Discover the top 10 fintech trends transforming mobile banking and payment apps in 2025.

The way people interact with money has transformed rapidly in the last decade. Mobile banking and payment apps are no longer just a convenience—they’re now a necessity. Whether it’s transferring money instantly, paying bills with a tap, or accessing banking services 24/7, fintech solutions are rewriting the rules of finance. Behind these innovations stand skilled fintech app developers, shaping the future of financial services with secure, scalable, and customer-friendly applications.

But what’s next for mobile banking and payment apps? Let’s explore 10 game-changing trends that are driving this exciting transformation in 2025.

Artificial Intelligence (AI) has moved from being a nice-to-have feature to becoming a core part of fintech apps. Payment and banking apps now use AI to analyze user spending patterns, predict needs, and deliver personalized recommendations. Imagine an app nudging you to save just before your salary arrives or suggesting investments aligned with your financial goals. That’s the power of AI.

Blockchain isn’t just about cryptocurrency anymore. In mobile banking and payment apps, it ensures secure, traceable, and tamper-proof transactions. By reducing dependency on intermediaries, blockchain also lowers transaction costs and accelerates cross-border payments, which is a huge plus for global users.

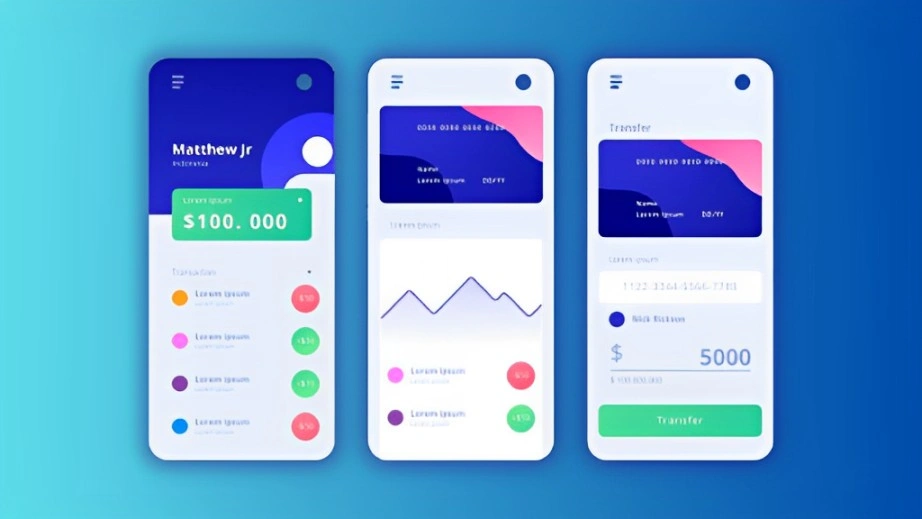

Digital-only banks, or neobanks, are shaking up traditional banking. With no physical branches, they rely entirely on apps to deliver services like instant account opening, international transfers, and AI-driven budgeting. Their appeal lies in convenience, low fees, and a sleek, user-focused design—exactly what modern users demand.

Passwords are slowly becoming a thing of the past. Mobile banking apps are now integrating biometric verification such as fingerprint scanning, facial recognition, and even voice ID to authenticate users. This not only boosts security but also creates a smoother login and transaction experience.

Open banking allows apps to integrate financial data from multiple institutions through secure APIs. For users, this means one app can provide a complete overview of their finances—savings, loans, and investments all in one place. For businesses, it opens up a world of collaboration and new revenue opportunities.

Imagine paying for a ride, buying groceries, or getting instant credit without ever leaving your favorite app. That’s embedded finance in action. By integrating financial services into non-financial platforms, fintech developers are making payments seamless and invisible. This trend is growing fast in e-commerce and ride-hailing apps.

Big data is helping mobile banking apps go beyond transactions and act as financial advisors. By analyzing massive amounts of data, apps can suggest savings strategies, warn about overspending, and recommend tailored investment opportunities. This creates a highly personalized experience for users.

Voice technology is finding its way into fintech. Imagine asking your app, “What’s my balance?” or “Pay my electricity bill,” and getting it done instantly. Voice-enabled banking is not only convenient but also makes financial apps more inclusive for users who may struggle with traditional interfaces.

Global transactions are often slow and expensive. Fintech developers are addressing this pain point with faster, cheaper, and more transparent cross-border payment solutions. Whether through blockchain, digital wallets, or partnerships with global institutions, sending money abroad is becoming as easy as sending a text message.

A growing number of consumers want their financial choices to align with sustainability values. Fintech apps are responding with features like carbon footprint tracking, green investment options, and eco-friendly spending insights. This trend reflects how technology can empower responsible financial behavior.

These 10 trends highlight how mobile banking and payment apps are evolving far beyond traditional financial services. From AI-driven personalization to sustainable finance, the future is about creating secure, user-friendly, and meaningful financial experiences. For businesses, adopting these innovations means staying ahead in an increasingly competitive space. For users, it means more control, transparency, and convenience in managing money.

While the 10 trends above highlight how mobile banking and payment apps are evolving, they also open exciting opportunities for businesses ready to embrace innovation. In 2025 and beyond, financial services are moving from being product-centric to user-centric. This shift means companies that leverage new technologies can build stronger customer relationships and open fresh revenue streams.

One major opportunity lies in hyper-personalization. Consumers no longer want generic financial tools; they expect apps that understand their habits, anticipate needs, and provide tailored solutions. Businesses that invest in apps capable of delivering custom insights—like savings nudges, investment tips, or spending analysis—can win customer loyalty quickly.

Another opportunity is global reach through cross-border payment solutions. As more people work remotely or engage in international trade, seamless global payments are becoming essential. Companies that integrate blockchain or innovative digital wallet technologies into their apps can serve both individuals and businesses with faster, cheaper, and more transparent international transactions.

Finally, partnerships and ecosystem building are creating growth avenues. Open banking and API integrations allow fintech apps to connect with a wide range of services—from insurance and lending to e-commerce and travel. Businesses can collaborate across industries to deliver bundled, value-driven experiences. For instance, a mobile banking app could integrate with a travel app to offer instant foreign currency conversion, travel insurance, and booking options in one place.

In short, the fintech space is brimming with potential. Businesses that act now—by adopting cutting-edge technologies, focusing on customer-centric design, and forging strategic partnerships—will not only stay competitive but also become leaders in shaping the future of digital finance.

The future of mobile banking and payment app development is bright, innovative, and deeply customer-focused. As trends like AI, blockchain, voice technology, and sustainability take center stage, the financial services landscape will continue to evolve at lightning speed.

For businesses aiming to launch or upgrade their financial solutions, staying on top of these trends is crucial. Partnering with a reliable fintech application development company can ensure you deliver secure, efficient, and future-ready apps that users will love.