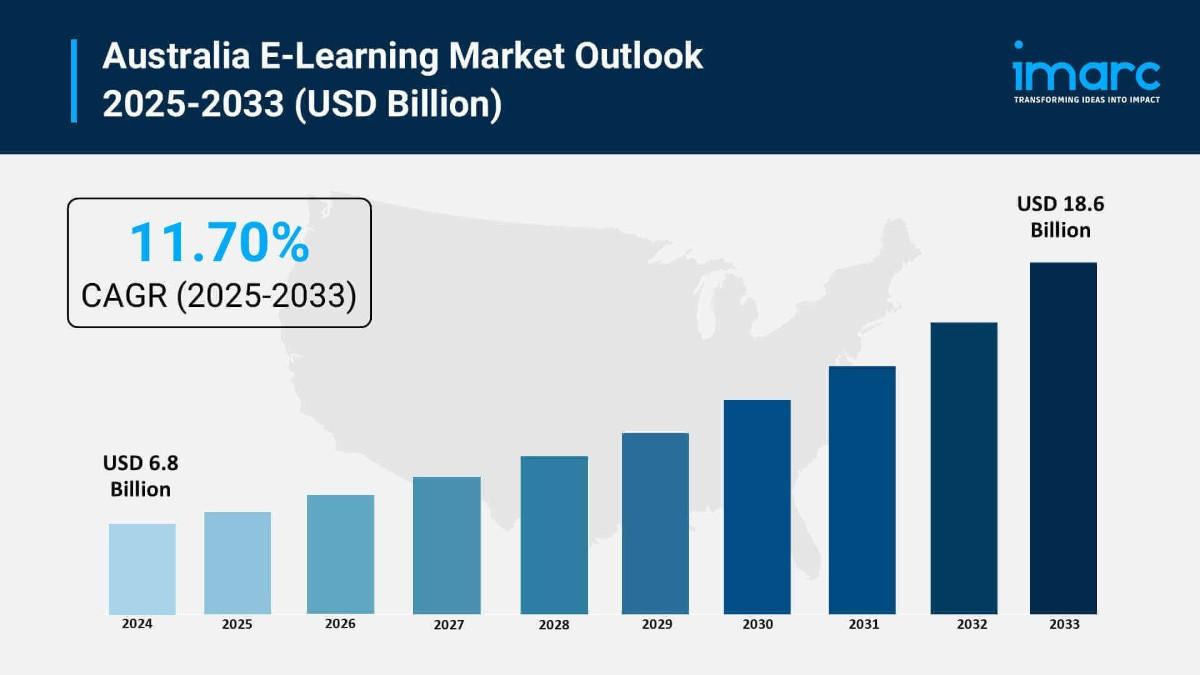

The Australia e-learning market reached USD 6.8B in 2024 and is expected to grow to USD 18.6B by 2033, at a strong CAGR of 11.7%.

The latest report by IMARC Group, “Australia E-Learning Market Size, Share, Trends and Forecast by Technology, Provider, Application, and Region, 2025-2033,” provides an in-depth analysis of the Australia e-learning market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry.

Report Attributes and Key Statistics:

Australia E-Learning Market Overview:

The market for e-learning in Australia is expanding rapidly, driven by the demand for scalable upskilling in vocational training. The Australia vocational training market will get to 29.41 billion USD in 2032. With the growing smartphone market, with an expected CAGR of 1.60% from 2024 to 2032, learning becomes more interactive and accessible for busy individuals. New regulations introduce in October 2025 a mandate. Australian education providers must seek government approval for offshore delivery. The providers must get approval for AI use for personalization at USD 15.80% CAGR from 2024 to 2032. This reflects strong government involvement. The government invests in digital literacy by incorporating e-learning into the national education system. Education institutions that prioritize e-learning are also considered ed-tech.

