Discover the 6 essential features every mutual fund software should have for efficient management and optimal performance.

There are multiple options available for mutual fund distributors (MFDs) when it comes to choosing the right mutual fund software. However, some features stand out, especially for MFDs looking to grow their business efficiently. Here are six must-have features to look for in the right software.

Features to Look for in the Right Software

1. White-Labeling Options

White-labeling lets MFDs customize the software to reflect their brand, making the experience unique for clients. It can include adding your logo, using your brand colors, and even setting up a personalized URL.

● URL Customization: Use a unique URL that’s specific to your brand.

● Color Customization: Match the software’s colors with your brand’s look.

● Logo Integration: Display your logo to reinforce your identity.

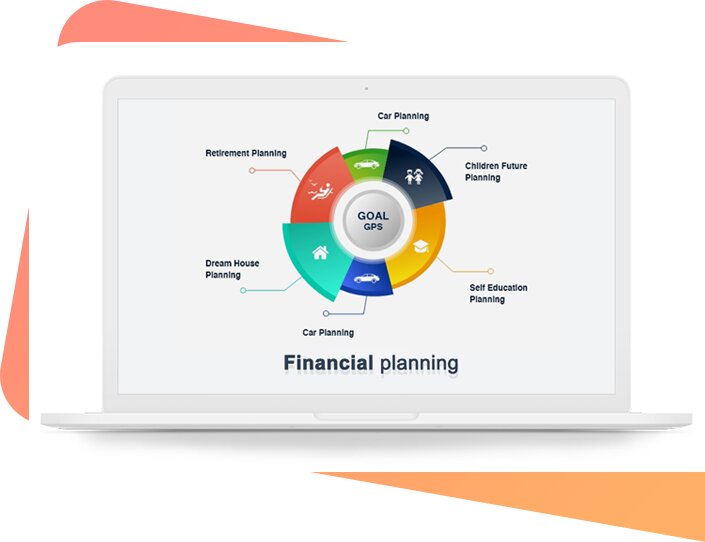

2. Goal-Based Planning

Many clients have specific goals like retirement or education savings. Goal-based planning tools help MFDs align investments with these goals, showing clients how each investment moves them closer to their objectives. This feature builds trust, as clients can see their progress clearly.

3. Instant Online Transactions

Today’s clients expect quick transactions. A reliable mutual fund software for distributors like that offered by REDVision Technologies supports instant online transactions (through NSE + MFU or BSE + MFU) and enables MFDs to execute transactions for SIPs, lumpsum investments, and redemptions with ease. This feature improves client satisfaction by saving time and reducing paperwork.

4. Calculators & Research Tools

Calculators and research tools help MFDs give clients accurate information on potential returns. From SIP calculators to fund comparisons, these tools make it easier for clients to make informed decisions, enhancing their confidence in your recommendations.

5. Digital Onboarding

Digital onboarding streamlines the process of adding new clients, making it simple and paperless. It supports remote onboarding with easy document verification and e-signature collection, allowing MFDs to quickly get clients started.

6. Portfolio Management

Portfolio management is the base for any wealth management software because it allows MFDs to monitor and manage client portfolios efficiently. Real-time updates enable MFDs to track investment performance, so they can make changes if required, and keep investments aligned to investors’ goals always.

Conclusion

The right software with these key features can transform an MFD’s business. It’s high time for MFDs to rely on technology and replace manual workload to save time, energy, and effort, and focus more on what truly matters – business and revenue growth, because at the end of the day, AUM and revenue are what MFDs work hard for.