Discover the strategic advantages of outsourcing your accounts payable and receivable functions.

In today’s fast-paced business world, efficiency and strategic financial management are not just goals—they are necessities for survival and growth. One of the most critical, yet often overlooked, areas for operational improvement lies within a company’s financial backbone: its accounts payable (AP) and accounts receivable (AR) processes. These functions, while essential, can be resource-intensive, consuming valuable time and capital that could be better allocated to core business activities. This is where the strategic advantage of outsourcing accounts payable and receivable comes into play. By entrusting these tasks to specialized experts, businesses can unlock significant benefits, from improved cash flow and reduced costs to enhanced accuracy and security.

The decision to outsource these processes is more than a simple shift in workflow; it’s a transformative move that reshapes a company’s financial landscape. An in-house AP and AR team requires constant oversight, training, and technological investment. The administrative burden of processing invoices, chasing payments, reconciling accounts, and managing compliance can pull focus away from strategic initiatives. Conversely, a dedicated outsourcing partner brings a wealth of expertise and cutting-edge technology to the table, ensuring that these tasks are handled with precision and efficiency. This partnership allows you to convert fixed costs into variable ones, providing a flexible financial model that can scale with your business’s needs.

Here are some of the key benefits of outsourcing your accounts payable and receivable functions:

Beyond the immediate financial gains, outsourcing these critical functions provides a layer of strategic insight. Expert partners can offer detailed reporting and analysis on your spending patterns and collection cycles. This data-driven approach empowers you to make more informed business decisions, identify trends, and address potential issues before they become major problems. For example, a thorough analysis of your AR data might reveal recurring issues with certain customers, prompting you to adjust your credit terms or communication strategy. Similarly, a review of AP data can highlight areas where you could negotiate better terms with suppliers.

Moreover, the security and compliance benefits of outsourcing cannot be overstated. Accounts payable and receivable processes handle sensitive financial information, making them a prime target for fraud. Reputable outsourcing firms invest heavily in state-of-the-art security protocols, including multi-factor authentication, data encryption, and robust access controls. They also stay up-to-date with the latest regulatory changes, such as GDPR and CCPA, ensuring your financial operations remain fully compliant. This provides peace of mind, knowing that your financial data is protected and your business is adhering to all legal requirements.

Here are additional strategic advantages of partnering with an outsourcing expert:

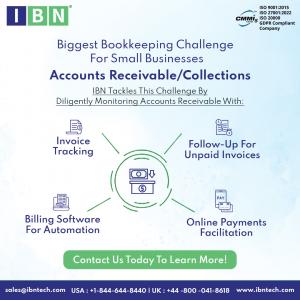

IBN Technologies is a leading provider of comprehensive financial and IT services, dedicated to helping businesses achieve operational excellence and strategic growth. With a proven track record in finance and accounting, including expert-level support for accounts payable and receivable, IBN leverages advanced technology and a deep understanding of industry best practices to deliver tailored solutions. Our goal is to streamline your financial operations, enhance security, and provide the strategic insights you need to make smarter business decisions. We partner with companies across various industries, from real estate to healthcare, offering a full suite of services that includes cloud solutions, cybersecurity, and business process automation.

In conclusion, the decision to strategically outsource your accounts payable and receivable is a forward-thinking move that can fundamentally transform your business. It is a pathway to improved cash flow, reduced operational costs, and enhanced accuracy, all while freeing up your internal resources to focus on what truly drives your company forward. By partnering with a reliable and experienced provider like IBN Technologies, you gain a competitive edge in an increasingly demanding market. The benefits extend far beyond a simple cost-cutting measure; it is an investment in the efficiency, security, and long-term financial health of your business. Embracing this strategic approach is not just about managing money—it’s about smart growth.

In today’s fast-paced business world, strategic financial management is a necessity for growth. Outsourcing accounts payable and receivable (AP/AR) transforms this critical function from a resource-intensive burden into a streamlined advantage. This strategic move unlocks significant benefits: improved cash flow through accelerated collections and optimized payments, reduced operational costs by eliminating in-house overhead, and enhanced accuracy via advanced automation. Partnering with an expert provider like IBN Technologies offers superior security, compliance, and valuable data insights. Ultimately, outsourcing AP/AR frees your team to focus on core business activities, driving innovation and ensuring long-term financial health.

© 2024 Crivva - Business Promotion. All rights reserved.