Explore consumer behavior and spending patterns with detailed insights into Diwali Shopping Trends USA, revealing top products and market shifts.

Every year, the Diwali shopping season ignites a vibrant surge in consumer activity, not only in India but across global markets like the USA. With diaspora communities celebrating in full spirit, Diwali shopping has transformed into a significant e-commerce event marked by rising product searches, discounts, and brand engagement. Understanding Diwali Shopping Trends USA is crucial for retailers who want to identify what drives buyers, when they purchase, and how their preferences shift across online and offline platforms.

The combination of advanced analytics and E-Commerce Data Intelligence Services has made it possible to decode market patterns more precisely than ever. From tracking fast-moving items like decorations, sweets, and jewelry to monitoring cross-platform sales, brands can now predict buyer intentions with remarkable accuracy. This digital shift not only enhances retail strategies but also shapes how businesses approach future festive seasons.

As we step deeper into this analysis, we’ll explore how data scraping reveals the behavioral DNA of consumers—providing evidence-backed insights that retail brands can use to boost sales, optimize pricing, and refine marketing during Diwali 2025.

The American retail scene experiences remarkable shifts during Diwali. Cultural enthusiasm combines with data-backed strategies to redefine consumer habits. Surveys show 68% of South Asian households and nearly 45% of non-Indian buyers in the U.S. participated in festive shopping in 2024, a clear 32% jump compared to 2023. These figures position Diwali as a growing revenue driver across U.S. marketplaces.

