Explore Extract store locations data from Kaufland & Aldi to gain retail expansion insights and identify growth opportunities in new markets.

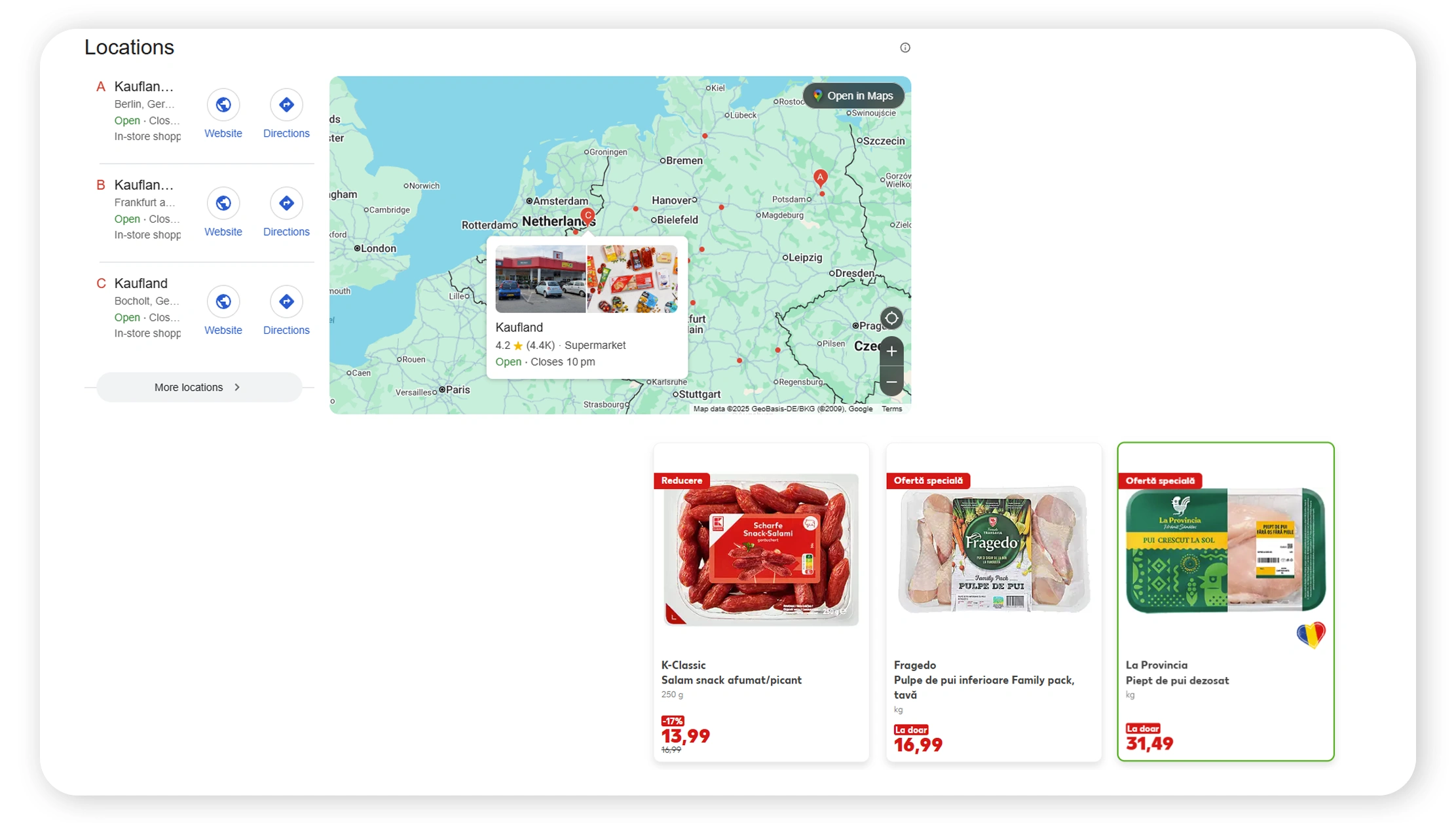

In an era of rapid retail transformation and strategic market repositioning, physical store footprint is more than a point on a map—it’s a signal of growth, demand, and brand ambition. When companies use methods to Extract store locations data from Kaufland & Aldi, they unlock insights into where retail expansion is actually happening and where latent capacity remains. For instance, the chain Kaufland now operates approximately 782 locations in Germany alone as of 2025. Meanwhile, ALDI in the U.S. is executing a strategy to open more than 225 new stores in 2025 as part of a five‑year plan. By integrating solutions that allow Kaufland Location Data Scraping and Aldi Location Data Extraction, organisations can build a Grocery Dataset reflecting retail density, regional share and expansion gaps. This report analyses a five‑year timeframe (2020‑2025) through six problem‑solving lenses, using real‑time outlet data from Kaufland & Aldi to guide retailers, investors and data teams in identifying growth opportunities through actionable insights.

