Explore whether cloud accounting software is the right choice for your business in KSA, offering efficiency, scalability, and real-time insights.

Cloud Accounting Software is the only way for businesses in Saudi Arabia to gain unmatched flexibility, real time data access and automation in financial management. Adopting best accounting software in Saudi Arabia can help businesses to streamline their operations and reduce human errors as it has features like automated bookkeeping, expense tracking and compliance with VAT regulations.

Due to more companies transitioning towards digital transformation, Cloud Accounting Software is becoming an absolute quintessential for all the businesses, irrespective of their size in KSA. Not only does it provide financial security by means of encrypted data storage, but it also makes scaling up to launch without major investment in infrastructure. This blog will discuss the benefits of Cloud Accounting Software, why it is the preferred choice for businesses in Saudi Arabia, and how you can choose the best solution for your company’s needs.

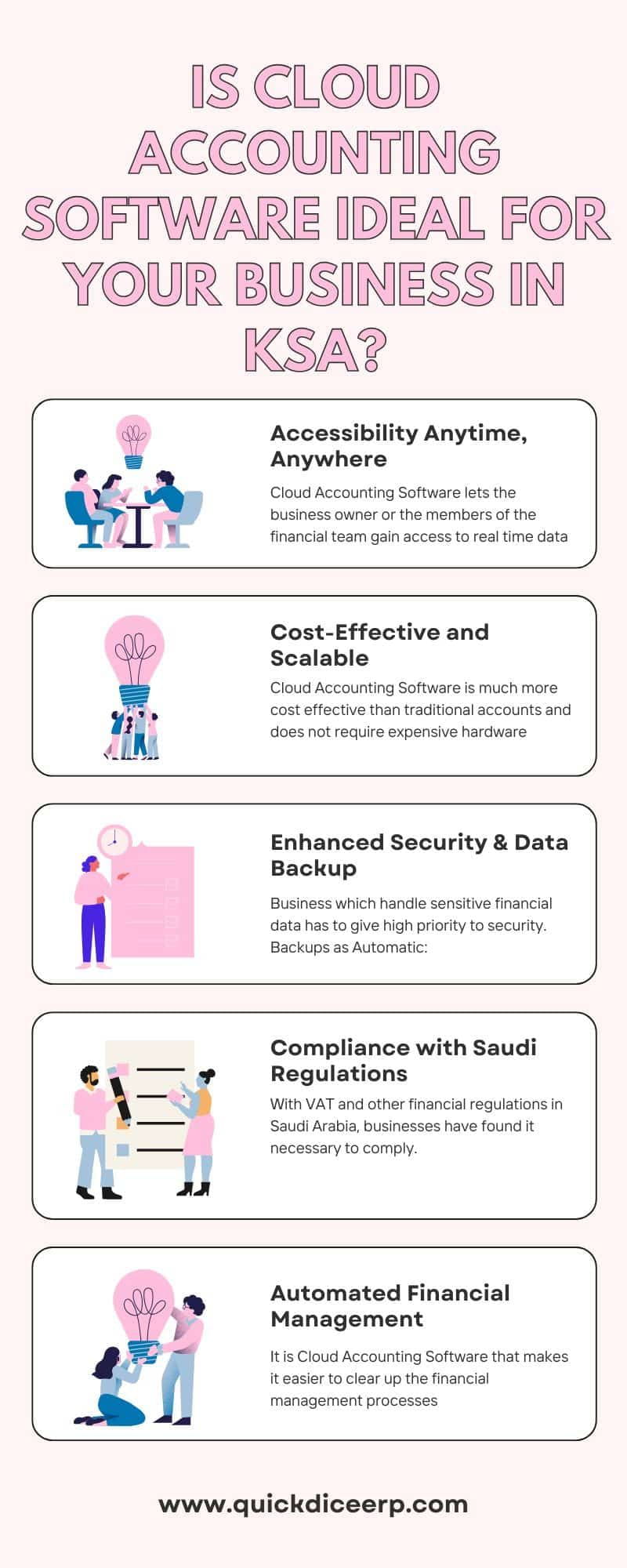

Cloud Accounting Software lets the business owner or the members of the financial team gain access to real time data wherever they are, e.g. the office, home or on the move. The flexibility in this helps in collaboration, quick decision making and real time updates on cash flow, invoices and expenses. Businesses in KSA can run efficiently with mobile and web access without being restricted to a physical location.

Cloud Accounting Software is much more cost effective than traditional accounts and does not require expensive hardware, installation, and ongoing maintenance. KSA allows businesses to choose plans that meet their needs, scale up without constraints of infrastructure. The cloud allows you to be flexible using cloud based solutions resulting in startups, SMEs and large enterprises being ideal for this.

Business which handle sensitive financial data has to give high priority to security. Backups as Automatic: The backup feature in Cloud Accounting Software automatically log in the old data, which means it is secured and remains accessible to set an example should anything happen for reasons unexplainable. With cloud storage, businesses in Saudi Arabia can be at ease that they will not lose critical financial records due to hardware failures or system crashes.

With VAT and other financial regulations in Saudi Arabia, businesses have found it necessary to comply. Accounting software in Saudi Arabia provides the option of accurate financial reporting, automation of tax calculations, and simplification of record keeping for audits. Regulatory features built in facilitates creating of VAT compliant invoices, tracking of expenses, error free submission of financial reports thus ensuring compliance to Saudi tax laws.

It is Cloud Accounting Software that makes it easier to clear up the financial management processes, such as invoicing, payroll, and expense tracking. Businesses can save the time in setting up the manual workflow by creating the automated workflow. This real time tracking and reporting features help businesses with better financial control as they do not depend on outdated spreadsheet or paper records.

However, there are a number of options available when it comes to choosing the best Cloud Accounting Software for your business in KSA and you need to be careful in selecting. They are a few of the points you should check.

For businesses in Saudi Arabia, switching to Cloud Accounting Software is a game changer as it provides real time accessibility, cost savings and security. Cloud based solutions ensure that business are organized and efficient because of features that simplify the management of such finance and options that ensure compliance with local tax regulations. Regardless of whether you operate as a small startup or a big enterprise, using accounting software in Saudi Arabia can make it easy to handle complicated financial processes and boost business performance as a whole.

© 2024 Crivva - Business Promotion. All rights reserved.