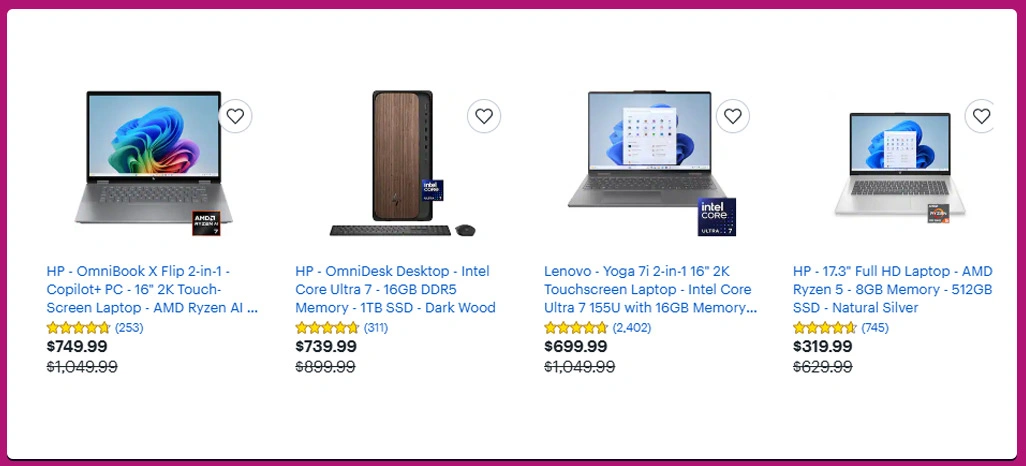

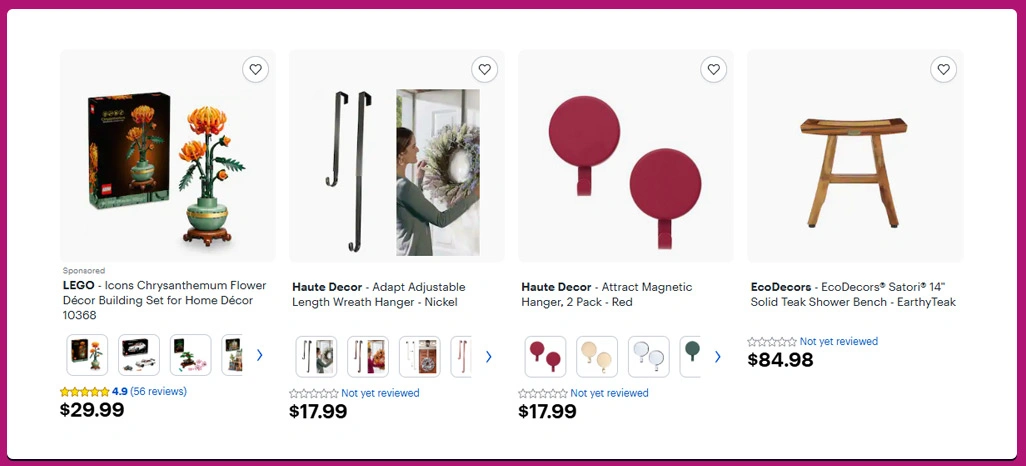

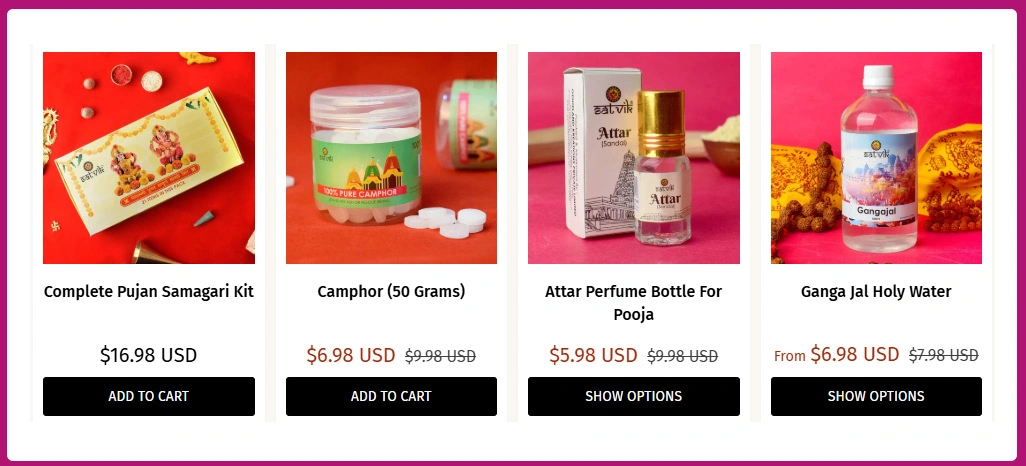

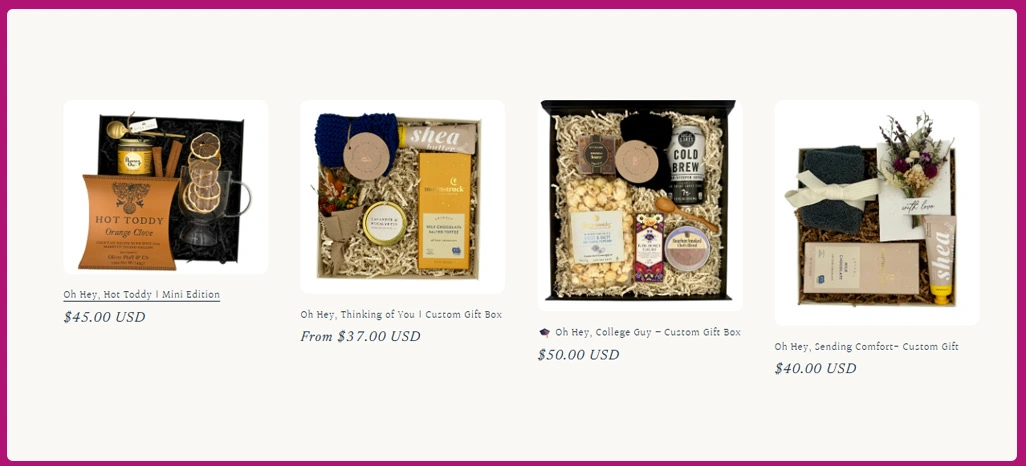

Diwali Shopping Trends USA reveal an emerging focus on utility-based gifting—smart home appliances, premium kitchenware, and customized hampers—alongside traditional choices. Online stores like Amazon and Walmart reported higher engagement for items that blend heritage with convenience.

| Product Type | Sales Growth (2024 vs 2023) | Top Platforms |

|---|---|---|

| Electronics | 44% | Best Buy, Amazon |

| Festive Décor | 38% | Walmart, Etsy |

| Jewelry & Gifts | 27% | Macy’s, Blue Nile |

| Gourmet Foods | 31% | Target, Instacart |

Such insights emphasize how Diwali Sales Data Scraping plays a crucial role in capturing these preferences. It allows retailers to analyze demand peaks, detect region-specific shopping surges, and build micro-targeted promotions. With each data layer, brands understand not just what consumers buy, but why they choose certain categories—helping forecast future festive demands effectively.