From 2020 to 2025 the footprint of major grocery players like Kaufland and ALDI has expanded steadily, signalling market saturation dynamics and opportunities. In Germany, Kaufland grew from over ~750 stores in 2022 to approximately 782 stores in 2025. Notably, the density in North Rhine‑Westphalia is 143 stores or roughly one store per ~125,000 people. Meanwhile in the U.S., ALDI’s portfolio exceeded 2,567 outlets as of August 2025. It is planning +225 new stores in 2025 alone. A table summarises 2020‑2025 store counts for both:

| Year | Kaufland (Germany) | ALDI (U.S.) |

|---|---|---|

| 2020 | ~700* | ~2,400* |

| 2021 | ~730* | ~2,500* |

| 2022 | ~750 | ~2,600 |

| 2023 | ~770 | ~2,640 |

| 2024 | ~780‑782 | ~2,567** |

| 2025 | 782 (confirmed) | 2,567 (Aug) |

*Estimates based on growth trends.

**Note: ALDI count may increase with 2025 additions.

Using tools to Extract store locations data from Kaufland & Aldi enables mapping of underserved regions, identifying over‑concentration zones, and calculating per‑capita store density. For example, with one Kaufland store every ~122,000 residents in Bavaria. Leveraging Web Scraping Kaufland & Aldi data for Retail Expansion Insights empowers strategic decisions about where to cluster, expand, or pull back.

When companies apply Extract store locations data from Kaufland & Aldi, they can identify regions where store density is low relative to population or income. In Germany, Kaufland has no presence in Austria despite neighbouring markets. Meanwhile, ALDI in the U.S. identifies states with zero or few locations—11 states reportedly had none as of mid‑2025. A table below shows coverage gaps:

| Region | Existing Stores | Population | Stores per 100k people |

|---|---|---|---|

| Bavaria (GER) | 107 Kaufland stores | ~13.14 M | ~0.815 |

| North Rhine‑Westphalia (GER) | 143 Kaufland stores | ~17.93 M | ~0.798 |

| Florida (USA) | 273 ALDI stores | ~22 M | ~1.24 |

| San Antonio metro (TX, USA) | 0 ALDI stores | ~1.5 M | 0 |

The disparity highlights growth potential: a state like Texas (129 ALDI stores, No 6 nationally) still has major cities underserved. By combining the scraped location feed with demographic overlays, one can compute metrics like “people per store”, competitor overlap, and pitch new markets. For retail chains planning store expansion, leveraging Scrape ALDI store locations data in the USA and Scrape Kaufland locations in Germany ensures data‑driven decisions about site selection, cannibalisation risk and new market entry.

Analyzing the rate at which stores are being added yields insight into momentum and strategic intent. ALDI’s plan to open more than 225 new locations in 2025 marks a record for the U.S. business. Its five-year investment plan envisages building to ~3,200 stores by 2028. By leveraging the Aldi Grocery Scraping API, businesses can monitor these openings in real time, track new locations, and extract valuable market intelligence. For Kaufland, the Schwarz Group announced ~300 new stores globally in FY 2024/25 across its brands (including Kaufland + Lidl). A table of pipeline:

| Chain | 2024 New Stores | 2025 Plan | Five‑Year Target |

|---|---|---|---|

| ALDI (US) | ~120 in 2024 | 225+ in 2025 | ~3,200 by 2028 |

| Kaufland (Global) | ~300 (Group) | Expansion across new countries | — |

By employing Kaufland Location Data Scraping and Aldi Location Data Extraction, users can monitor additions at the store‑level, compare planned vs actual openings, and flag delays or acceleration in new market roll‑outs. The velocity of openings often signals where demand, funds and strategic focus align—a key insight for suppliers, investors and competitors alike.

