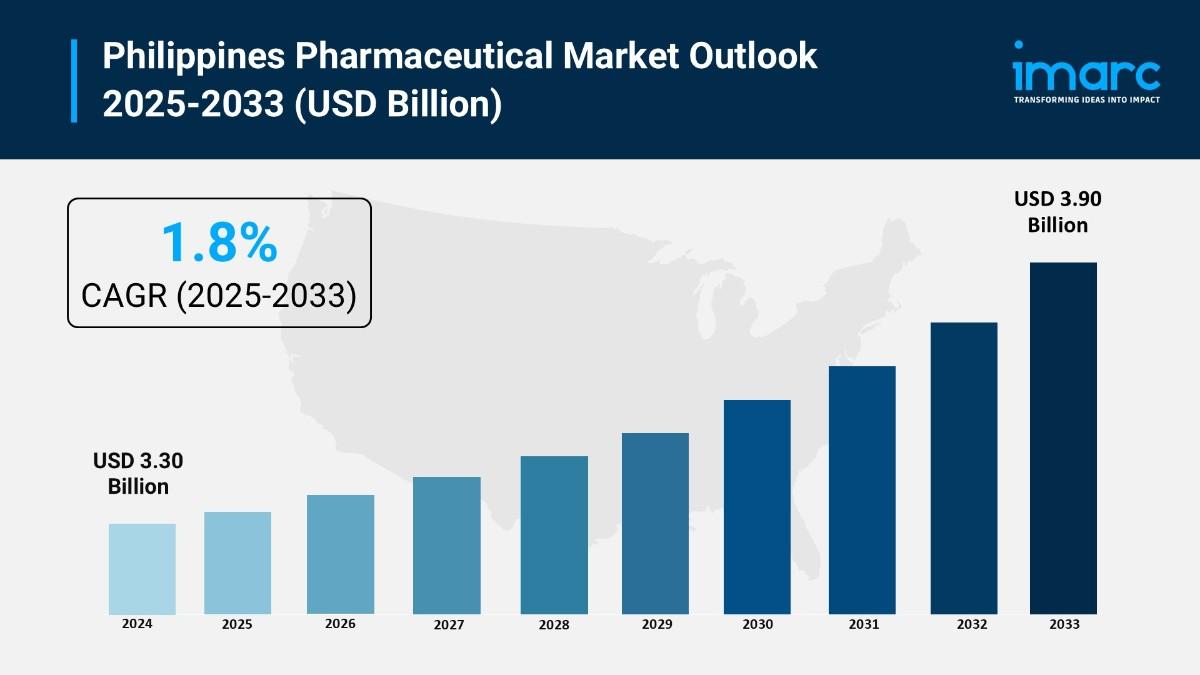

The Philippines pharmaceutical market reached USD 3.30B in 2024 and is expected to grow to USD 3.90B by 2033, reflecting a steady CAGR of 1.80%.

The latest report by IMARC Group, “Philippines Pharmaceutical Market Size, Share, Trends, and Forecast by Prescription Therapeutic Category, Therapeutic Category, and Region, 2025-2033,” provides an in-depth analysis of the Philippines pharmaceutical market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry.

Report Attributes and Key Statistics:

Philippines Pharmaceutical Market Overview:

The Philippines pharmaceutical market is experiencing steady expansion driven by rising healthcare expenditure with medical inflation reaching 19.3% in 2024. Government increasing health budget focusing on strengthening public healthcare facilities, subsidizing necessary drugs, and funding universal healthcare programs. Government approved USD 514.44 million expansion for Health Facilities Enhancement Program representing 6.6% increase from 2023 funds enabling procurement of advanced pharmaceutical products and medical technologies. Private healthcare providers expanding services investing in high-quality products catering to growing middle-class population. Consumer spending on healthcare increasing as individuals prioritize health and wellness particularly evident in urban areas where higher disposable incomes driving demand for premium medications.

