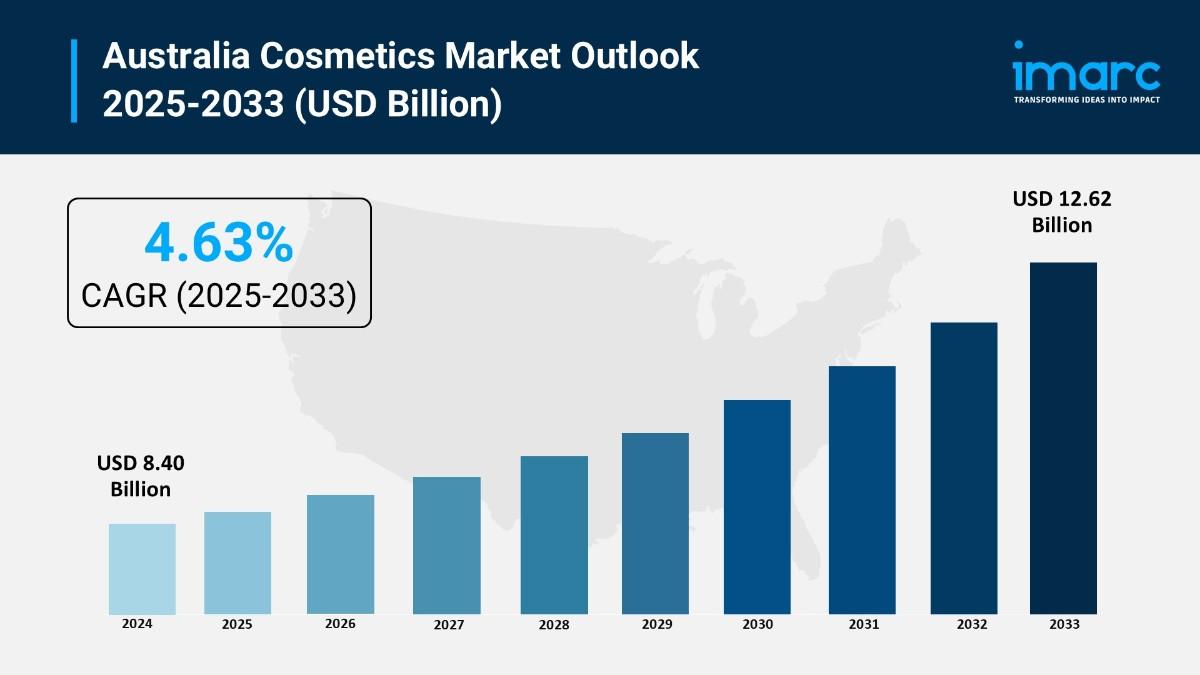

Australia cosmetics market reached USD 8.40B in 2024 and is expected to grow to USD 12.62B by 2033, at a steady CAGR of 4.63% during the forecast period.

The latest report by IMARC Group, “Australia Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2025-2033,” provides an in-depth analysis of the Australia cosmetics market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia cosmetics market size reached USD 8.40 Billion in 2024 and is projected to grow to USD 12.62 Billion by 2033, exhibiting a steady growth rate of 4.63% during the forecast period.

Report Attributes and Key Statistics:

Australia Cosmetics Market Overview:

Demand increase within Australia cosmetics market follows escalating consumer interest in sustainable and ethically sourced products reflecting environmental consciousness. Rising awareness about skincare and personal grooming importance combined with innovations in clean beauty formulations drive market expansion. High disposable income and elevated standard of living lead to increased spending on premium-quality cosmetics products. Growing cosmopolitan population makes Australia attractive target market for numerous manufacturers. Local indie brands like Go-To, Sukin, and Biologi focusing on natural ingredients, minimalist formulations, and complete transparency are gaining competitive advantage. Digital engagement through influencer marketing and e-commerce platforms enhances product discovery and purchase convenience supporting sustained market growth.

Request For Sample Report: https://www.imarcgroup.com/australia-cosmetics-market/requestsample

Australia Cosmetics Market Trends:

Australia cosmetics market trends: Sustainability and clean beauty movement dominating with brands prioritizing biodegradable recyclable packaging, water conservation, and non-toxic cruelty-free ingredients. May 2025 market research revealing 60% of Australian shoppers demonstrating strong commitment to cruelty-free and vegan beauty ranges. Digital transformation reshaping customer experience with AI-based skin analysis, virtual try-on features, and personalized skincare questionnaires bridging gap between offline and online convenience. Influencer marketing driving immediate demand peaks when mainstream influencers promote products. K-beauty influence promoting multi-step skincare routine adoption among Australian consumers. Hybrid skin-makeup products responding to clean girl aesthetic trends gaining traction. Natural and organic ingredients becoming standard rather than niche with consumers checking product backgrounds encouraging sustainability certifications.

