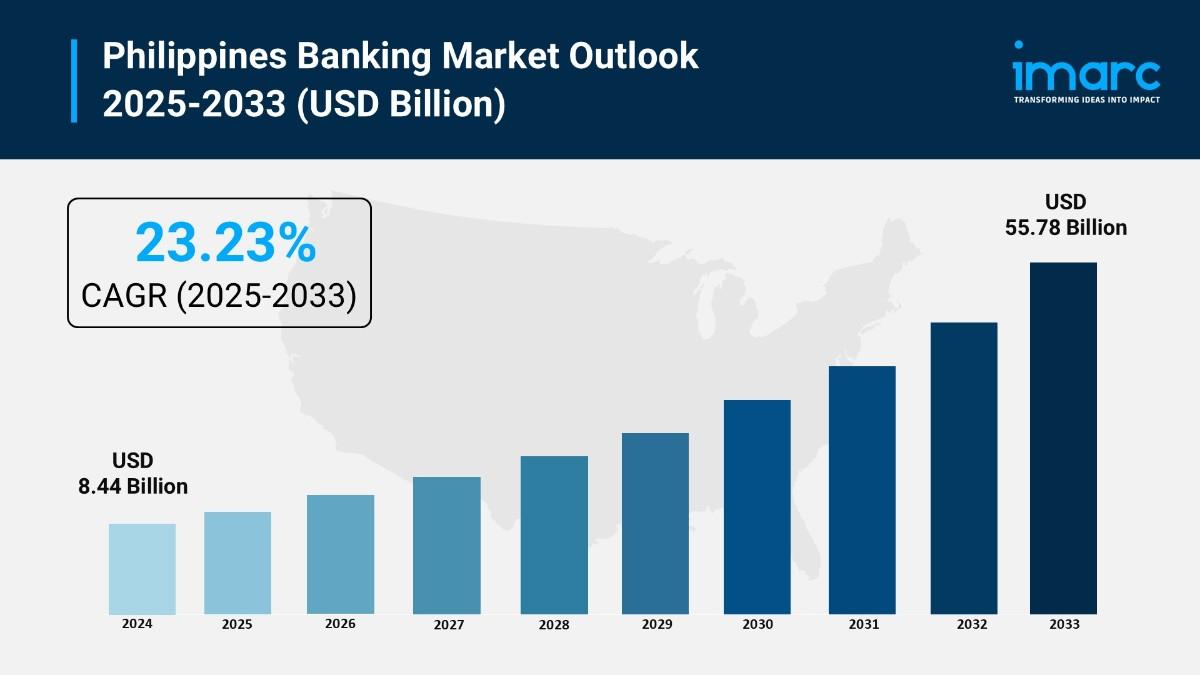

The Philippines banking market size reached USD 8.44 billion in 2024 and is projected to grow to USD 55.78 billion by 2033, at a growth rate of 23.23%.

The latest report by IMARC Group, “Philippines Banking Market Size, Share, Trends and Forecast by Banking Services, End User, and Region, 2025-2033,” provides an in-depth analysis of the Philippines banking market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines banking market size reached USD 8.44 Billion in 2024 and is projected to grow to USD 55.78 Billion by 2033, exhibiting a growth rate of 23.23% during the forecast period.

Report Attributes and Key Statistics:

Philippines Banking Market Overview:

The Philippines banking market is driven by rising financial inclusion growing middle-class demand increasing reliance remittance-driven services digital innovations supportive regulations consumer preference modern financial products. January 2025 Bangko Sentral ng Pilipinas allowing maximum 10 digital banks operate lifting moratorium grant new licenses effective January 1 2025 adding four more current six license holders. March 2025 Philippines digital banks collectively surpassed PHP 80 billion deposits demonstrating rapid growth. April 2025 Forbes World’s Best Banks list featured Maya Bank first GoTyme Bank second with digital banks occupying nearly half top nine positions. GCash operating over 90 million users while Maya Bank reached PHP 588 million deposit balances first half 2024. Payments gross transaction value reaching USD 123 billion by 2025 at 18 percent CAGR supporting sustained nationwide expansion.

Request For Sample Report: https://www.imarcgroup.com/philippines-banking-market/requestsample

Philippines Banking Market Trends:

Philippines banking market trends indicate rapid digital transformation with smartphones internet connectivity reshaping consumer banking interactions. Mobile phone imports reached USD 3.93 billion in 2024 supporting digital banking adoption. July 2025 digital banks list features six licensed banks Maya Overseas Filipino Tonik GoTyme UNOBank UnionDigital with new slots available existing banks wanting convert. April 2025 Forbes list revealed Maya jumped from third GoTyme from seventh demonstrating sharp rise digital banking popularity. March 2025 digital banks collectively surpassing PHP 80 billion deposits with competitive landscape expected intensifying four new licenses. Rise fintech solutions with GCash PayMaya transforming payment systems enabling individuals send money make payments buy services without conventional bank account. Open banking frameworks regulatory push increasing competition efficiency innovation enabling data sharing authorized third parties.