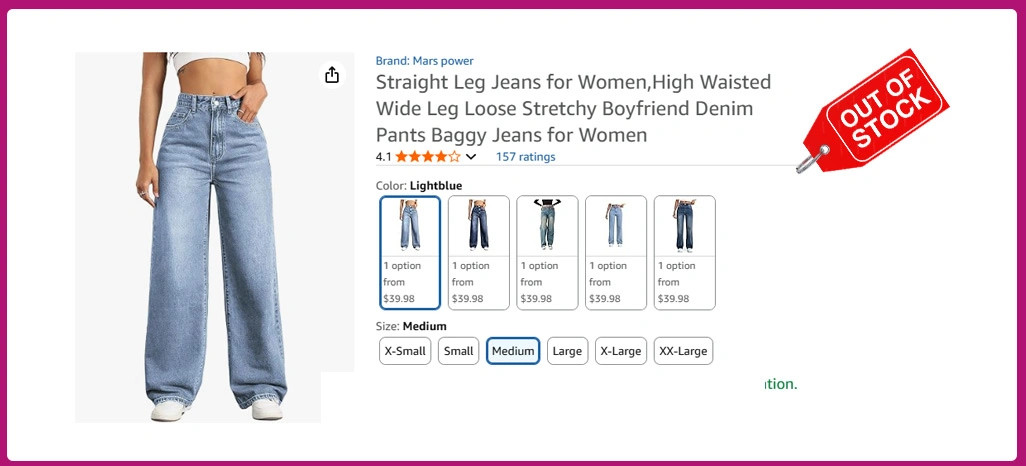

Product categories during Diwali witness highly dynamic sales cycles. Apparel, electronics, and festive décor dominate consumer carts, but the data indicates strong momentum in emerging product types such as smart gadgets and sustainable gifting. This diversification aligns with environmentally conscious purchasing seen in urban U.S. markets.

Reports based on E-Commerce Data Scraping show product listings in the Diwali category surged by 58% between September and November 2024. Over 74% of purchases occurred after exposure to online discounts or limited-time offers.

| Product Category | Avg. Discount Offered | Conversion Rate (%) |

|---|---|---|

| Apparel | 22% | 41% |

| Electronics | 18% | 54% |

| Home Décor | 25% | 37% |

| Jewelry | 20% | 32% |

Retailers using AI-Powered Retail Insights USA have benefited immensely by identifying high-performing categories and responding faster to sudden spikes. This empowers them to plan inventory better and synchronize campaigns with consumer moods.

Category analysis also highlights that fashion and electronics achieve longer post-Diwali sales lifecycles, making them strategic segments for retargeting. As purchasing timelines shrink, accurate festive forecasts become essential. These findings support how Diwali Shopping Trends USA continue to evolve with personalization and digital agility at their core.

Advertising drives the emotional heartbeat of Diwali shopping. Consumers in the U.S. are increasingly drawn to visual storytelling and influencer marketing that merge cultural symbolism with aspirational modernity. In 2024, digital ad expenditure targeting Diwali audiences grew by 46%, and influencer-driven campaigns achieved three times higher engagement than generic ones.

| Campaign Type | ROI (%) | Retention Growth |

|---|---|---|

| Influencer Marketing | 182% | 21% |

| Email Promotions | 136% | 18% |

| Paid Ads | 114% | 15% |

This data proves how personalized promotion strategies build trust and connection. Shoppers resonate more with curated offers and emotion-based narratives than broad discounts. Using Festival Shopping Data Analysis, brands can measure engagement metrics and allocate budgets to the highest-performing channels.

Through these insights, marketers can optimize creative content, adjust frequency, and fine-tune ad targeting parameters. This strategic recalibration strengthens long-term brand recall, even after the festive period ends. The deeper analytics layer enhances marketers’ ability to anticipate user actions, transforming seasonal promotions into consistent revenue streams through sustained loyalty.

