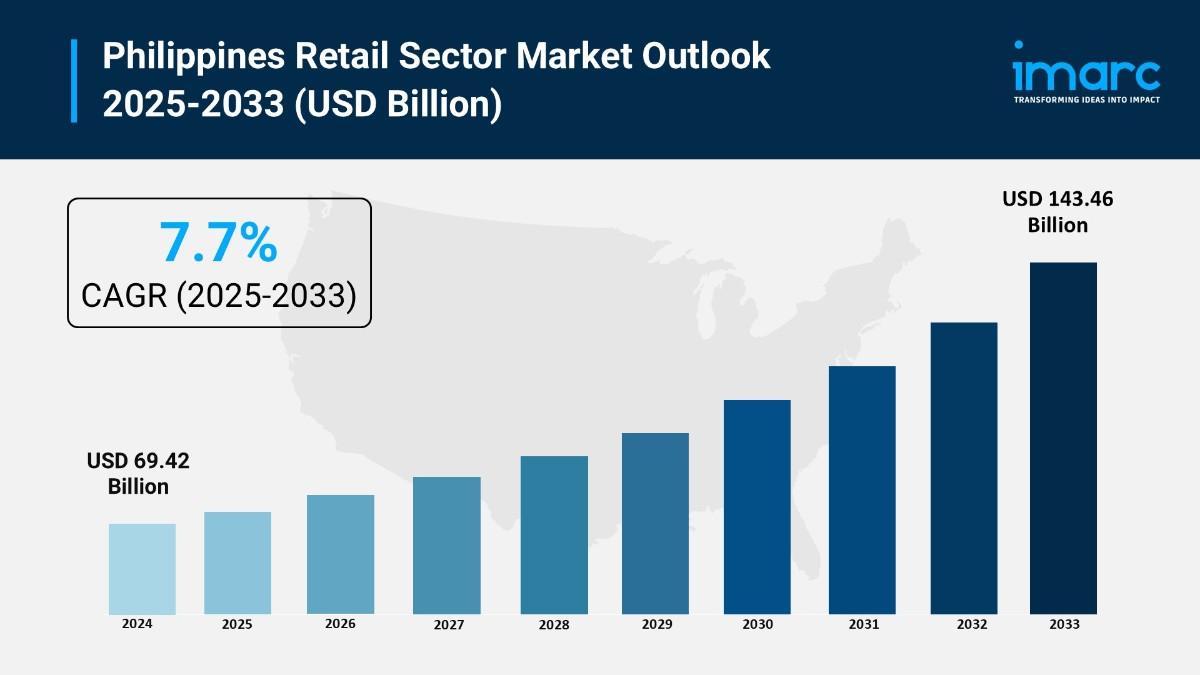

The Philippines retail sector market reached USD 601.8B in 2024 and is expected to grow to USD 1,173.3B by 2033, recording a CAGR of 7.70%.

The latest report by IMARC Group, “Philippines Retail Sector Market Report by Product (Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Region 2025-2033,” provides an in-depth analysis of the Philippines retail sector market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines retail sector market size reached USD 601.8 Billion in 2024 and is projected to grow to USD 1,173.3 Billion by 2033, exhibiting a growth rate of 7.70% during the forecast period.

Report Attributes and Key Statistics:

Philippines Retail Sector Market Overview:

The Philippines retail sector market is driven by increasing consumer spending e-commerce expansion technological advancements urbanization improved supply chain management rising disposable incomes enhanced customer experiences. Smartphone household penetration rose 74.1 percent in 2021 with e-money users surging from 8 percent (2019) to 36 percent (2021). February 2025 SM Prime Holdings investing PHP 100 billion in 2025 with PHP 21 billion allocated mall expansion opening three new malls renovating existing spaces. Philippine Retailers Association reported industry generated approximately PHP 4.7 trillion revenue for 2024 with forecast 15 percent growth to PHP 5.4 trillion in 2025 driven healthy remittances growing population. Microsoft Philippines reported 86 percent Filipino knowledge workers integrating AI into daily routines exceeding global 75 percent regional 83 percent averages supporting technological transformation market expansion nationwide.

Request For Sample Report: https://www.imarcgroup.com/philippines-retail-sector-market/requestsample

Philippines Retail Sector Market Trends:

Philippines retail sector market trends indicate rise of omnichannel retailing providing seamless shopping experiences across online mobile in-store channels. September 2025 SM Prime Holdings announced raising PHP 17 billion through bond issuance supporting PHP 100 billion investment program with PHP 67 billion residential buildup PHP 21 billion mall expansion PHP 12 billion hospitality projects. September 2025 quick commerce services expanded rapidly with major e-commerce players launching 30-minute delivery promises for groceries essentials in urban centers as convenience-driven shopping preferences intensified. May 2025 Metro Manila retail sector projected delivering 158,000 square meters new space annually through 2027 with vacancy rate falling 13 percent by end 2025. Traditional trade accounts 56.69 percent market with digitalization projects linking 175,000 sari-sari outlets to supply-chain dashboards trimming stock-outs. Retailers adopting AI machine learning big data analytics optimizing inventory management operational efficiency. Increasing emphasis on personalized customer experiences with data analytics loyalty programs location-based technologies supporting market growth.