Philippines Banking Market Drivers:

Drivers include expanding middle-class population with household incomes rising seeking access financial services supporting evolving lifestyles long-term goals. Growing demand savings accounts investment products credit products personal loans mortgages credit cards. Strong remittance inflows with Philippines one world’s largest recipients consistent funds overseas Filipino workers averaging USD 30.5 billion annually approximately 10 percent GDP playing vital role strengthening banking sector. Banks offering specialized products remittance-linked savings accounts preferential loan options digital transfer services simplifying cross-border transactions. January 2025 BSP allowing four new digital bank licenses effective January 1 demonstrating regulatory support innovation. March 2025 digital banks PHP 80 billion deposits with GCash already disbursing PHP 155 billion loans to 5.4 million borrowers increasing 70 percent year-on-year.

Market Challenges:

Market Opportunities:

Philippines Banking Market Segmentation:

By Banking Services:

By End User:

By Regional Distribution:

Philippines Banking Market News:

July 2025: Full list digital banks Philippines features six licensed banks Maya Bank Overseas Filipino Bank Tonik Digital Bank GoTyme Bank UNOBank UnionDigital Bank with new slots available existing banks wanting convert into digital. Tonik offering highest interest rate 6 percent per annum time deposits demonstrating competitive landscape. Six digital banks granted licenses operational with BSP allowance increased to 10 creating possibility more digital banks entering market demonstrating continued sector expansion innovation.

April 2025: Forbes World’s Best Banks 2025 list featured digital banks taking lead with Maya Bank ranking first GoTyme Bank second marking sharp rise both compared 2024 list with Maya jumping from third GoTyme from seventh. UNO Digital Bank returned eighth place while SeaBank Philippines made debut ninth place. Nearly half list now occupied banks didn’t exist few years ago demonstrating rapid digital banking adoption Philippines while traditional banks Metrobank BPI PNB continue holding ground.

March 2025: Philippines digital banks collectively surpassed PHP 80 billion deposits demonstrating rapid growth competitive landscape. BSP recently announced decision welcome four more digital banks in 2025 making competitive landscape expected becoming more intense. BSP stated only applicants demonstrating unique value proposition innovative business models not currently available will be considered new licenses. GCash already disbursed PHP 155 billion loans potentially strong contender new licenses with 5.4 million borrowers increasing more than 70 percent year-on-year.

Key Highlights of the Report:

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines banking market growth to USD 55.78 billion by 2033?

A1: Market driven by January 2025 BSP allowing 10 digital banks operating adding four new licenses, March 2025 digital banks PHP 80 billion deposits, GCash 90 million users PHP 155 billion loans 5.4 million borrowers 70% year-on-year increase, Maya PHP 588 million deposits, mobile phone imports USD 3.93 billion 2024, payments USD 123 billion by 2025 18% CAGR, remittances USD 30.5 billion annually 10% GDP supporting 23.23% CAGR addressing financial inclusion digital transformation requirements.

Q2: How are digital banking and regulatory support transforming the Philippines banking landscape?

A2: January 2025 BSP lifting moratorium allowing four new digital bank licenses effective January 1. April 2025 Forbes list Maya first GoTyme second with digital banks occupying nearly half top nine. March 2025 digital banks PHP 80 billion deposits with GCash PHP 155 billion loans 5.4 million borrowers. July 2025 six licensed banks operational with BSP allowance increased 10. Open banking frameworks promoting competition innovation. Cashless economy initiatives QR-based payments mobile wallets supporting market maturation nationwide.

Q3: What opportunities exist for banking stakeholders in emerging Philippines market segments?

A3: Opportunities include digital bank licenses capitalizing January 2025 BSP allowing four new licenses CIMB SeaBank OwnBank conversions, fintech partnerships leveraging GCash 90 million users Maya PHP 588 million deposits, remittance services targeting USD 30.5 billion annually specialized products, financial inclusion expanding microfinancing mobile banking rural populations, open banking implementing data sharing frameworks, cashless initiatives supporting digital payments QR wallets, SME banking targeting business solutions, and premium services developing wealth management supporting market diversification addressing banking innovation demands.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=28671&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302