Modern retail strategies rely heavily on data-driven precision. During Diwali, competitive pricing, stock movement, and sales fluctuations occur rapidly across marketplaces. To maintain relevance, brands rely on Web Scraping for real-time competitive visibility, empowering them to identify price changes and trending SKUs.

Studies show that 60% of product price updates happen within three days before Diwali, demanding fast decision-making by sellers. The following data reflects these fluctuations across platforms:

| Metric | Avg. Change Pre-Diwali | Data Source |

|---|---|---|

| Price Adjustments | +12% | Marketplace APIs |

| Product Listings | +33% | Retail Dashboards |

| Stock Turnover | +18% | Seller Feeds |

These observations support how E-Commerce Data Scraping USA captures constant market movement, ensuring that brands react in time. With comprehensive dashboards and analytics tools, retailers detect trends like regional preferences or unlisted competitor offerings.

Such intelligence fuels Diwali Online Shopping Insights, helping teams recalibrate product positioning instantly. Businesses that react to real-time insights see 23% higher revenue efficiency compared to static planning models. By fusing automation and analytics, Diwali transforms into a data-driven retail accelerator for U.S. brands.

Price transparency has become the foundation of consumer decision-making. Studies show that 71% of Diwali shoppers compare prices across multiple platforms before finalizing purchases. Maintaining competitive accuracy across retail listings is now a crucial profitability factor.

Through Diwali Product Price Monitoring, retailers can detect variations across platforms and optimize their discount range to ensure consistency. Findings show categories like ethnic apparel and kitchen appliances have the widest pricing gaps—affecting conversion performance directly.

| Product Type | Avg. Price Variation | Conversion Uplift |

|---|---|---|

| Ethnic Apparel | 17% | +18% |

| Smart Appliances | 14% | +22% |

| Gift Hampers | 10% | +12% |

Integrating Retail Data Scraping for Festive Sales helps brands align real-time pricing with consumer expectations. Retailers who implemented adaptive pricing reported a 19% improvement in conversion and 11% reduction in abandoned carts.

Additionally, brands gain deeper insights into discount elasticity—understanding the exact thresholds where buyers commit to checkout. These findings enhance Diwali Shopping Trends USA studies, ensuring consistent growth during competitive periods while maintaining brand loyalty through transparency and trust.

Post-festive analytics now power the next cycle of retail planning. Predictive algorithms can simulate buyer behavior based on Diwali sales data, offering a head start on future marketing strategies. Brands deploying Pricing Intelligence Data Scraping have improved ROI accuracy and reduced forecasting errors by nearly 14%.

| Predictive Metric | ROI Impact | Accuracy Growth |

|---|---|---|

| Dynamic Pricing | +21% | 89% |

| Demand Forecasting | +24% | 91% |

| Stock Optimization | +18% | 87% |

Integrating Real-Time Diwali Sales Analytics refines product curation, while Diwali E-Commerce Trends 2025 highlight an increasing preference for sustainable packaging and premium delivery options. These trends indicate an evolution beyond short-term discounts—toward value-driven, conscious purchasing.

By analyzing shopper retention, time-of-day purchase peaks, and category loyalty, brands can prepare better for Diwali 2025. Predictive analytics ensures more efficient allocation of budgets and promotions. As a result, retailers achieve higher sales stability and consumer trust beyond the festive peak season, fostering continuous growth momentum.

With the rapid rise in Diwali Shopping Trends USA, we empower businesses to make informed festive decisions using deep data intelligence. Our solutions simplify how retailers gather, clean, and analyze complex e-commerce datasets, giving them an edge during high-demand periods.

We offer tailored solutions that enhance every retail decision:

By applying Festival Shopping Data Analysis, we help businesses anticipate upcoming trends, create smarter festive campaigns, and generate consistent growth across Diwali and other seasonal events.

Festive consumer behavior continues to evolve, and Diwali Shopping Trends USA provides retailers with actionable insights to enhance engagement and improve product positioning. Understanding these dynamics allows brands to build smarter campaigns and anticipate festive demands efficiently.

With detailed Diwali E-Commerce Trends 2025, retailers can forecast future demands, design competitive campaigns, and craft impactful product strategies to capture market attention. Connect with Retail Scrape today to start transforming festive data into actionable insights that drive your brand’s next big Diwali success story.