Breakout trading is one of the most effective strategies in crypto markets, especially when paired with modern tools that provide real-time insight into price action and volume dynamics. As digital assets continue to show unpredictable yet repeatable patterns, breakout setups offer traders a structured way to profit from sharp moves. In this article, we’ll break […]

Breakout trading is one of the most effective strategies in crypto markets, especially when paired with modern tools that provide real-time insight into price action and volume dynamics. As digital assets continue to show unpredictable yet repeatable patterns, breakout setups offer traders a structured way to profit from sharp moves.

In this article, we’ll break down what breakout trading is, how to spot true versus false breakouts, and which crypto market analysis tools can help you gain an edge. You’ll also discover why using the best crypto screener is essential for real-time breakout identification.

A breakout occurs when the price of a cryptocurrency moves beyond a significant level of resistance or support. This move often indicates the start of a new trend or a continuation of an existing one, and it can be accompanied by a surge in trading volume.

Breakouts can be upward (bullish) or downward (bearish). Traders typically look for:

A defined horizontal support/resistance level

Consolidation before the move

A volume spike as confirmation

For example, when Bitcoin trades sideways between $29,000 and $30,000 for days and then suddenly surges above $30,000 with heavy volume, that’s a classic breakout scenario.

Identifying breakouts in real time and acting quickly requires the right set of tools. Here are the most valuable ones:

1. Crypto Screener

The best crypto screener will allow you to filter assets by key breakout indicators like sudden price movement, volume spikes, or RSI divergence. Look for features such as:

Price % change in short timeframes (1h, 15min)

Volume surge filters

Volatility indicators

Trend strength metrics

2. Candlestick-Based Alerts

Real-time alerts when certain candles close above resistance levels can notify you instantly of breakout opportunities. These are often integrated into screener platforms or charting tools.

3. Order Book & Volume Analysis

Watching how the order book shifts and where large buy/sell walls sit can offer clues before a breakout occurs. Volume confirmation is critical—breakouts without volume are often fakeouts.

4. Trend Indicators

Simple Moving Averages (SMA), Bollinger Bands, and Average True Range (ATR) help validate whether a breakout is likely to continue or reverse.

Let’s walk through a simple breakout strategy using real-time tools:

Scan the Market: Use your crypto screener to find coins up 5%+ in the last hour with rising volume.

Confirm the Setup: Pull up a 15-minute chart and look for recent consolidation near a resistance level.

Watch the Breakout: Wait for the price to break the level and close above it with high volume.

Set Risk Levels: Place a stop-loss just below the breakout zone.

Plan Your Exit: Use previous highs or Fibonacci extensions to target profits.

Resistance at $1.50

Price consolidating between $1.40–$1.49

Breakout candle closes at $1.52 with 2x average volume

Enter long at $1.53, stop-loss at $1.48, target at $1.75

Not every breakout is valid. In fact, many traders fall victim to false breakouts—temporary price moves that reverse quickly and trigger stop-losses. To minimize this:

Always wait for candle close above resistance, not just a wick.

Require volume confirmation—no volume, no trade.

Avoid trading breakouts during extremely low liquidity periods (e.g., weekends).

Use multiple timeframes to confirm the breakout (e.g., 15-min + 1-hr chart).

In fast-paced crypto markets, identifying and reacting to breakouts manually is inefficient and risky. The ability to scan the entire market for breakout setups with specific filters in seconds gives traders a serious edge.

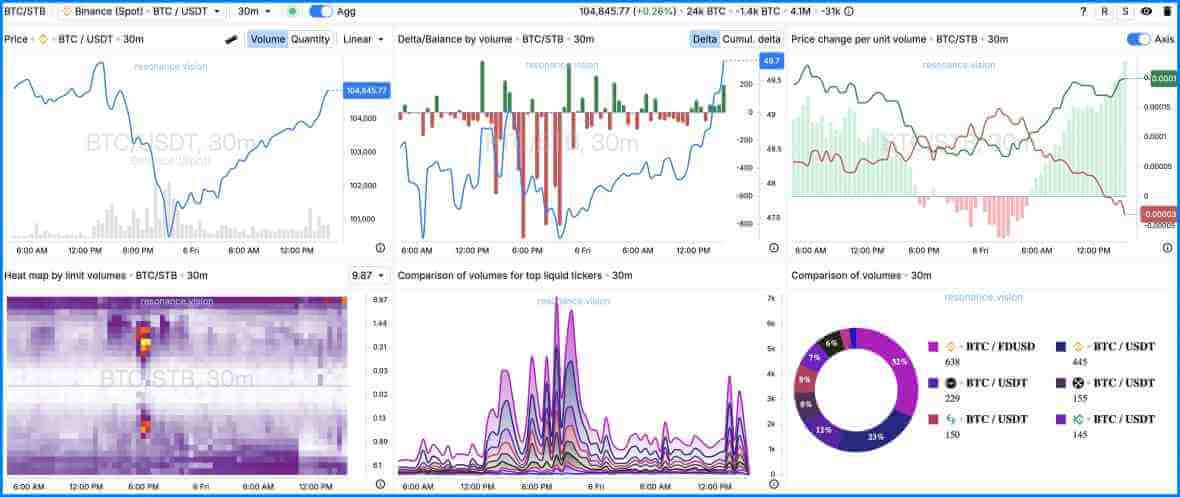

That’s why more professionals rely on advanced crypto market analysis tools and screeners to stay ahead. Platforms like Resonance provide real-time monitoring of price movements, volume shifts, and custom breakout alerts—all from one dashboard. Whether you’re just getting started or refining your edge, Resonance’s crypto screener and analytics suite can help you time breakouts with confidence.

Ready to stop guessing and start trading breakouts like a pro? Try the tools on Resonance and elevate your crypto trading game today.