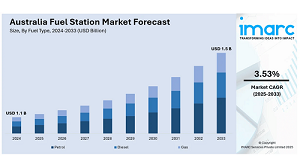

Australia’s fuel station market to grow from USD 1.1B in 2024 to USD 1.5B by 2033, expanding at a 3.53% CAGR.

The latest report by IMARC Group, titled “Australia Fuel Station Market Report by Fuel Type (Petrol, Diesel, Gas), End Use (Road Transport Vehicle, Air Transport Vehicle, Water Transport Vehicle), and Region 2025-2033,” offers comprehensive analysis of the Australia fuel station market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia fuel station market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.5 Billion by 2033, exhibiting a CAGR of 3.53% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1.1 Billion

Market Forecast in 2033: USD 1.5 Billion

Market Growth Rate (2025-2033): 3.53%

Australia Fuel Station Market Overview

The Australia fuel station market is experiencing steady transformation driven by infrastructure growth supporting increased vehicle usage, transition towards sustainable mobility solutions, rising consumer demand for convenience and digital services, and energy diversification initiatives positioning the industry for ongoing expansion and evolution. The market is evolving beyond traditional fuel dispensing into comprehensive service hubs offering retail convenience, fresh food options, parcel collection services, and integrated digital payment systems. Station operators are responding to changing consumer lifestyles with extended value propositions including loyalty programs, mobile applications, and multi-service offerings that increase customer dwell time and transaction values across metropolitan and regional locations.

Australia’s fuel station industry demonstrates strategic adaptation through retail and on-site service expansion, renewable fuel infrastructure development including biodiesel and ethanol blends, electric vehicle charging network consolidation at existing locations, and partnerships between energy companies and government initiatives supporting alternative fuel adoption. The market maintains critical importance across road transport vehicle fueling, air transport vehicle support, and water transport vehicle services throughout diverse geographic regions. The integration of high-speed EV charging technology, real-time digital interfaces, hydrogen fuel infrastructure for heavy vehicle fleets, and sustainable transportation solutions is creating favorable market conditions, requiring substantial investments in renewable energy options, charging infrastructure deployment, convenience retail expansion, and environmental stewardship initiatives. Australia’s strategic focus on addressing evolving mobility needs, combined with commitments to emission reduction and clean energy transition, makes it an increasingly dynamic market for fuel station modernization and sustainable service delivery.

Request For Sample Report:

https://www.imarcgroup.com/australia-fuel-station-market/requestsample

Australia Fuel Station Market Trends

- Retail and on-site service expansion: Transformation into full-service retail centers providing convenience stores, fresh food counters, parcel collection points, mobile payment systems, and loyalty applications addressing consumer convenience preferences and increasing transaction values per visit.

- Development of renewable fuel infrastructure: Progressive addition of biodiesel and ethanol blends, nascent-stage hydrogen supply infrastructure, and alternative fuel pump lanes responding to regulatory requirements and growing consumer environmental consciousness toward sustainable transportation.

- EV charging networks consolidation: Strategic integration of electric vehicle charging infrastructure at existing fuel station locations along major highways and city centers with high-speed charging technology and real-time digital interfaces supporting Australia’s electric mobility advancement.

- Convenience and digital integration: Implementation of mobile payment systems, loyalty applications, and real-time service interfaces enabling consolidated consumer experiences, operational simplification, and enhanced customer interaction through technology-enabled solutions.

- Multi-service hub transformation: Evolution from traditional fueling stations to diversified service centers offering extended value propositions through non-fuel products, retail services, and integrated convenience offerings aligned with modern consumer lifestyles and behavior patterns.

- Sustainable mobility transition: Industry-wide shift supporting cleaner fuel alternatives, electric vehicle infrastructure, hydrogen stations for heavy fleets, and renewable energy options demonstrating environmental stewardship commitment and forward-thinking strategic positioning.

Market Drivers

- Infrastructure growth acceleration: Expanding road networks, urban development, and regional connectivity improvements boosting vehicle usage patterns and creating increased demand for accessible, conveniently located fuel station services across metropolitan and regional corridors.

- Transition to sustainable mobility: National commitment to emission reduction, clean energy adoption, and environmental sustainability driving investment in alternative fuel infrastructure, EV charging networks, and renewable fuel options supporting long-term industry transformation.

- Consumer convenience demand: Growing preference for one-stop service destinations offering integrated fueling, retail shopping, food services, and digital payment options reflecting busy lifestyles and efficiency requirements increasing non-fuel revenue opportunities.

- Electric vehicle adoption: Rising number of EVs on Australian roads creating demand for charging infrastructure at strategic locations, particularly along highways and urban centers, requiring dual-fuel and electric service capability at existing stations.