Extracting location data enables one not just to count stores but to deduce format, size, and market role. ALDI’s rapid U.S. openings target Midwestern and Western states, converting former Winn‑Dixie/Harveys stores. This suggests a strategy of acquiring and converting versus ground‑up builds. On the other hand, Kaufland’s European expansion includes entry into France & Italy in 2025. A deeper analysis can compare store density, store type (discount vs hypermarket), and demographic alignment by using a Grocery Dataset derived via Web Scraping Kaufland & Aldi data for Retail Expansion Insights. For example, in Germany the ratio of Kaufland stores in Saxony (83 stores for ~4.06 M population) translates to one store per ~48,900 people. Contrasting that with U.S. ALDI density in Anaheim‑Los Angeles or Miami could reveal regional opportunities. Tools to Scrape ALDI store locations data in the USA provide geocoded addresses, opening dates, and format types. Similarly, Scrape Kaufland locations in Germany yield local competitor map overlays. The patterns of store openings, formats and regional alignment reveal strategic intent—whether chains are chasing high‑density urban metros or targeting underserved suburban corridors.

When chains expand physical presence, the upstream ecosystem—suppliers, logistics, real estate partners—must move accordingly. Using methods to Extract store locations data from Kaufland & Aldi allows supplier firms to map demand nodes and plan product launches. For instance: a region where ALDI is opening 50+ stores in a state signals enhanced freight operations, increased local shelf space and more ingredient demand. In 2024 ALDI opened ~120 U.S. stores. Meanwhile Kaufland’s global store additions highlight opportunities for fresh‑produce suppliers to target new store openings in Eastern Europe. By maintaining a Grocery Dataset that tracks store openings by region and format, manufacturers can prioritize which regions to service, allocate truck lanes, and measure growth potential. Further, by combining location data with socio‑economic overlays (income, household size, urban vs rural), the strategic alignment of supply chains becomes visible. This insight is especially valuable for those offering to service both Kaufland and ALDI chains, enabling them to anticipate where growth is happening—and where competition or saturation may lie.

Armed with actionable data from Extract store locations data from Kaufland & Aldi, retail planners, property analysts and expansion leads can build benchmarks, monitor risk and optimise investment. Metrics to monitor: store openings by year, stores per 100k population, competitor clustering, and expansion latency. For example, if ALDI opens 225+ stores in 2025 while a state still shows zero presence, that state may represent a “greenfield” opportunity. Conversely, high store‑density areas may face cannibalisation risk—Kaufland’s Berlin listing of 35 stores across ~3.66 M population results in ~1 store per ~104k people. Using Kaufland Location Data Scraping and Aldi Location Data Extraction in conjunction with GIS mapping and heat‑maps you can visualise underserved zones and optimum catchment areas. Further, combining with real‑time outlet data from Kaufland & Aldi enables monitoring of store closures, relocations or format conversions—early signals of under‑performance or strategic pivot. This holistic view empowers decision‑makers to flag high‑growth corridors, negotiate site leases from informed vantage points, and measure competitive intensity dynamically.

Real Data API offers an enterprise‑grade platform that automates Extract store locations data from Kaufland & Aldi, delivering geocoded datasets ready for analysis. Our Kaufland Location Data Scraping and Aldi Location Data Extraction modules provide daily updates on openings, closures, formats and addresses across regions. We collate this into a curated Grocery Dataset that integrates seamlessly with your BI stack. With capabilities to Scrape ALDI store locations data in the USA and Scrape Kaufland locations in Germany, your team gains location‑intelligence at global scale. Our system also supports Web Scraping Kaufland & Aldi data for Retail Expansion Insights, enabling pipelines that feed into heat‑map dashboards, cannibalisation modelling and site‑selection algorithms. Whether you’re a retailer, supplier or real‑ estate partner, Real Data API delivers the infrastructure, data and analytics to stay ahead of expansion curves.

In a retail landscape where physical presence still matters, leveraging data on store locations is a cornerstone of strategic growth. By choosing to Extract store locations data from Kaufland & Aldi, organisations unlock actionable insights: where chains are growing fastest, which regions remain underserved, and how store density correlates with population metrics and market demand. Real Data API empowers you to monitor this in real time, build rich Grocery Datasets, and steer your expansion strategy with clarity. Whether you are planning supplier logistics, expansion modelling or competitive benchmarking, the location‑data advantage is critical. Act now—equip your team with location intelligence and be ready for the next wave of retail expansion. Schedule your demo with Real Data API today and gain the competitive edge in store‑network insight.

Source: https://realdataapi.com/extract-store-locations-data-from-kaufland-aldi.php

Contact Us:

Email: [email protected]

Phone No: +1 424 3777584

Visit Now: https://www.realdataapi.com/

#ExtractStoreLocationsDataFromKauflandAndAldi

#KauflandLocationDataScraping

#AldiLocationDataExtraction

#RealTimeOutletDataFromKauflandAndAldi

#ScrapeStoreDensityAcrossRegions

#WebScrapingKauflandAndAldiDataForRetailExpansionInsights