Request For Sample Report: https://www.imarcgroup.com/philippines-pharmaceutical-market/requestsample

Philippines Pharmaceutical Market Trends:

Philippines pharmaceutical market trends include increasing concern for universal health care and medicine availability transforming industry dynamics. Preventive healthcare means including vitamins, supplements, and health-related products experiencing great popularity increase. Consumers showing greater health awareness driving demand for wellbeing and immunity-enhancing products. Stricter quality control and faster drug licensing procedures fostering pharmaceutical companies working in more competitive and dynamic environment. Generic medicines demand surging with branded generics category projected growing at 4.7% CAGR. Chronic disease medications particularly cardiovascular drugs, diabetes treatments, and oncology therapies recording increased demand reflecting rising non-communicable disease prevalence. E-pharmacy and online consultation platforms expanding accessibility supporting digital health transformation.

Philippines Pharmaceutical Market Drivers:

Philippines pharmaceutical market drivers include growing geriatric population with approximately 6% of total population aged 65 years or more according to United Nations Population Fund. Elderly adults comparatively more prone to degenerative and chronic disorders including arthritis, hypertension, and diabetes significantly boosting need for personalized treatments and long-term medications. BMI report projects market reaching PHP 438 billion (USD 7.5 billion) by 2029 from PHP 352 billion (USD 6.1 billion) in 2024 growing at five-year CAGR of 4.5% in local currency terms. AstraZeneca partnering with Department of Trade and Industry launching first Pharma Innovation Hub operating as regional center for digital health technologies. Universal Health Care Act ensuring automatic PhilHealth enrollment for all Filipinos supporting medication accessibility.

Market Challenges:

Market Opportunities:

Philippines Pharmaceutical Market Segmentation:

By Prescription Therapeutic Category:

By Therapeutic Category:

By Regional Distribution:

Philippines Pharmaceutical Market News:

August 2025: BMI report projects Philippines remaining major pharmaceutical market in Asia with five-year growth of 4.5% by 2029 citing strategic pharmaceutical investments. Market projected growing to PHP 438 billion (USD 7.5 billion) by 2029 from PHP 352 billion (USD 6.1 billion) in 2024 representing 4.5% CAGR in local currency terms supporting sector expansion.

August 2025: Department of Trade and Industry partnered with AstraZeneca launching first Pharma Innovation Hub operating as regional center for digital health technologies and research collaborations. Initial oncology innovation center similar to UK facility utilizing artificial intelligence for early cancer detection supporting healthcare workforce capacity building and evidence-based policy development.

August 2025: Pharmaceutical sector recorded increased demand for chronic disease medications particularly cardiovascular drugs, diabetes treatments, and oncology therapies reflecting rising non-communicable disease prevalence. Trend supporting market diversification with specialized therapeutic categories gaining prominence addressing population health needs transformation supporting targeted pharmaceutical interventions.

June 2025: AstraZeneca’s Oncology Innovation Center expected advancing country’s cancer care capabilities supporting Philippines pharmaceutical market projection reaching USD 7.5 billion in 2029. Center designed leveraging digital technologies improving early detection and patient support systems addressing critical healthcare gaps supporting treatment outcomes improvement.

Key Highlights of the Report:

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines pharmaceutical market growth to USD 3.90 billion by 2033?

A1: Rising healthcare expenditure with 19.3% medical inflation and USD 514.44 million government program expansion drive growth. Growing geriatric population at 6% total requiring long-term medications. Universal Health Care Act and Pharma Innovation Hub supporting 1.80% CAGR addressing chronic disease prevalence.

Q2: How are innovation initiatives and regulatory developments transforming the Philippines pharmaceutical landscape?

A2: AstraZeneca’s first Pharma Innovation Hub providing digital health technologies and AI-powered early cancer detection. PICS certification proposal requiring imported medicine quality standards. Generic medicines growing 4.7% CAGR. Universal healthcare outpatient drug benefits expanding market access supporting industry transformation.

Q3: What opportunities exist for pharmaceutical stakeholders in emerging Philippines market segments?

A3: Generic drug expansion, innovation hub development, and PICS certification adoption offer growth potential. Export market positioning as regional hub, public-private partnerships, herbal medicine production, outpatient drug benefits supply, and manufacturing capacity upgrades represent opportunities supporting competitive positioning.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28750&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302