- Government policy support: Regulatory frameworks and funding initiatives promoting alternative fuel adoption, hydrogen infrastructure development, and emission reduction targets incentivizing operators to invest in renewable and sustainable energy solutions.

- Energy diversification needs: Industry recognition of changing energy landscape requiring portfolio expansion beyond traditional petroleum products to include renewable fuels, hydrogen, and electric charging ensuring competitive positioning and future relevance.

Challenges and Opportunities

Challenges:

- Capital investment requirements for infrastructure modernization including EV charging installation, renewable fuel systems, hydrogen stations, and digital technology integration creating significant financial barriers for independent operators

- Traditional fuel demand uncertainty with electric vehicle proliferation and alternative fuel adoption threatening conventional petrol and diesel sales revenue streams requiring business model adaptation and diversification strategies

- Regulatory compliance complexity navigating evolving environmental standards, fuel quality specifications, safety requirements, and alternative energy mandates across different state and territory jurisdictions increasing operational costs

- Site location constraints and urban planning restrictions limiting expansion opportunities in high-demand areas, particularly for charging infrastructure deployment requiring electrical grid capacity upgrades and adequate space allocation

- Competitive market pressures from major integrated oil companies, convenience retail chains, and emerging EV charging network specialists creating margin compression and requiring differentiation through service quality and innovation

Opportunities:

- Renewable fuel infrastructure development expanding biodiesel, ethanol blends, and hydrogen supply capabilities positioning operators as sustainability leaders and capturing environmentally conscious consumer segments while meeting regulatory requirements

- EV charging network expansion through strategic partnerships with energy companies, government funding programs, and technology providers creating new revenue streams and customer attraction opportunities at existing high-traffic locations

- Convenience retail diversification transforming stations into comprehensive service hubs with fresh food offerings, parcel services, click-and-collect facilities, and experiential retail increasing profitability through higher-margin non-fuel products

- Public-private partnership opportunities collaborating with government agencies on hydrogen infrastructure, renewable fuel pilots, and regional service accessibility programs accessing funding support and strategic development incentives

- Digital transformation initiatives implementing mobile apps, loyalty programs, fleet management solutions, and real-time service interfaces enhancing customer experience, operational efficiency, and data-driven decision-making capabilities

Australia Fuel Station Market Segmentation

By Fuel Type:

By End Use:

- Road Transport Vehicle

- Air Transport Vehicle

- Water Transport Vehicle

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report:

Australia Fuel Station Market News (2023-2024)

- August 2023: Ampol partnered with OneH2 to expand hydrogen fuel stations across Australia, focusing on heavy vehicle fleet applications to reduce emissions, following BP’s hydrogen refueling station launch supporting national hydrogen economy aspirations.

- November 2024: Shell Card expanded acceptance to 184 OTR service stations and over 1,500 sites nationwide including Shell, Coles Express, and Liberty locations, transforming Australian fleet management capabilities within the fuel station sector.

- 2024: Electric vehicle charging infrastructure deployment accelerated at existing fuel station locations along major highways and urban centers with high-speed charging technology and real-time digital payment interfaces supporting growing EV adoption.

- 2024: Fuel station operators increased investment in convenience retail expansion incorporating fresh food counters, extended product ranges, and parcel collection services responding to consumer demand for consolidated service offerings.

- 2024: Renewable fuel infrastructure development progressed with increased availability of biodiesel and ethanol blends at pump lanes across urban and regional locations supporting sustainable transportation goals and regulatory compliance.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Fuel Type, End Use, and Regional Analysis

Q&A Section

Q1: What drives growth in the Australia fuel station market?

A1: Market growth is driven by infrastructure expansion boosting vehicle usage, transition to sustainable mobility with alternative fuel adoption, consumer convenience demand for multi-service offerings, electric vehicle proliferation requiring charging infrastructure, government policy support for clean energy transition, and energy diversification needs positioning stations for future relevance.

Q2: What are the latest trends in this market?

A2: Key trends include retail and on-site service expansion into full-service hubs, development of renewable fuel infrastructure with biodiesel and hydrogen options, EV charging networks consolidation at strategic locations, convenience and digital integration through mobile payments and loyalty apps, multi-service hub transformation, and sustainable mobility transition supporting environmental objectives.

Q3: What challenges do companies face?

A3: Major challenges include capital investment requirements for infrastructure modernization, traditional fuel demand uncertainty from EV adoption, regulatory compliance complexity across jurisdictions, site location constraints limiting expansion opportunities, and competitive market pressures creating margin compression requiring service differentiation.

Q4: What opportunities are emerging?

A4: Emerging opportunities include renewable fuel infrastructure development positioning sustainability leadership, EV charging network expansion creating new revenue streams, convenience retail diversification with higher-margin products, public-private partnership opportunities for hydrogen and alternative fuel projects, and digital transformation initiatives enhancing customer experience and operational efficiency.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302