Philippines Retail Sector Market Drivers:

Drivers include rising disposable income among middle class leading increased consumer spending essential lifestyle sectors with households directing larger budget portions toward fashion electronics personal care packaged foods. April 2025 SM Group opened 88th Philippines mall announcing plans 2 additional malls launch latter part 2025 reinforcing dominance with aggressive store expansion strategy. April 2025 Puregold implemented aggressive expansion strategy planning 25 new locations provincial market penetration. USD 600 billion Luzon Economic Corridor connecting Subic Clark Manila Batangas via rail expressways complemented Subic-Clark Railway Clark National Food Hub lowering logistics costs 25.5 percent GDP. Build Better More program with 169 PPP projects enhancing seaports airports fiber lines shrinking delivery lead times attracting foreign brands provincial malls. Swift urbanization driving people toward cities where modern living demands convenience accessibility with urban consumers favoring organized retail settings malls supermarkets convenience stores supporting sustained market expansion.

Market Challenges:

Market Opportunities:

Philippines Retail Sector Market Segmentation:

By Product:

By Distribution Channel:

By Regional Distribution:

Philippines Retail Sector Market News:

September 2025: SM Prime Holdings announced plans raising PHP 17 billion through bond issuance supporting PHP 100 billion investment program for 2025. Investment allocation includes PHP 67 billion for residential buildup PHP 21 billion for mall expansion PHP 12 billion for hospitality projects demonstrating sustained commitment retail infrastructure expansion across Philippines. Development reinforcing company position as dominant retail player supporting economic growth job creation regional development nationwide supporting market competitiveness operational efficiency.

September 2025: Quick commerce services expanded rapidly in Philippines with major e-commerce players launching 30-minute delivery promises for groceries and essentials in urban centers. Development driven by intensifying convenience-driven shopping preferences particularly among millennial Gen Z consumers seeking instant gratification on-demand services. Rapid expansion demonstrating evolution of retail landscape meeting changing consumer expectations supporting digital transformation market innovation competitive differentiation nationwide.

May 2025: Metro Manila retail sector projected delivering 158,000 square meters new space annually through 2027 as physical mall space take-up returns pre-pandemic levels according Colliers Philippines. Vacancy rate expected falling 13 percent by end 2025 with mall developers investing PHP 13 billion to PHP 21 billion developing refreshing retail spaces. Development supporting absorption of brick-and-mortar mall space from large retailers foreign home furnishing brands demonstrating resilient retail infrastructure expansion.

Key Highlights of the Report:

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines retail sector market growth to USD 1,173.3 billion by 2033?

A1: Market driven by increasing consumer spending with PHP 4.7 trillion (2024) projected PHP 5.4 trillion (2025) 15% growth, February 2025 SM Prime PHP 100 billion investment with PHP 21 billion mall expansion, April 2025 SM Group opened 88th mall planning 2 additional malls, April 2025 Puregold adding 25 locations, smartphone penetration 74.1% with 86% AI adoption, USD 600 billion Luzon Economic Corridor supporting 7.70% CAGR addressing consumer demand infrastructure development requirements.

Q2: How are omnichannel integration and technology transforming the Philippines retail sector landscape?

A2: September 2025 SM Prime raising PHP 17 billion supporting PHP 100 billion investment with PHP 21 billion mall expansion. September 2025 quick commerce services launching 30-minute delivery promises urban centers. May 2025 Metro Manila delivering 158,000 square meters annually through 2027. 86% knowledge workers integrating AI exceeding global averages. Traditional trade 56.69% share with 175,000 sari-sari outlets digitally connected supporting omnichannel innovation market maturation operational efficiency nationwide.

Q3: What opportunities exist for retail stakeholders in emerging Philippines market segments?

A3: Opportunities include provincial expansion capitalizing on emerging markets modern retail formats, omnichannel integration implementing click-and-collect social commerce live-stream shopping, digital payment adoption leveraging e-wallets QR codes contactless transactions, premium product demand targeting middle-class high-quality branded items, experiential retail transforming centers into lifestyle destinations, technology integration implementing AI chatbots AR VR experiences, Retail Trade Liberalization capitalizing foreign retailers entry, and tourism growth targeting 7 million arrivals supporting market diversification addressing retail innovation demands.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=23546&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302