Request For Sample Report: https://www.imarcgroup.com/australia-e-learning-market/requestsample

Australia E-Learning Market Trends:

Key Australian industry events include the October 2024 Media Federation of Australia announcing the launch of a free OzTAM VOZ Total TV system of audience measurement e-learning course for media and marketing communication professionals and the May 2024 Australian Institute of Higher Education launching a Hybrid-1 course combining on-campus and online study. Technologies such as virtual reality and augmented reality can be used to create engaging experiential learning, cloud technologies can be used to create scalable flexible solutions which allow learners to access content any time anywhere, and adaptive learning platforms can adjust content. Advanced video conferencing applications permit interaction in real time. Gamification designs game aspects in educational settings with points, badges, leader boards, and rewards to elementally play in online education.

Australia E-Learning Market Drivers:

Australia’s e-learning market has experienced growth as a result of improving technology, increasing quality, accessibility and effectiveness of e-learning with VR AR providing more engaging solutions. The government agencies offer grants to support and finance the implementation of digital education initiatives within institutions. Subsidized use of digital technology is prominent in K-12 and tertiary education. Government policies foster vocational training in healthcare information technology and manufacturing. Usable AI-improved adaptive learning systems: AI algorithms analyze individual learner needs and skills for provision of personalized content and assessments, optimizing skill acquisition. Adaptive systems assist learners through chatbots and virtual tutors with personalized help. AI-powered training for the corporate sector is customizable for each individual employee. An office is not required. Travel is not required. Physical educational materials are not required. It is cost-effective.

Market Challenges:

Market Opportunities:

Australia E-Learning Market Segmentation:

By Technology:

By Provider:

By Application:

By Regional Distribution:

Australia E-Learning Market News:

September 2025: Australia tracking over 1,771 EdTech startups with 189 funded and 59 having secured Series A+ funding concentrated primarily in urban hubs like Sydney hosting 33% of companies and Melbourne. EdTech ecosystem generating USD 2.5 billion in domestic revenue and USD 1.1 billion from exports demonstrating significant industry maturation and global competitiveness.

June 2025: Australian EdTech startups revolutionizing education with 800 companies generating USD 2.2 billion in revenue making learning more accessible, fun, and effective. AI and machine learning platforms using smart algorithms to personalize learning fitting each student’s needs. COVID-19 pandemic accelerating digital tool adoption proving remote learning viability supporting flexible anytime anywhere study.

April 2025: By 2025 experts projecting 40% of Australian higher education incorporating hybrid models due to ability offering flexibility with quality ensuring educational continuity during disruptions like natural disasters and health crises. Global VR and AR market in education expected reaching USD 12.6 billion with Australian institutions increasingly adopting immersive technologies for experiential learning.

Key Highlights of the Report:

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia e-learning market growth to USD 18.6 billion by 2033?

A1: Market driven by vocational training adoption with market reaching USD 29.41 billion by 2032 requiring scalable upskilling, AI integration exhibiting 15.80% CAGR enhancing personalization, and government investing in digital literacy infrastructure grants. VR AR creating immersive experiences, corporate sector utilizing customized training modules, and cost-effectiveness eliminating physical infrastructure costs support 11.70% growth rate addressing flexible accessible educational requirements.

Q2: How are government initiatives and technology integration transforming the Australia e-learning landscape?

A2: October 2025 regulatory proposals requiring overseas course delivery approval strengthening quality standards oversight. Government offering grants to K-12 and tertiary institutions incorporating digital technologies. AI-driven adaptive learning tailoring content based on individual needs with chatbots providing real-time support. VR AR making learning interactive, cloud technology enabling anytime anywhere access. These position regulatory support and technological advancement as drivers supporting quality delivery market integrity and personalized learning enhancement.

Q3: What opportunities exist for e-learning stakeholders in emerging Australia market segments?

A3: Stakeholders can capitalize on corporate training expansion developing employee skills compliance programs, international market development offering multi-language globally recognized courses, and institutional partnerships collaborating for blended learning models. AI-driven personalization implementing adaptive tools and predictive analytics, hybrid learning combining online on-campus instruction, and specialized certifications creating professional development courses represent opportunities alongside regional expansion targeting underserved areas and government training programs supporting market diversification addressing workforce development global education requirements.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=21948&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302