Extract Food Delivery Insights from Tier 2 Cities India to understand evolving food choices and regional consumption behavior.

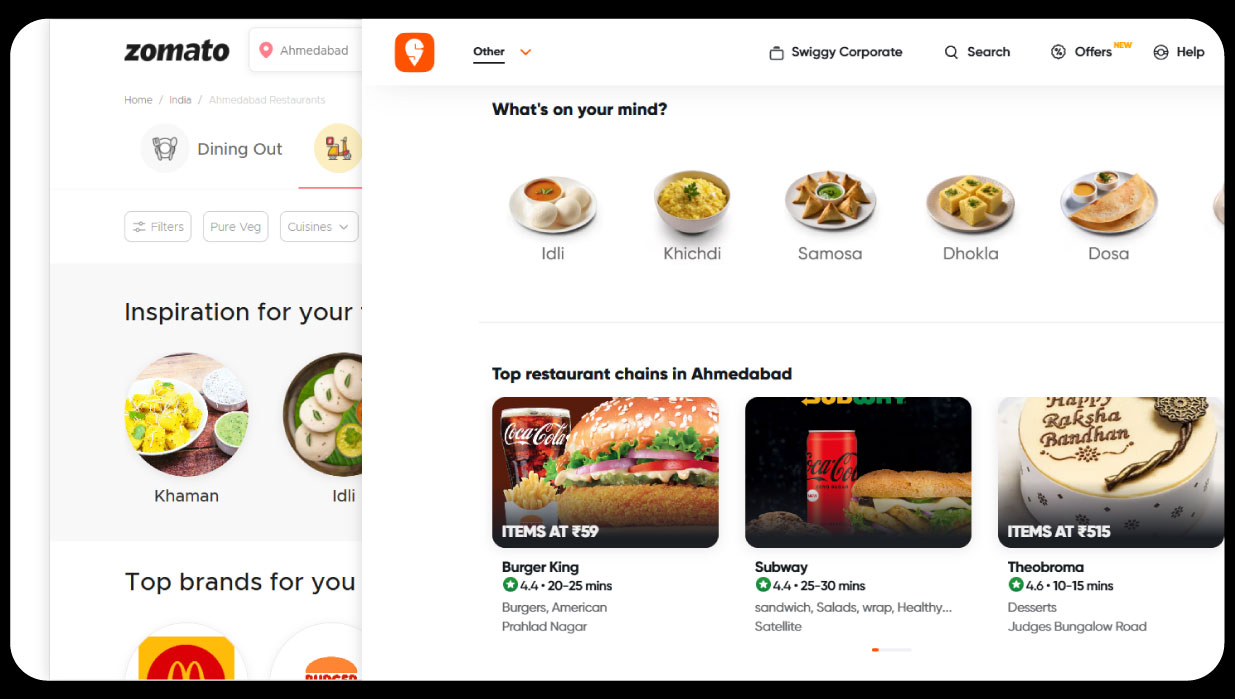

India’s food delivery industry has seen a paradigm shift in recent years, with Tier 2 cities emerging as significant contributors to growth. As urbanization spreads beyond metros, platforms like Zomato and Swiggy are witnessing rising adoption rates in cities like Bhopal, Jaipur, Coimbatore, Lucknow, and Bhubaneswar. These regions showcase unique consumption patterns, price sensitivities, and cuisine preferences that are vastly different from those in Tier 1 cities. Businesses seeking to stay competitive and hyperlocal must Extract Food Delivery insights from Tier 2 cities India to stay ahead of evolving food habits.

Between 2020 and 2025, Tier 2 cities in India have seen an exponential increase in food delivery app usage. As per industry data, these cities contributed over 32% of Zomato and Swiggy’s total order volume in 2024. Several factors drive this:

The need to extract Zomato & Swiggy user preferences data from these regions becomes even more vital when launching new products or planning targeted marketing campaigns.

While both Zomato and Swiggy have deep market penetration, their growth strategies differ across Tier 2 cities.

Zomato

Swiggy

The need for Zomato & Swiggy data scraping in India arises when businesses aim to measure market reach, user engagement, and pricing strategies across these diverse platforms.

Despite these hurdles, the volume and variety of Tier 2 food delivery data make it a high-value asset for brands looking to localize offerings and grow efficiently.

A cloud kitchen brand planning to expand to Tier 2 cities used scraped data from both platforms to assess viability. The insights helped the brand:

This approach cut their entry cost by 30% and increased order volume in new cities by 45% within 90 days.

India’s Tier 2 cities present an untapped goldmine of food delivery insights. The rising order volumes, regional food preferences, and evolving consumer expectations make it critical for stakeholders to invest in continuous data extraction and trend analysis. Whether you’re a food aggregator, brand, or restaurant chain, using data to understand these markets is no longer optional—it’s essential.

With access to accurate Food Delivery App Menu Datasets , businesses can monitor what’s being served, what’s being ordered, and what trends are emerging next—making them future-ready in the competitive Tier 2 food delivery ecosystem.