Australia Cosmetics Market Drivers:

Drivers include rising disposable income with Australia gross disposable income reaching USD 418,415 million December 2024 increasing purchasing power for premium cosmetics. Growing middle-class population fueling demand for both mass and luxury skincare products. Social media and e-commerce platforms significantly influencing consumer behavior with nearly all Australians having internet access. March 2025 Hydrinity expanding into Australian market through partnership with Device Consulting introducing advanced skincare solutions via medical aesthetics clinics. January 2025 Wesfarmers Health launching Atomica beauty and wellness concept store featuring international brands including Bubble Skincare Innisfree and The Ordinary expanding affordable beauty retail. February 2025 Adore Beauty partnering with Tutch for omnichannel integration opening first physical store targeting 25+ stores by 2028. Digital platforms enabling seamless mobile shopping experiences.

Market Challenges:

Market Opportunities:

Australia Cosmetics Market Segmentation:

By Product Type:

By Category:

By Gender:

By Distribution Channel:

By Regional Distribution:

Australia Cosmetics Market News:

March 2025: Hydrinity US-based skincare brand announced expansion into Australian market through partnership with Device Consulting. Collaboration aimed to introduce Hydrinity’s advanced skincare solutions to Australian consumers particularly through medical aesthetics clinics and professionals specializing in cosmetic treatments. Partnership leveraging professional distribution channels for premium skincare products reflecting growing demand for science-backed dermatological formulations addressing aging skin concerns through specialized clinical settings.

February 2025: Adore Beauty Australia’s leading online beauty retailer announced partnership with technology company Tutch implementing omnichannel integration strategy. Partnership providing endless aisle capabilities for retailer’s highly anticipated entry into physical retail with first store at Westfield Southland Shopping Centre Melbourne opening early February. Adore Beauty planning to launch 25+ stores over three years targeting 30% revenue growth and doubling EBIT margin transforming from pure-play online platform into omnichannel beauty authority.

January 2025: Wesfarmers Health launched pilot Atomica beauty and wellness concept store at Castle Towers shopping centre Sydney. Store featuring affordable and accessible beauty-focused retail proposition with international brands including Bubble Skincare Innisfree The Ordinary Milani and ELF alongside Australian brands. Atomica providing dedicated Glow Advisors offering tailored beauty consultations with services including skin scanning makeup applications and lash enhancements. Conversion from former Priceline location representing first step in planned expansion across Australia in 2025.

Key Highlights of the Report:

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia cosmetics market growth to USD 12.62 billion by 2033?

A1: Market driven by escalating demand for sustainable ethically sourced products reflecting environmental consciousness, rising disposable income with December 2024 gross disposable income reaching USD 418,415 million enabling premium cosmetics spending, and growing awareness about skincare and personal grooming importance. March 2025 Hydrinity expansion through Device Consulting partnership, February 2025 Adore Beauty omnichannel strategy launching 25+ stores, January 2025 Wesfarmers Atomica beauty store, and digital engagement through influencer marketing AI-based skin analysis virtual try-on features support 4.63% growth rate addressing sustainability innovation and convenience requirements.

Q2: How are sustainability initiatives and digital transformation reshaping the Australia cosmetics landscape?

A2: May 2025 research revealing 60% of Australian shoppers demonstrating strong commitment to cruelty-free vegan beauty ranges driving sustainable product innovation. Brands prioritizing biodegradable recyclable packaging water conservation and non-toxic cruelty-free ingredients achieving competitive advantage. Local indie brands Go-To Sukin and Biologi focusing on natural ingredients minimalist formulations and complete transparency gaining market traction. February 2025 Adore Beauty and Tutch partnership implementing endless aisle capabilities integrating online offerings with in-store experience. AI-based skin analysis virtual try-on features and personalized skincare questionnaires enhancing online shopping experience. These position sustainability and digitalization as drivers supporting customer convenience ethical consumption and brand loyalty.

Q3: What opportunities exist for cosmetics stakeholders in emerging Australia market segments?

A3: Stakeholders can capitalize on sustainable product innovation developing eco-friendly packaging biodegradable containers and refillable options attracting environmentally-aware consumers, natural ingredients focus leveraging Australia’s reputation for high-quality organic cosmetics targeting export markets, and omnichannel retail expansion integrating physical stores with digital platforms. Clean beauty formulations with transparent ingredient lists, male grooming segment addressing hair loss skincare fragrance needs, and anti-aging solutions with retinol peptides hyaluronic acid collagen represent opportunities alongside personalized beauty implementing AI-powered skin analysis, and indigenous ingredients incorporating Australian native botanicals supporting market diversification addressing evolving consumer preferences.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=33919&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302