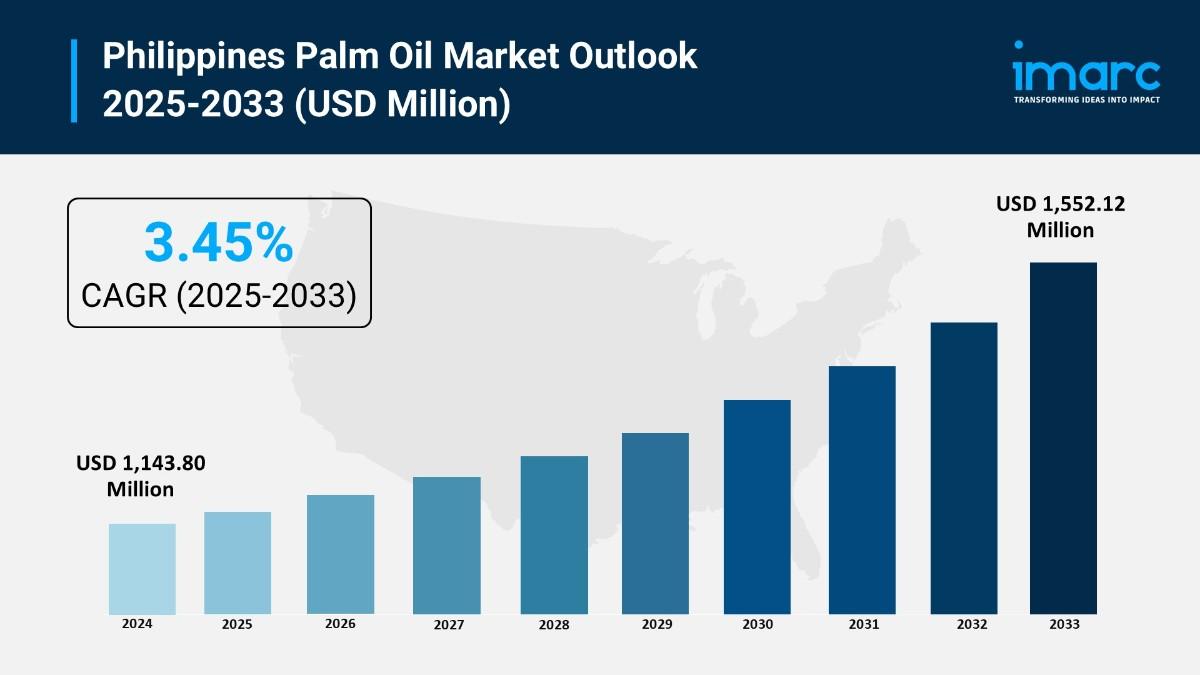

The Philippines palm oil market size reached USD 1,143.80 M in 2024 and is projected to reach USD 1,552.12 M by 2033 with a 3.45% CAGR.

The latest report by IMARC Group, “Philippines Palm Oil Market Size, Share, Trends and Forecast by Application and Region, 2025-2033,” provides an in-depth analysis of the Philippines palm oil market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines palm oil market size reached USD 1,143.80 Million in 2024 and is projected to grow to USD 1,552.12 Million by 2033, exhibiting a growth rate of 3.45% during the forecast period.

Report Attributes and Key Statistics:

Philippines Palm Oil Market Overview:

The Philippines palm oil market relies heavily on imports meeting demand for edible oils as cost-effective substitute for domestic coconut oil. Palm and palm kernel oil were most imported oils totaling 939,000 tonnes in 2023 making up 87 percent of country’s total oils and fats imports. April 2025 rising coconut oil costs drove consumers shifting to cheaper palm oil with Philippine Coconut Authority consumption expected to drop 20,000 metric tons to 200,000 MT. Palm oil imports forecast to rise 11 percent to one million MT from 895,000 MT. Philippines possesses approximately 63,380 hectares oil palm plantations producing 140,000 tonnes annually accounting for 10 percent oils and fats production with 11 palm oil mills and 5 refineries. Government mandated biodiesel blending with petroleum diesel with palm oil primary feedstock supporting renewable energy policies. Department of Energy outlined targets increasing biofuel usage strengthening palm oil position in alternative energy mix.

