MoR vs PSP: Learn how to choose the right payment partner for your SaaS, compare benefits, fees, and integrations for seamless transactions.

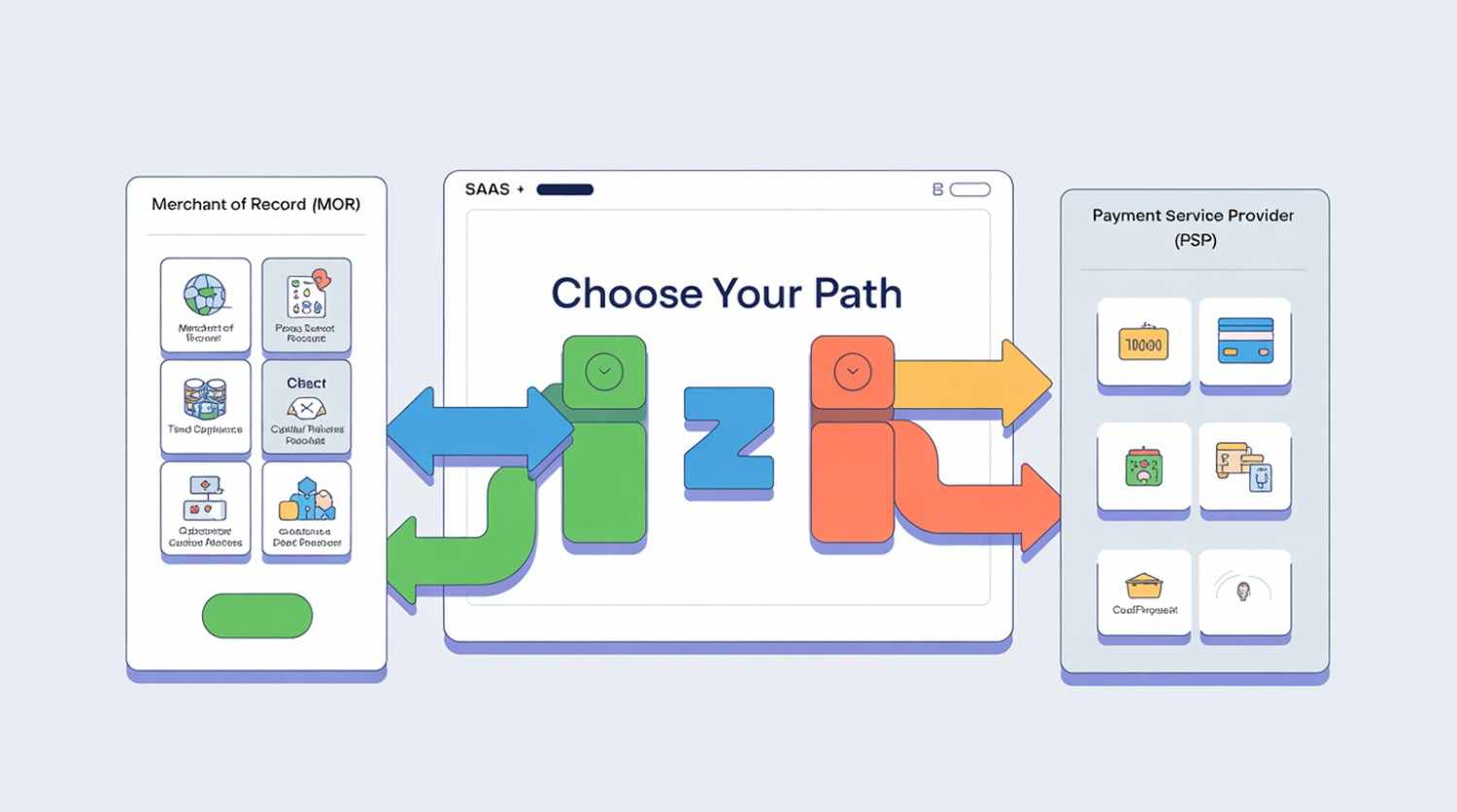

Running a SaaS business involves many moving parts, but one of the most crucial choices you’ll face is how to manage payments. Picking the right payment partner can affect cash flow, customer experience, and compliance. Two popular options are MoR (Merchant of Record) and PSP (Payment Service Provider). It’s important to understand their differences, benefits, and limitations to choose the best fit for your SaaS company.

A Merchant of Record is the entity legally responsible for transactions on your platform. This includes processing payments, managing taxes, handling chargebacks, and ensuring compliance with global regulations. Essentially, the MoR takes ownership of the transaction. This allows you to focus on growing your SaaS product without worrying about legal and financial risks.

For SaaS businesses, using an MoR simplifies international sales since it automatically manages VAT, GST, and other local taxes. This can save startups and growing companies a lot of time and effort, especially when expanding globally.

A Payment Service Provider acts as a bridge between your business, banks, and credit card networks. PSPs process payments but leave responsibilities like taxes, compliance, and refunds with your business. Well-known PSPs include Stripe, PayPal, and Adyen.

PSPs give businesses flexibility and control over transactions but require more hands-on management of regulatory and tax obligations. This model works well for SaaS companies with internal teams capable of handling finance, compliance, and refunds.

When comparing MoR vs PSP, it’s important to see how each model manages payments in its own way. MoR assumes legal responsibility, compliance, and tax management. On the other hand, PSP offers the infrastructure to process payments but passes the operational and regulatory duties to your business.

MoR is the best choice for simplicity, compliance, and global reach. PSP provides flexibility, lower costs, and control, but it requires you to manage tax and operational responsibilities on your own.

Choosing the right option depends on your business goals, resources, and growth strategy:

MoR works best for SaaS businesses that want simplicity, compliance, and a global reach. Examples include:

PSP is suitable for businesses that want control, flexibility, and lower transaction fees, such as:

For most SaaS businesses aiming for global reach, MoR is often the faster, safer option. PSPs are best for companies that prioritize control and have the infrastructure to manage payment operations themselves.

Small SaaS startups usually benefit from MoR solutions because they simplify global sales and lower compliance burdens, allowing founders to focus on growth.

Yes, but it can be complex. Switching requires migrating subscriptions, customer data, and payment history, so careful planning is essential.

MoRs generally have higher fees for their services, including compliance and tax management. PSPs have lower transaction fees but require you to manage additional costs like refunds and disputes.

MoR is typically better for global SaaS since it takes care of local taxes, currency conversion, and compliance automatically. PSPs may need extra integrations for the same features.

Yes, most MoRs include fraud management as part of their service. PSPs offer tools but leave risk management mostly to your business.

Control over customer data is limited with MoR since they own the transaction. PSPs provide full access, which is preferable for marketing and analytics but comes with compliance duties.

Choosing between an MoR and a PSP depends on your SaaS business model, growth objectives, and available resources. MoR is ideal if you seek simplicity, global reach, and compliance handled for you. PSP is better if you want flexibility, control, and lower transaction costs but are prepared to manage taxes and compliance yourself. Understanding these differences helps ensure your SaaS business can grow smoothly without payment or legal issues.