Request For Sample Report: https://www.imarcgroup.com/philippines-palm-oil-market/requestsample

Philippines Palm Oil Market Trends:

Philippines palm oil market trends indicate strong import dependency and growing biodiesel sector participation. March 2025 average palm oil import price stood at USD 950 per ton declining 2.4 percent from previous year with Indonesia and Malaysia main suppliers. April 2025 palm oil prices in Metro Manila markets ranging P80 to P126 per liter compared to last year’s P65 to P100 per liter reflecting upward pressure. January 2025 Indonesia increased crude palm oil export levy to 10 percent from 7.5 percent to finance larger biodiesel program with B40 mandate starting January 2025 expected to boost palm oil demand by 2 million MT. Growing consumption of processed foods in Philippines primary driver with palm oil used in baked foods snacks margarine instant noodles because of stability long shelf life low cost. Top three vegetable oil companies dominate 80 percent of cooking oil market with Minola brand holding 38 percent market share followed by Baguio brand 34 percent. Palm oil derivatives widely used in cosmetics personal care industry with rising disposable incomes and heightened self-care awareness.

Philippines Palm Oil Market Drivers:

Drivers include increasing urbanization and fast-paced lifestyles driving demand for ready-to-eat convenient food with processed food industry rapidly developing. Philippines concluded 2023 as fastest-growing economy in ASEAN with 5.6 percent growth rate projected continuing 6.2 percent in 2024-2025. Government biodiesel blending mandates reducing dependence on fossil fuels promoting environmental sustainability with palm oil primary feedstock for biodiesel production. Department of Energy targets increasing biofuel usage supporting palm oil as strategic raw material with palm oil-based biodiesel gaining support as cleaner-burning alternative essential in urban centers. Rising disposable incomes and self-care awareness driving cosmetics personal care products demand with palm oil’s moisturizing properties oxidative stability making it ideal for soaps lotions shampoos creams. Local producers preferring palm oil over other oils since it improves product quality taste without increasing costs supporting consistent market expansion across foodservice household cooking industrial sectors.

Market Challenges:

Market Opportunities:

Philippines Palm Oil Market Segmentation:

By Application:

By Regional Distribution:

Philippines Palm Oil Market News:

August 2025: Philippines emerged among top palm oil exporters in H1 2025 with approximately USD 40 million export value demonstrating country’s growing participation in regional palm oil trade alongside established exporters Indonesia Malaysia. Development highlighting Philippines positioning in global palm oil supply chain with Asia-Pacific region dominance showcasing three out of top five exporters located in region.

April 2025: Rising coconut oil costs drove Filipino consumers shifting to cheaper palm oil with Philippine Coconut Authority flagging inflationary concerns. Coconut oil consumption expected to drop 20,000 metric tons to 200,000 MT with sudden demand increase driving palm oil imports rising 11 percent to one million MT from 895,000 MT. Palm oil prices in Metro Manila ranging P80 to P126 per liter compared to last year’s P65 to P100 per liter.

March 2025: Average palm oil import price stood at USD 950 per ton declining 2.4 percent against previous year with overall import price seeing mild curtailment. Indonesia and Malaysia remained main suppliers to Philippines with Malaysia demonstrating highest growth rate in value of imports. Import data reflecting Philippines heavy reliance on imported palm oil meeting 87 percent of country’s total oils and fats imports supporting domestic consumption.

Key Highlights of the Report:

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines palm oil market growth to USD 1,552.12 million by 2033?

A1: Market driven by 87% import dependency with 939,000 tonnes imports in 2023, fastest-growing ASEAN economy with 5.6% growth rate, April 2025 palm oil imports rising 11% to one million MT, government biodiesel mandates with palm oil primary feedstock, processed food industry expansion, and rising personal care segment demand supporting 3.45% CAGR.

Q2: How are import trends and biodiesel mandates transforming the Philippines palm oil landscape?

A2: April 2025 rising coconut oil costs drove consumers shifting to cheaper palm oil with consumption dropping 20,000 MT. March 2025 import price USD 950 per ton with Indonesia Malaysia main suppliers. January 2025 Indonesia increased export levy to 10% financing B40 mandate expected boosting demand 2 million MT. Top three companies dominate 80% cooking oil market with Minola 38% Baguio 34% share supporting market maturation and stable supply chains.

Q3: What opportunities exist for palm oil stakeholders in emerging Philippines market segments?

A3: Opportunities include biodiesel expansion capitalizing on Department of Energy biofuel targets, plantation development in BARMM region with 800,000 hectares capacity, refining capacity investment with Land Bank PHP 450 million support, processed food industry targeting baked goods snacks margarine, personal care derivatives for cosmetics, reducing 87% import dependency, and value-added products for local international markets supporting diversification.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=41108&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302